Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 2020, Old World Deli signed a $300,000, 5% annual interest rate, six month note payable with the amount borrowed plus accrued

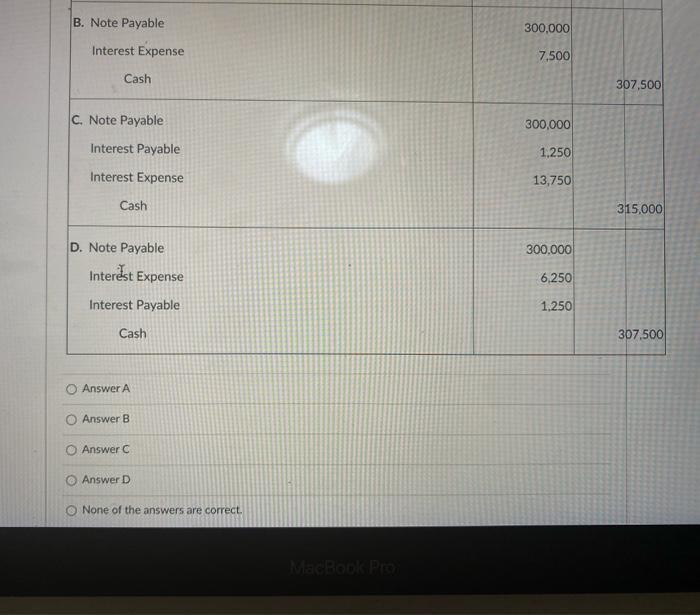

On December 1, 2020, Old World Deli signed a $300,000, 5% annual interest rate, six month note payable with the amount borrowed plus accrued interest due six months later on June 1, 2021. Old World Deli is on an annual accounting period and records the appropriate adjusting entry for the note on December 31, 2020. What will the general journal entry Old World Deli will record on June 1, 2021 to record the payment of the note plus interest? Debit Credit A. Note Payable 300,000 Interest Expense 15,000 fash 315.000 B. Note Payable 300,000 Interest Expense 7.500 Cash 307.500 C. Note Payable 300,000 Interest Payable 1,250 Interest Expense 13,750 Cash 315,000 B. Note Payable 300,000 Interest Expense 7,500 Cash 307,500 C. Note Payable 300,000 Interest Payable 1,250 Interest Expense 13,750 Cash 315,000 D. Note Payable 300,000 Interest Expense 6.250 Interest Payable 1,250 Cash 307,500 Answer A O Answer B O Answer C O Answer D None of the answers are correct. MacBook Pro

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Cal culation of carh needed to pay ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started