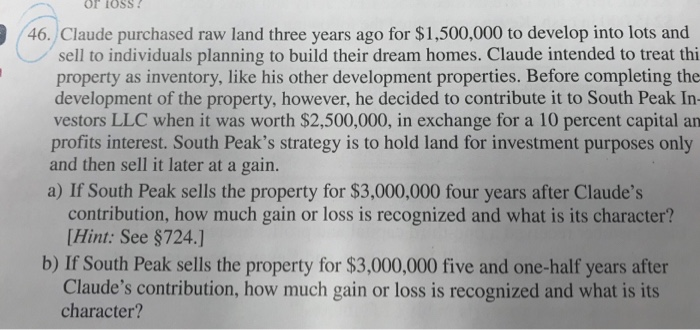

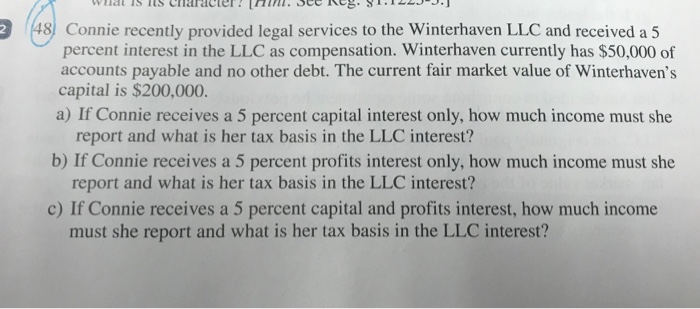

or tosS 46. Claude purchased raw land three years ago for $1,500,000 to develop into lots and sell to individuals planning to build their dream homes. Claude intended to treat thi property as inventory, like his other development properties. Before completing the development of the property, however, he decided to contribute it to South Peak In vestors LLC when it was worth $2,500,000, in exchange for a 10 percent capital an profits interest. South Peak's strategy is to hold land for investment purposes only and then sell it later at a gain. a) If South Peak sells the property for $3,000,000 four years after Claude's contribution, how much gain or loss is recognized and what is its character? Hint: See 8724.] b) If South Peak sells the property for $3,000,000 five and one-half years after Claude's contribution, how much gain or loss is recognized and what is its character? 2 48) Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $50,000 of accounts payable and no other debt. The current fair market value of Winterhaven's capital is $200,000 a) If Connie receives a 5 percent capital interest only, how much income must she report and what is her tax basis in the LLC interest? report and what is her tax basis in the LLC interest? must she report and what is her tax basis in the LLC interest? b) If Connie receives a 5 percent profits interest only, how much income must she c) If Connie receives a 5 percent capital and profits interest, how much income or tosS 46. Claude purchased raw land three years ago for $1,500,000 to develop into lots and sell to individuals planning to build their dream homes. Claude intended to treat thi property as inventory, like his other development properties. Before completing the development of the property, however, he decided to contribute it to South Peak In vestors LLC when it was worth $2,500,000, in exchange for a 10 percent capital an profits interest. South Peak's strategy is to hold land for investment purposes only and then sell it later at a gain. a) If South Peak sells the property for $3,000,000 four years after Claude's contribution, how much gain or loss is recognized and what is its character? Hint: See 8724.] b) If South Peak sells the property for $3,000,000 five and one-half years after Claude's contribution, how much gain or loss is recognized and what is its character? 2 48) Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $50,000 of accounts payable and no other debt. The current fair market value of Winterhaven's capital is $200,000 a) If Connie receives a 5 percent capital interest only, how much income must she report and what is her tax basis in the LLC interest? report and what is her tax basis in the LLC interest? must she report and what is her tax basis in the LLC interest? b) If Connie receives a 5 percent profits interest only, how much income must she c) If Connie receives a 5 percent capital and profits interest, how much income