Answered step by step

Verified Expert Solution

Question

1 Approved Answer

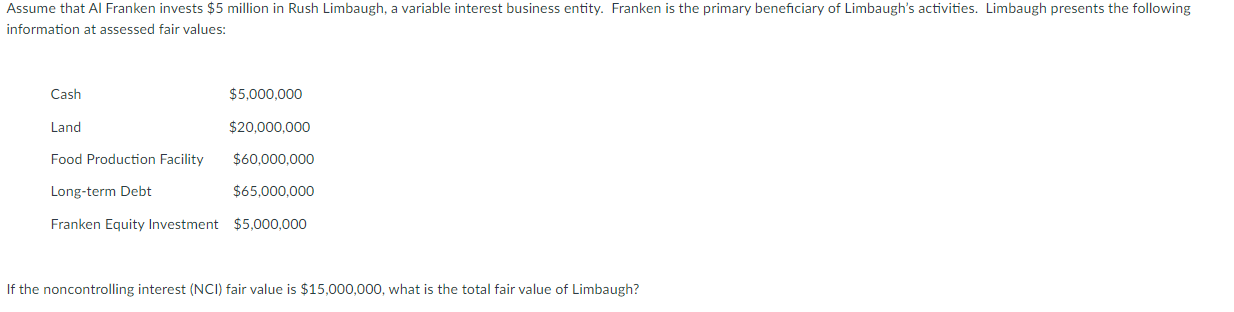

Options for Q1 include: $20,000,000 $5,000,000 $15,000,000 $10,000,000 Assume that Al Franken invests $5 million in Rush Limbaugh, a variable interest business entity. Franken is

Options for Q1 include:

$20,000,000

$5,000,000

$15,000,000

$10,000,000

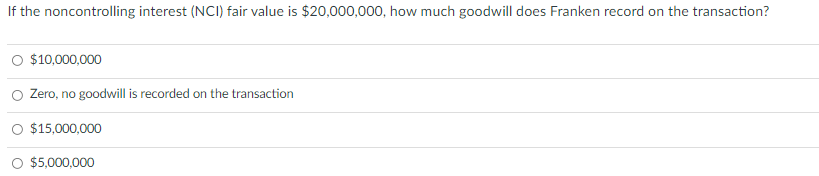

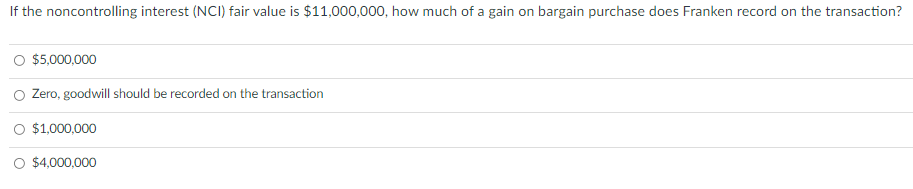

Assume that Al Franken invests $5 million in Rush Limbaugh, a variable interest business entity. Franken is the primary beneficiary of Limbaugh's activities. Limbaugh presents the following , information at assessed fair values: Cash $5,000,000 Land $20,000,000 Food Production Facility $60,000,000 Long-term Debt $65.000.000 Franken Equity Investment $5,000,000 If the noncontrolling interest (NCI) fair value is $15,000,000, what is the total fair value of Limbaugh? If the noncontrolling interest (NCI) fair value is $20,000,000, how much goodwill does Franken record on the transaction? $10,000,000 Zero, no goodwill is recorded on the transaction $15,000,000 $5,000,000 If the noncontrolling interest (NCI) fair value is $11,000,000, how much of a gain on bargain purchase does Franken record on the transaction? $5,000,000 Zero, goodwill should be recorded on the transaction $1,000,000 $4,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started