Answered step by step

Verified Expert Solution

Question

1 Approved Answer

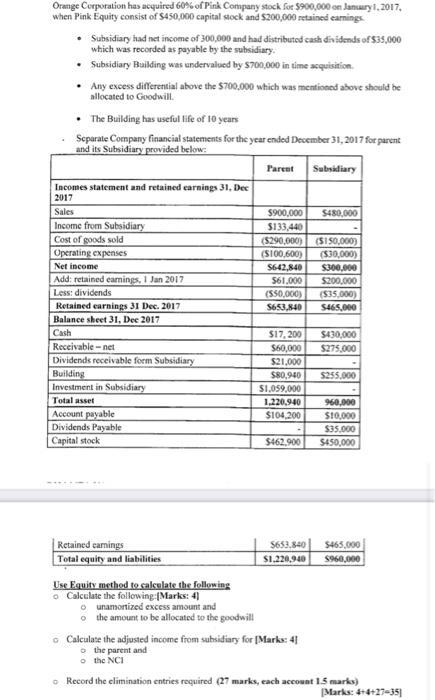

Orange Corporation has acquired 60% of Pink Company stock for $900,000 on January 1, 2017, when Pink Equity consist of $450,000 capital stock and

Orange Corporation has acquired 60% of Pink Company stock for $900,000 on January 1, 2017, when Pink Equity consist of $450,000 capital stock and $200,000 retained earnings Subsidiary had net income of 300,000 and had distributed cash dividends of $35,000 which was recorded as payable by the subsidiary. Subsidiary Building was undervalued by $700,000 in time acquisition Any excess differential above the $700,000 which was mentioned above should be allocated to Goodwill. The Building has useful life of 10 years Separate Company financial statements for the year ended December 31, 2017 for parent and its subsidiary provided below: Incomes statement and retained earnings 31. Dec 2017 Sales Income from Subsidiary Cost of goods sold Operating expenses Net income Add: retained earnings, 1 Jan 2017 Less: dividends Retained earnings 31 Dec. 2017 Balance sheet 31, Dec 2017 Cash Receivable-net Dividends receivable form Subsidiary Building Investment in Subsidiary Total asset Account payable Dividends Payable Capital stock Retained earnings Total equity and liabilities Use Equity method to calculate the following Calculate the following:(Marks: 4) o unamortized excess amount and o the amount to be allocated to the goodwill Parent $900,000 $133,440 ($290,000) ($150,000) ($100,600) ($30,000) $642,840 $300,000 $61,000 ($50,000) $653,840 $17, 200 $60,000 $21,000 $80,940 Subsidiary $480,000 Calculate the adjusted income from subsidiary for [Marks: 4] the parent and o the NCI $200,000 ($35,000) $465,000 $430,000 $275,000 $255,000 $1,059,000 1,220,940 960,000 $104,200 $10,000 $35,000 $462,900 $450,000 $653,840 $465,000 $1,220,940 $960,000 Record the elimination entries required (27 marks, each account 1.5 marks) Marks: 4+4+27-35

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A The unamortized excess amount is 215000 and the amount to be allocated to goodwill is 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started