Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Orange Corporation was established on July 1, 2022. The company's articles of incorporation authorizes the corporation to issue 1,000,000, $2par value common stock and

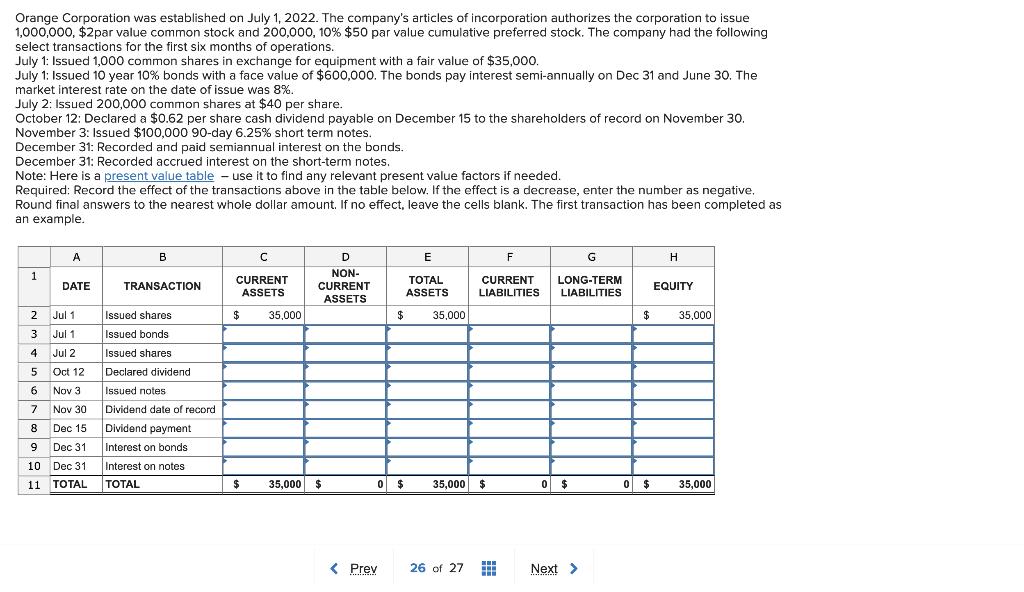

Orange Corporation was established on July 1, 2022. The company's articles of incorporation authorizes the corporation to issue 1,000,000, $2par value common stock and 200,000, 10% $50 par value cumulative preferred stock. The company had the following select transactions for the first six months of operations. July 1: Issued 1,000 common shares in exchange for equipment with a fair value of $35,000. July 1: Issued 10 year 10% bonds with a face value of $600,000. The bonds pay interest semi-annually on Dec 31 and June 30. The market interest rate on the date of issue was 8%. July 2: Issued 200,000 common shares at $40 per share. October 12: Declared a $0.62 per share cash dividend payable on December 15 to the shareholders of record on November 30. November 3: Issued $100,000 90-day 6.25% short term notes. December 31: Recorded and paid semiannual interest on the bonds. December 31: Recorded accrued interest on the short-term notes. Note: Here is a present value table - use it to find any relevant present value factors if needed. Required: Record the effect of the transactions above in the table below. If the effect is a decrease, enter the number as negative. Round final answers to the nearest whole dollar amount. If no effect, leave the cells blank. The first transaction has been completed as an example. 1 A DATE 2 Jul 1 3 Jul 1 4 Jul 2 5 Oct 12 6 Nov 3 7 Nov 30 8 Dec 15 9 Dec 31 10 Dec 31 11 TOTAL B TRANSACTION Issued shares Issued bonds Issued shares Declared dividend Issued notes Dividend date of record Dividend payment Interest on bonds Interest on notes TOTAL C CURRENT ASSETS $ 35,000 $ D NON- CURRENT ASSETS 35,000 $ 0 $ < Prev E TOTAL ASSETS $ 35,000 F G CURRENT LONG-TERM LIABILITIES LIABILITIES 35,000 $ 26 of 27 # 0 $ Next > 0 $ H EQUITY 35,000 35,000

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started