Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options in the table are numbers that I need answers for if your calculations are right it will be up there. Consider the case of

Options in the table are numbers that I need answers for if your calculations are right it will be up there.

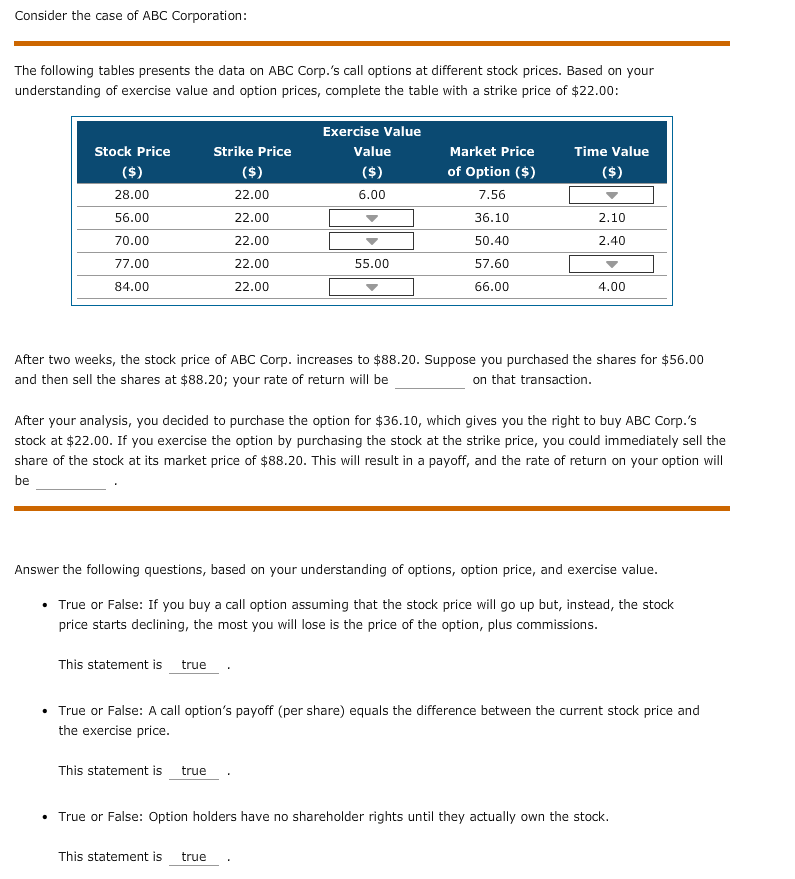

Consider the case of ABC Corporation: The following tables presents the data on ABC Corp.'s call options at different stock prices. Based on your understanding of exercise value and option prices, complete the table with a strike price of $22.00: Time Value Stock Price ($) 28.00 Exercise Value Value ($) 6.00 ($) 56.00 Strike Price ($) 22.00 22.00 22.00 22.00 22.00 Market Price of Option ($) 7.56 36.10 50.40 57.60 66.00 2.10 2.40 70.00 77.00 84.00 - 55.00 4.00 After two weeks, the stock price of ABC Corp. increases to $88.20. Suppose you purchased the shares for $56.00 and then sell the shares at $88.20; your rate of return will be on that transaction. After your analysis, you decided to purchase the option for $36.10, which gives you the right to buy ABC Corp.'s stock at $22.00. If you exercise the option by purchasing the stock at the strike price, you could immediately sell the share of the stock at its market price of $88.20. This will result in a payoff, and the rate of return on your option will be Answer the following questions, based on your understanding of options, option price, and exercise value. True or False: If you buy a call option assuming that the stock price will go up but, instead, the stock price starts declining, the most you will lose is the price of the option, plus commissions. This statement is true . True or False: A call option's payoff (per share) equals the difference between the current stock price and the exercise price. This statement is true . True or False: Option holders have no shareholder rights until they actually own the stock. This statement is trueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started