;

; Options to fill box:

Options to fill box:

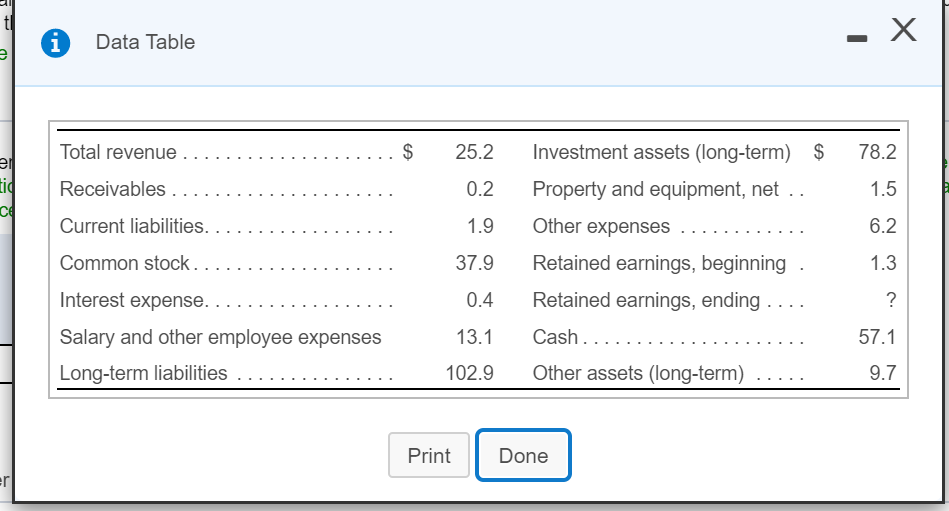

cash

common stock

current liabilities

interest expense

investments assest (long term)

long term liability

net income

other assest

other expenses

property and equipment, net recieveable

retained earning

revenue

salary and other employee expenses

total revenue

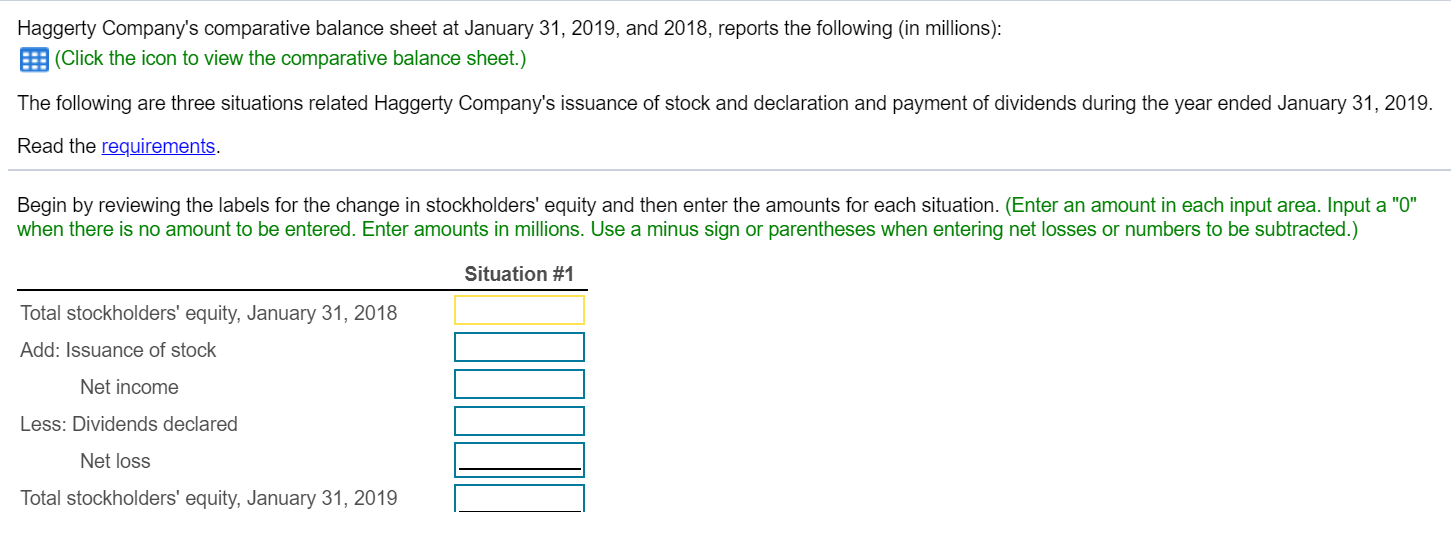

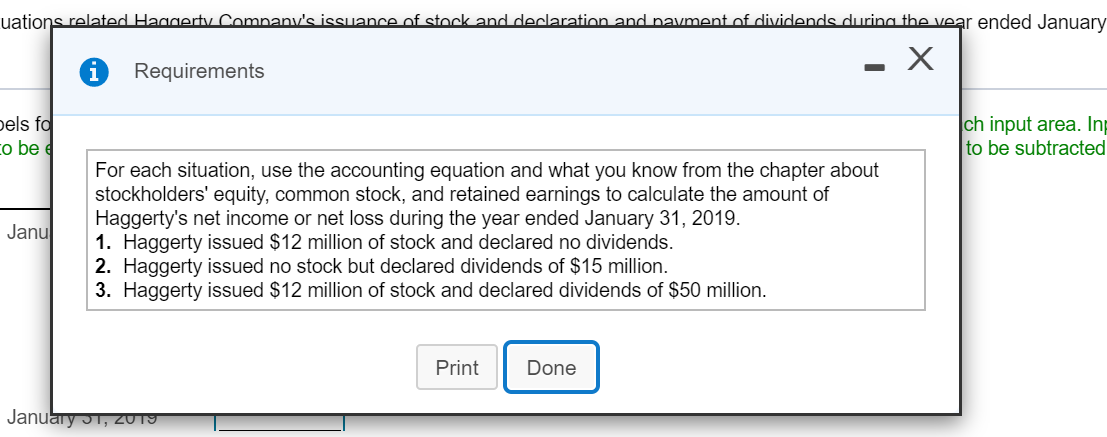

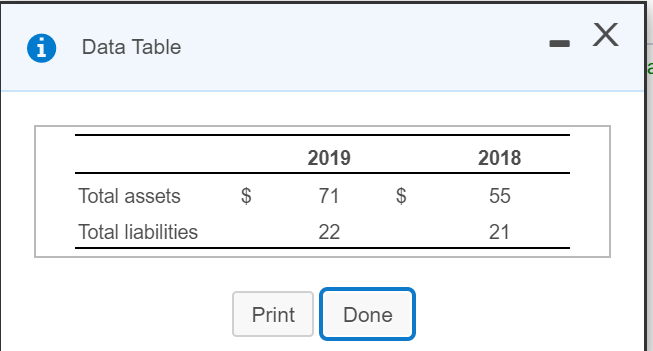

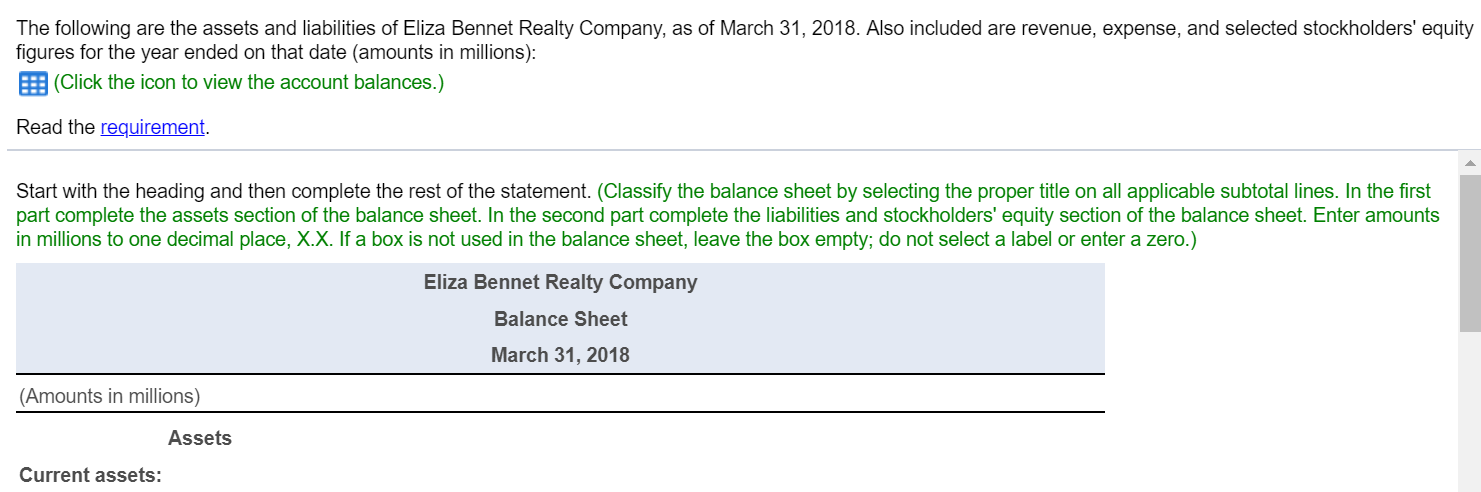

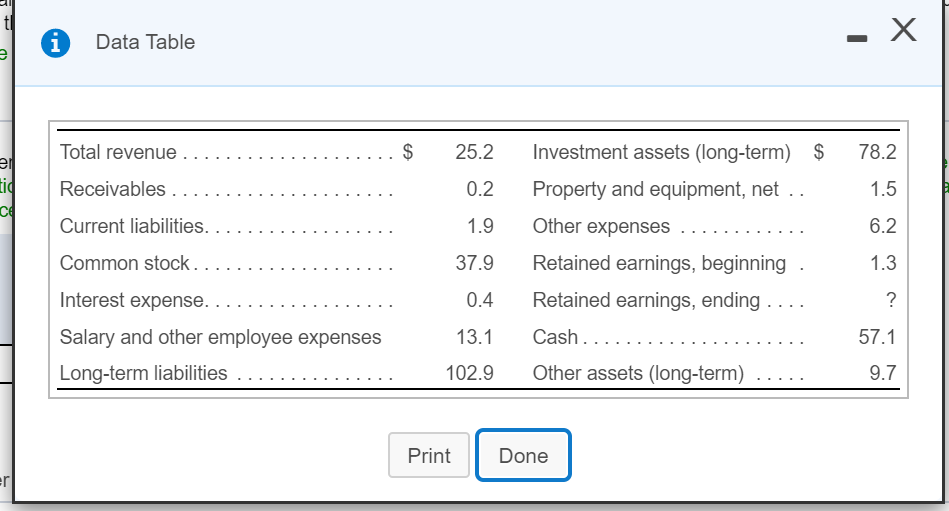

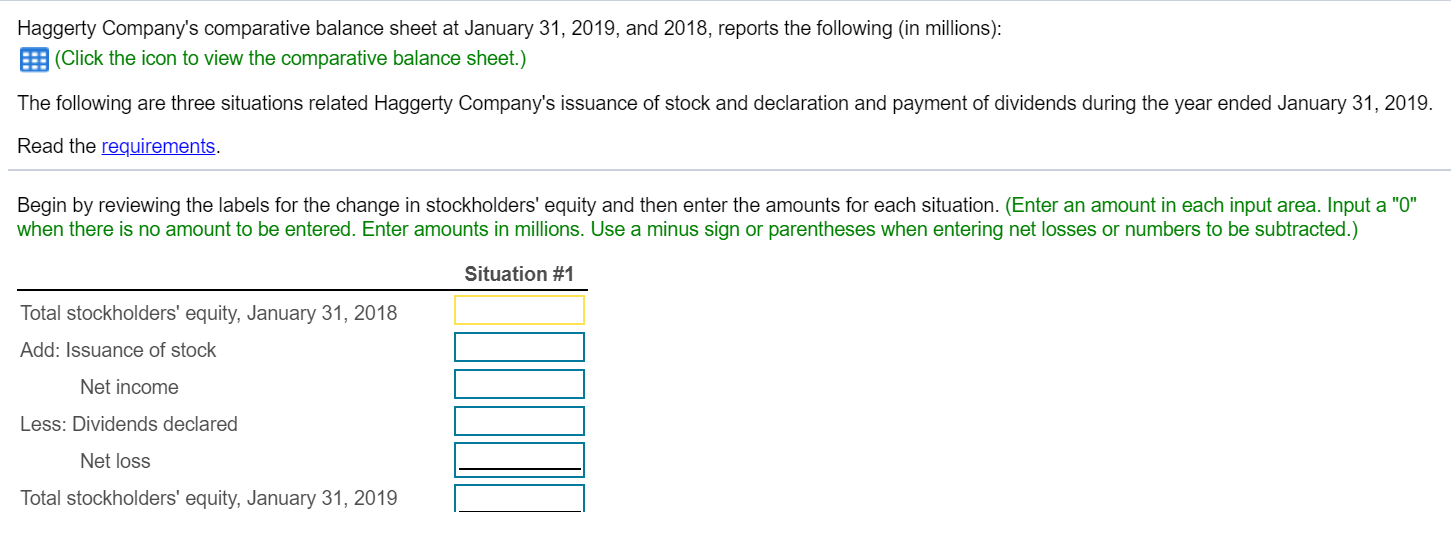

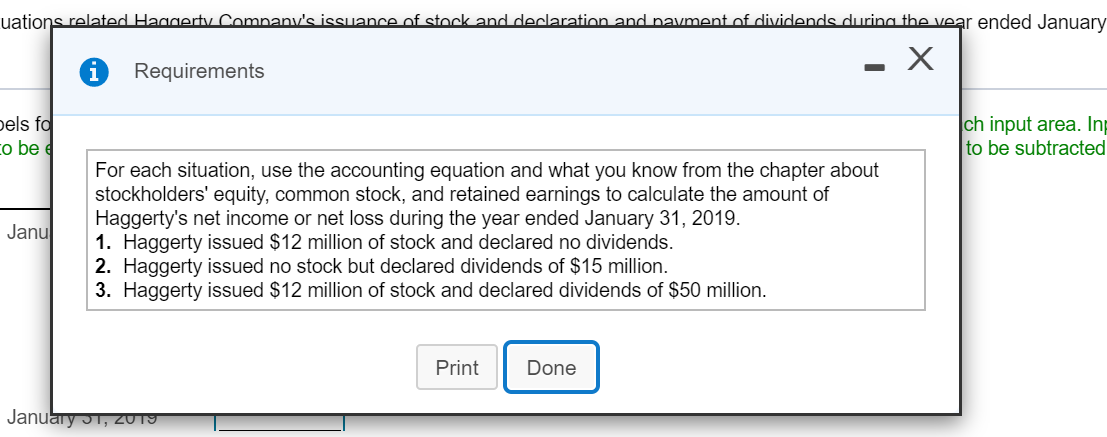

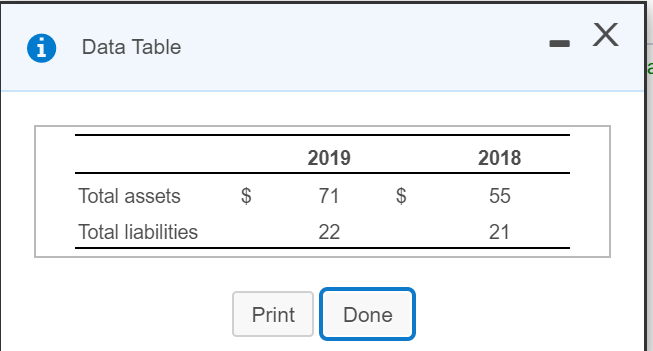

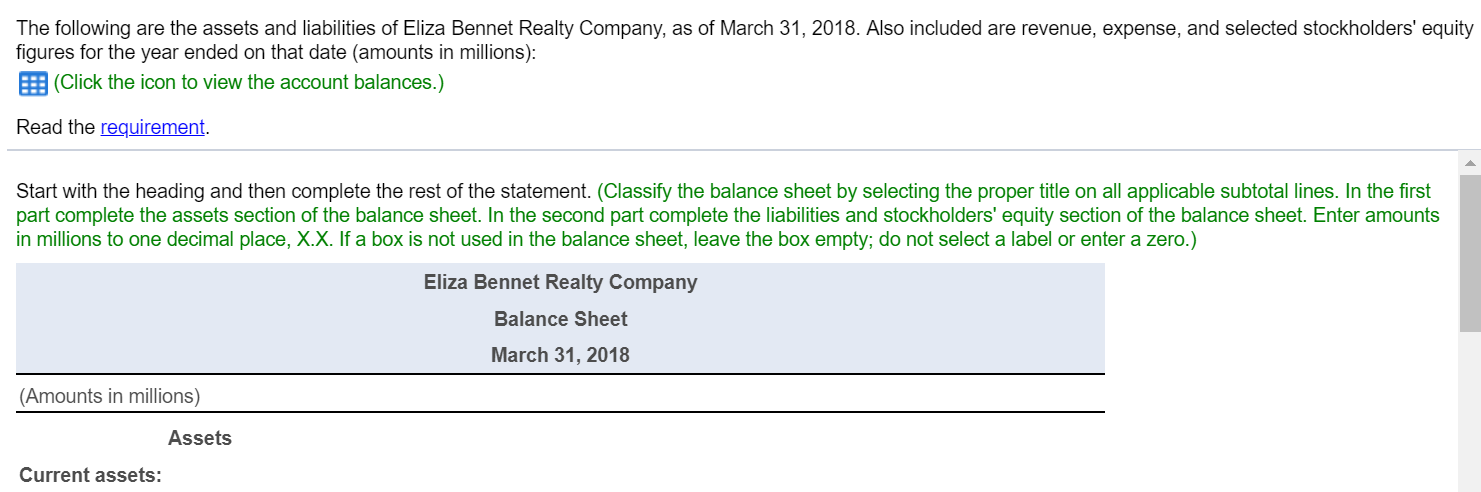

Haggerty Company's comparative balance sheet at January 31, 2019, and 2018, reports the following in millions): B (Click the icon to view the comparative balance sheet.) The following are three situations related Haggerty Company's issuance of stock and declaration and payment of dividends during the year ended January 31, 2019. Read the requirements. Begin by reviewing the labels for the change in stockholders' equity and then enter the amounts for each situation. (Enter an amount in each input area. Input a "0" when there is no amount to be entered. Enter amounts in millions. Use a minus sign or parentheses when entering net losses or numbers to be subtracted.) Situation #1 Total stockholders' equity, January 31, 2018 Add: Issuance of stock Net income Less: Dividends declared Net loss Total stockholders' equity, January 31, 2019 uations related Haggerty Company's issuance of stock and declaration and navment of dividends during the vear ended January Requirements - X pels fa co bed Ich input area. Ing to be subtracted Janu For each situation, use the accounting equation and what you know from the chapter about stockholders' equity, common stock, and retained earnings to calculate the amount of Haggerty's net income or net loss during the year ended January 31, 2019. 1. Haggerty issued $12 million of stock and declared no dividends. 2. Haggerty issued no stock but declared dividends of $15 million. 3. Haggerty issued $12 million of stock and declared dividends of $50 million. Print Done January 1, 2019 - X i Data Table 2019 2018 Total assets $ 71 $ 55 Total liabilities 22 21 Print Done The following are the assets and liabilities of Eliza Bennet Realty Company, as of March 31, 2018. Also included are revenue, expense, and selected stockholders' equity figures for the year ended on that date (amounts in millions): B (Click the icon to view the account balances.) Read the requirement. Start with the heading and then complete the rest of the statement. (Classify the balance sheet by selecting the proper title on all applicable subtotal lines. In the first part complete the assets section of the balance sheet. In the second part complete the liabilities and stockholders' equity section of the balance sheet. Enter amounts in millions to one decimal place, X.X. If a box is not used in the balance sheet, leave the box empty; do not select a label or enter a zero.) Eliza Bennet Realty Company Balance Sheet March 31, 2018 (Amounts in millions) Assets Current assets: Total assets ti - X i Data Table Total revenue $ $ 25.2 78.2 eil tid CE Receivables. 0.2 1.5 Current liabilities. ... 1.9 6.2 37.9 Investment assets (long-term) $ Property and equipment, net .. Other expenses Retained earnings, beginning Retained earnings, ending .... Cash..... Other assets (long-term) 1.3 0.4 Common stock.... Interest expense. Salary and other employee expenses Long-term liabilities ? 13.1 57.1 102.9 9.7 Print Done er

;

; Options to fill box:

Options to fill box: