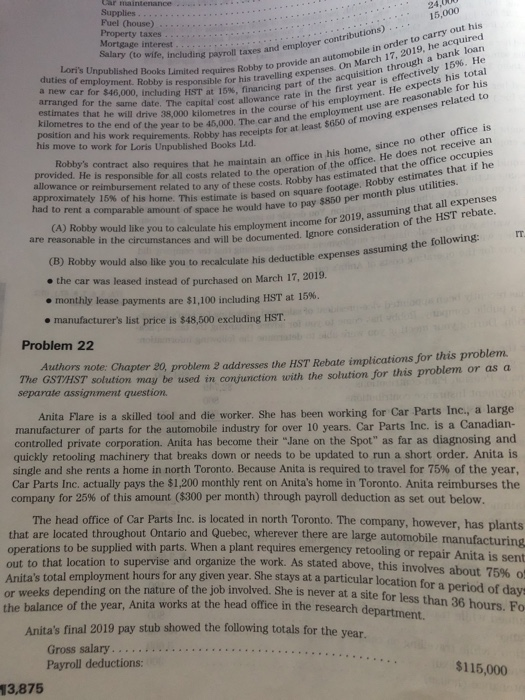

or weeks depending on the nature of the job involved. She is never at a site for less than 36 hours. Fo 15.000 Salary to wife, including payroll taxes and employer contributions) duties of employment. Robby is responsible for his travelling expenses. On March 17, 2019, he acquired Lori's Unpublished Books Limited requires Robby to provide an automobile in order to carry out his a new car for $46,000, including HST at 15%, financing part of the acquisition through a bank loan kilometres to the end of the year to be 45,000. The car and the employment use are reasonable for his estimates that he will drive 38,000 kilometres in the course of his employment. He expects his total arranged for the same date. The capital cost allowance rate in the first year is effectively 1696. He position and his work requirements. Robby has receipts for at least $650 of moving expenses related to allowance or reimbursement related to any of these costs. Robby has estimated that the office occuples provided. He is responsible for all costs related to the operation of the office. He does not receive an Robby's contract also requires that he maintain an office in his home, since no other office is had to rent a comparable amount of space he would have to pay $850 per month plus utilities approximately 15% of his home. This estimate is based on square footage. Robby estimates that if he (A) Robby would like you to calculate his employment income for 2019, assuming that all expenses are reasonable in the circumstances and will be documented. Ignore consideration of the HST rebate. (B) Robby would also like you to recalculate his deductible expenses assuming the following: Car maintenance Supplies Fuel (house) Property taxes Mortgage interest his move to work for Loris Unpublished Books Ltd. the car was leased instead of purchased on March 17, 2019. monthly lease payments are $1,100 including HST at 15%. manufacturer's list price is $48,500 excluding HST. IT Problem 22 Authors note: Chapter 20, problem 2 addresses the HST Rebate implications for this problem. The GST/HST solution may be used in conjunction with the solution for this problem or as a separate assignment question. Anita Flare is a skilled tool and die worker. She has been working for Car Parts Inc., a large manufacturer of parts for the automobile industry for over 10 years. Car Parts Inc. is a Canadian- controlled private corporation. Anita has become their "Jane on the Spot" as far as diagnosing and quickly retooling machinery that breaks down or needs to be updated to run a short order. Anita is single and she rents a home in north Toronto. Because Anita is required to travel for 75% of the year, Car Parts Inc. actually pays the $1,200 monthly rent on Anita's home in Toronto. Anita reimburses the company for 25% of this amount ($300 per month) through payroll deduction as set out below. The head office of Car Parts Inc. is located in north Toronto. The company, however, has plants that are located throughout Ontario and Quebec, wherever there are large automobile manufacturing operations to be supplied with parts. When a plant requires emergency retooling or repair Anita is sent out to that location to supervise and organize the work. As stated above, this involves about 75% o Anita's total employment hours for any given year. She stays at a particular location for a period of days the balance of the year, Anita works at the head office in the research department. Anita's final 2019 pay stub showed the following totals for the year. Gross salary.... Payroll deductions: 13,875 $115,000 or weeks depending on the nature of the job involved. She is never at a site for less than 36 hours. Fo 15.000 Salary to wife, including payroll taxes and employer contributions) duties of employment. Robby is responsible for his travelling expenses. On March 17, 2019, he acquired Lori's Unpublished Books Limited requires Robby to provide an automobile in order to carry out his a new car for $46,000, including HST at 15%, financing part of the acquisition through a bank loan kilometres to the end of the year to be 45,000. The car and the employment use are reasonable for his estimates that he will drive 38,000 kilometres in the course of his employment. He expects his total arranged for the same date. The capital cost allowance rate in the first year is effectively 1696. He position and his work requirements. Robby has receipts for at least $650 of moving expenses related to allowance or reimbursement related to any of these costs. Robby has estimated that the office occuples provided. He is responsible for all costs related to the operation of the office. He does not receive an Robby's contract also requires that he maintain an office in his home, since no other office is had to rent a comparable amount of space he would have to pay $850 per month plus utilities approximately 15% of his home. This estimate is based on square footage. Robby estimates that if he (A) Robby would like you to calculate his employment income for 2019, assuming that all expenses are reasonable in the circumstances and will be documented. Ignore consideration of the HST rebate. (B) Robby would also like you to recalculate his deductible expenses assuming the following: Car maintenance Supplies Fuel (house) Property taxes Mortgage interest his move to work for Loris Unpublished Books Ltd. the car was leased instead of purchased on March 17, 2019. monthly lease payments are $1,100 including HST at 15%. manufacturer's list price is $48,500 excluding HST. IT Problem 22 Authors note: Chapter 20, problem 2 addresses the HST Rebate implications for this problem. The GST/HST solution may be used in conjunction with the solution for this problem or as a separate assignment question. Anita Flare is a skilled tool and die worker. She has been working for Car Parts Inc., a large manufacturer of parts for the automobile industry for over 10 years. Car Parts Inc. is a Canadian- controlled private corporation. Anita has become their "Jane on the Spot" as far as diagnosing and quickly retooling machinery that breaks down or needs to be updated to run a short order. Anita is single and she rents a home in north Toronto. Because Anita is required to travel for 75% of the year, Car Parts Inc. actually pays the $1,200 monthly rent on Anita's home in Toronto. Anita reimburses the company for 25% of this amount ($300 per month) through payroll deduction as set out below. The head office of Car Parts Inc. is located in north Toronto. The company, however, has plants that are located throughout Ontario and Quebec, wherever there are large automobile manufacturing operations to be supplied with parts. When a plant requires emergency retooling or repair Anita is sent out to that location to supervise and organize the work. As stated above, this involves about 75% o Anita's total employment hours for any given year. She stays at a particular location for a period of days the balance of the year, Anita works at the head office in the research department. Anita's final 2019 pay stub showed the following totals for the year. Gross salary.... Payroll deductions: 13,875 $115,000