Answered step by step

Verified Expert Solution

Question

1 Approved Answer

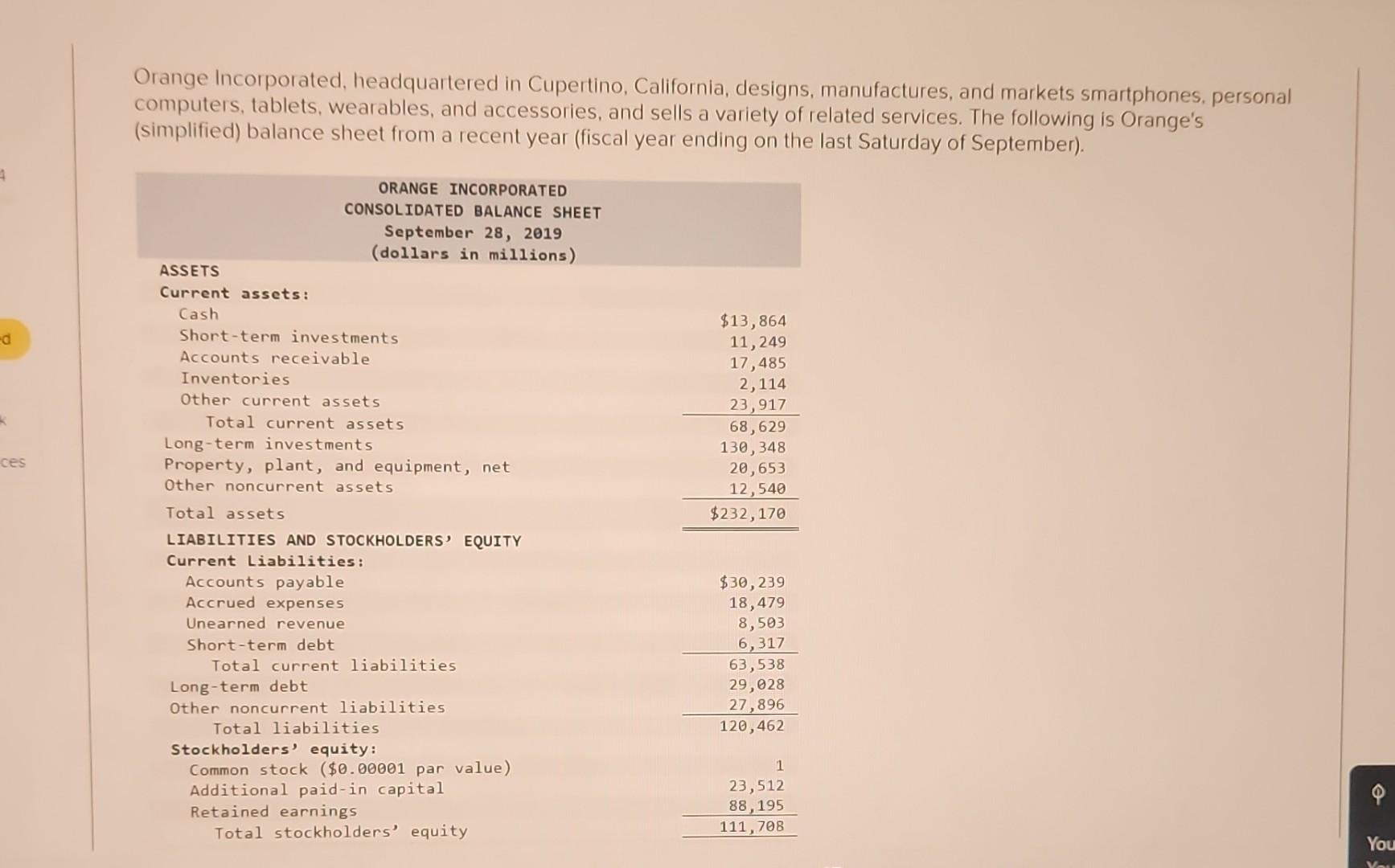

Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The

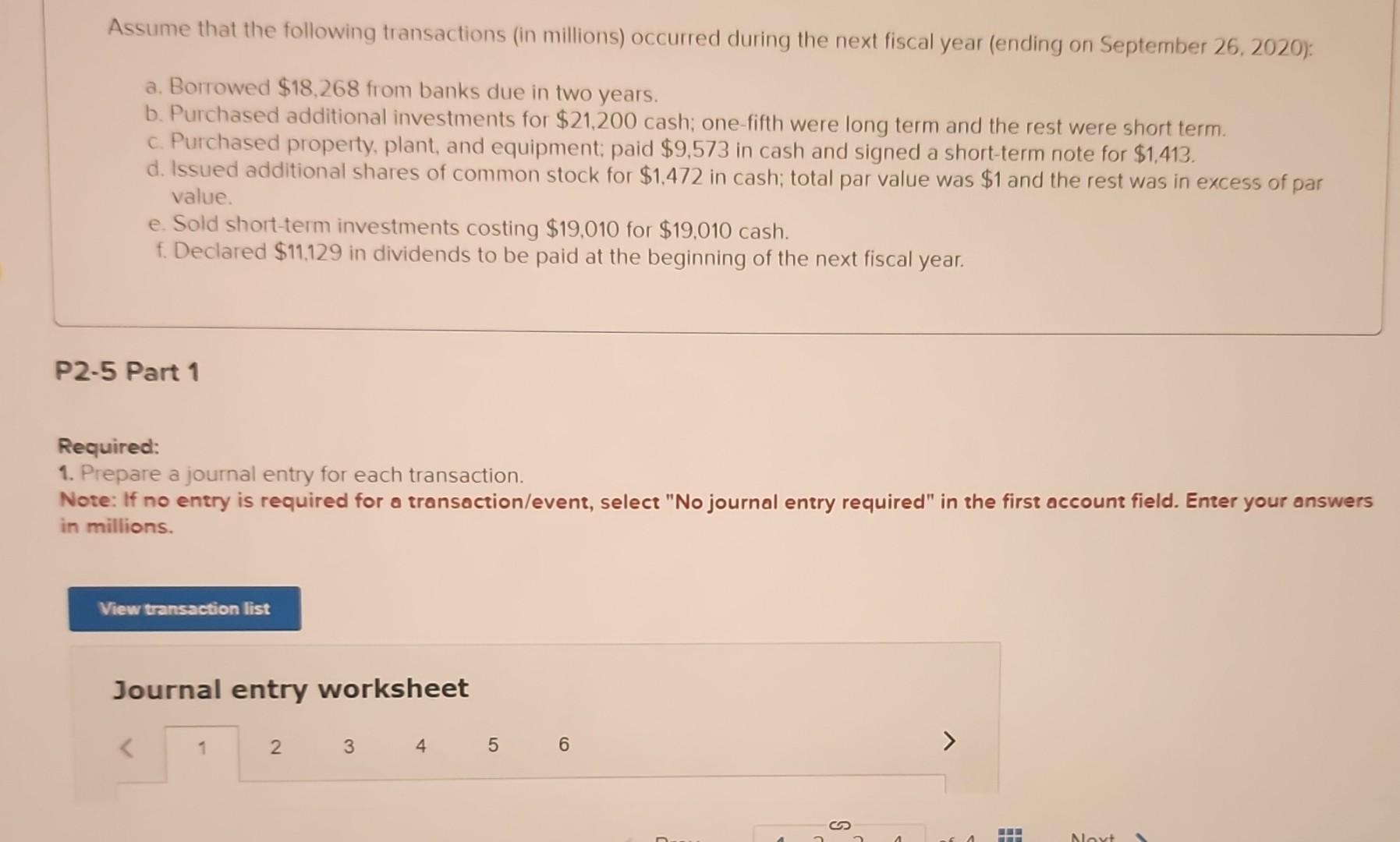

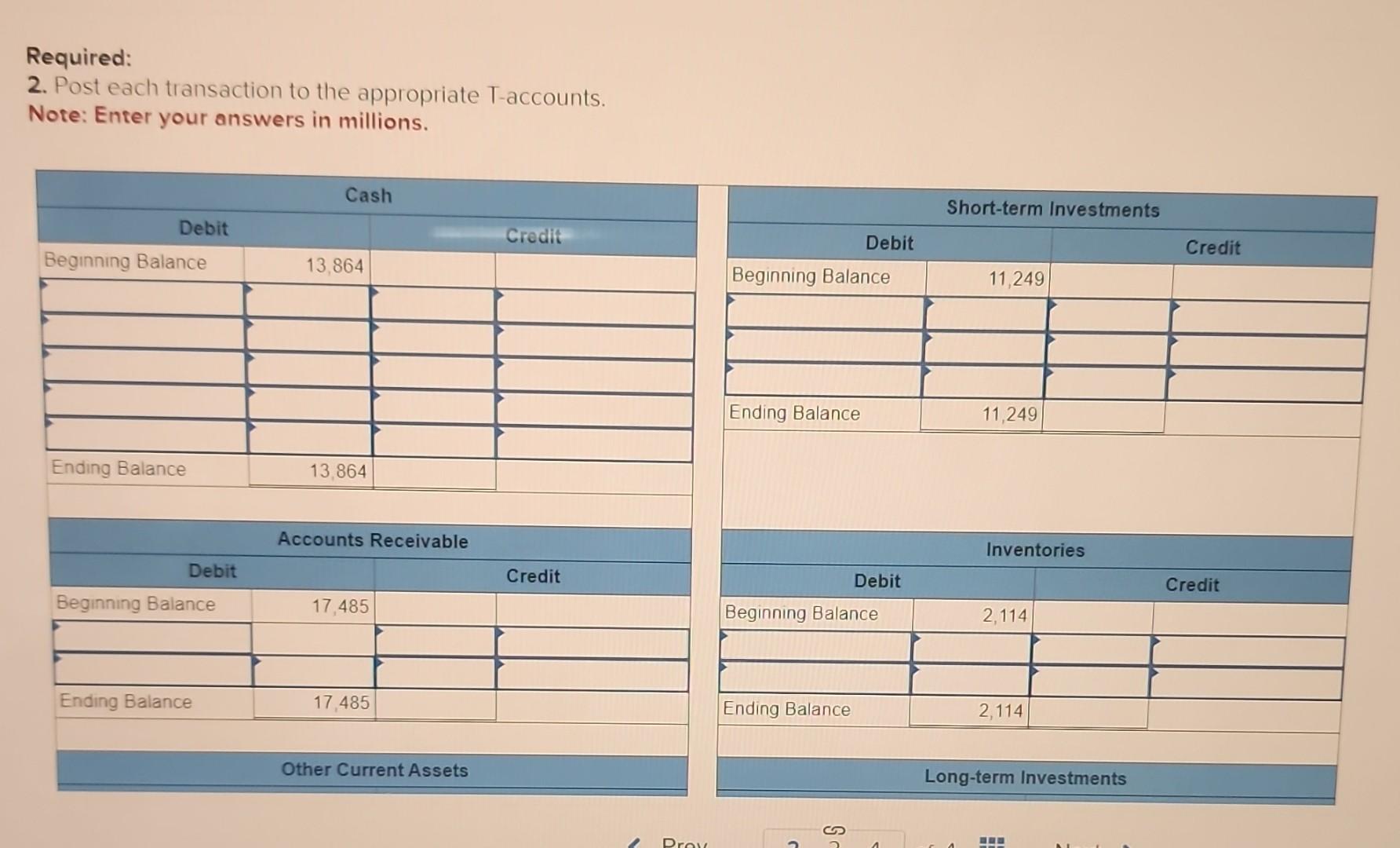

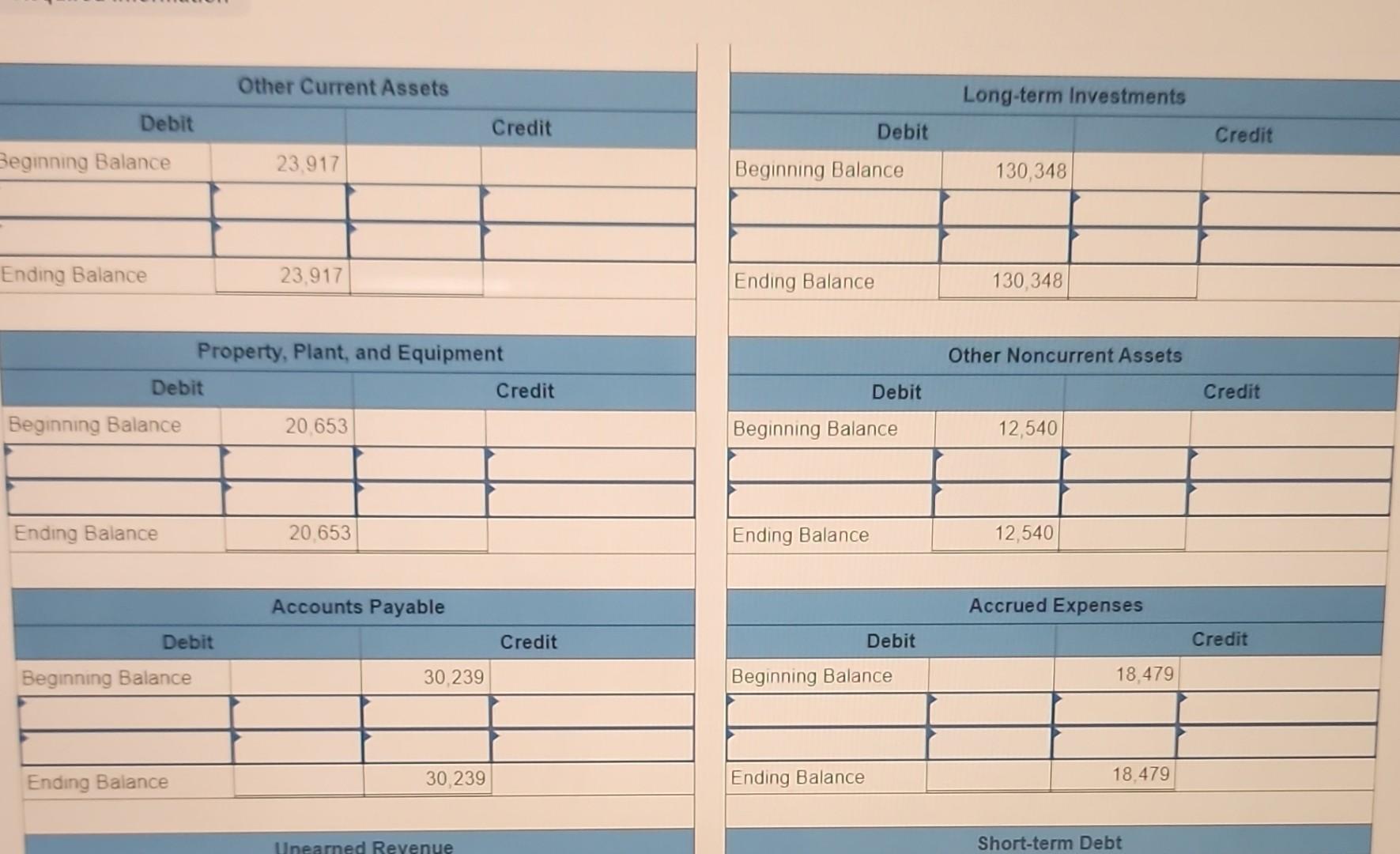

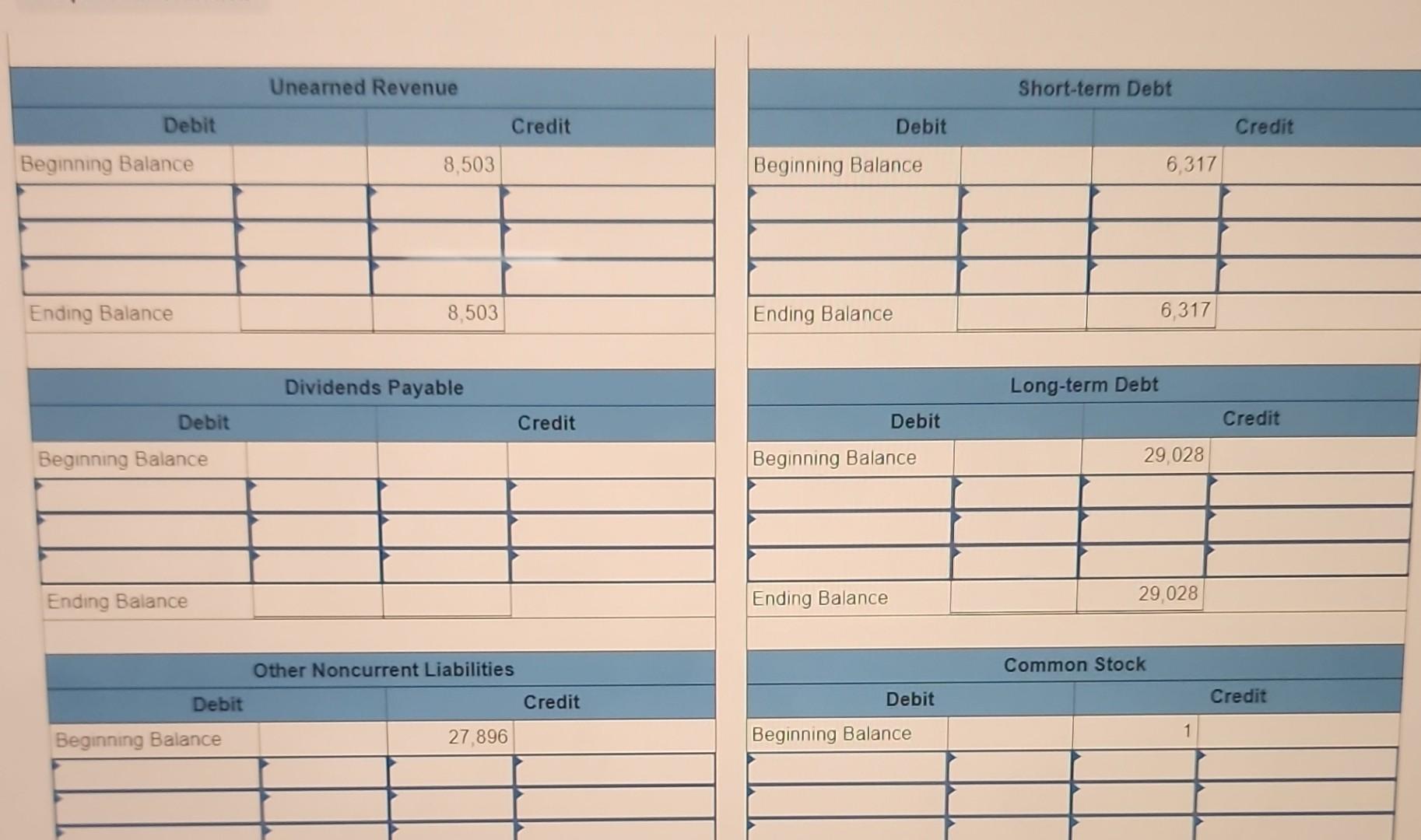

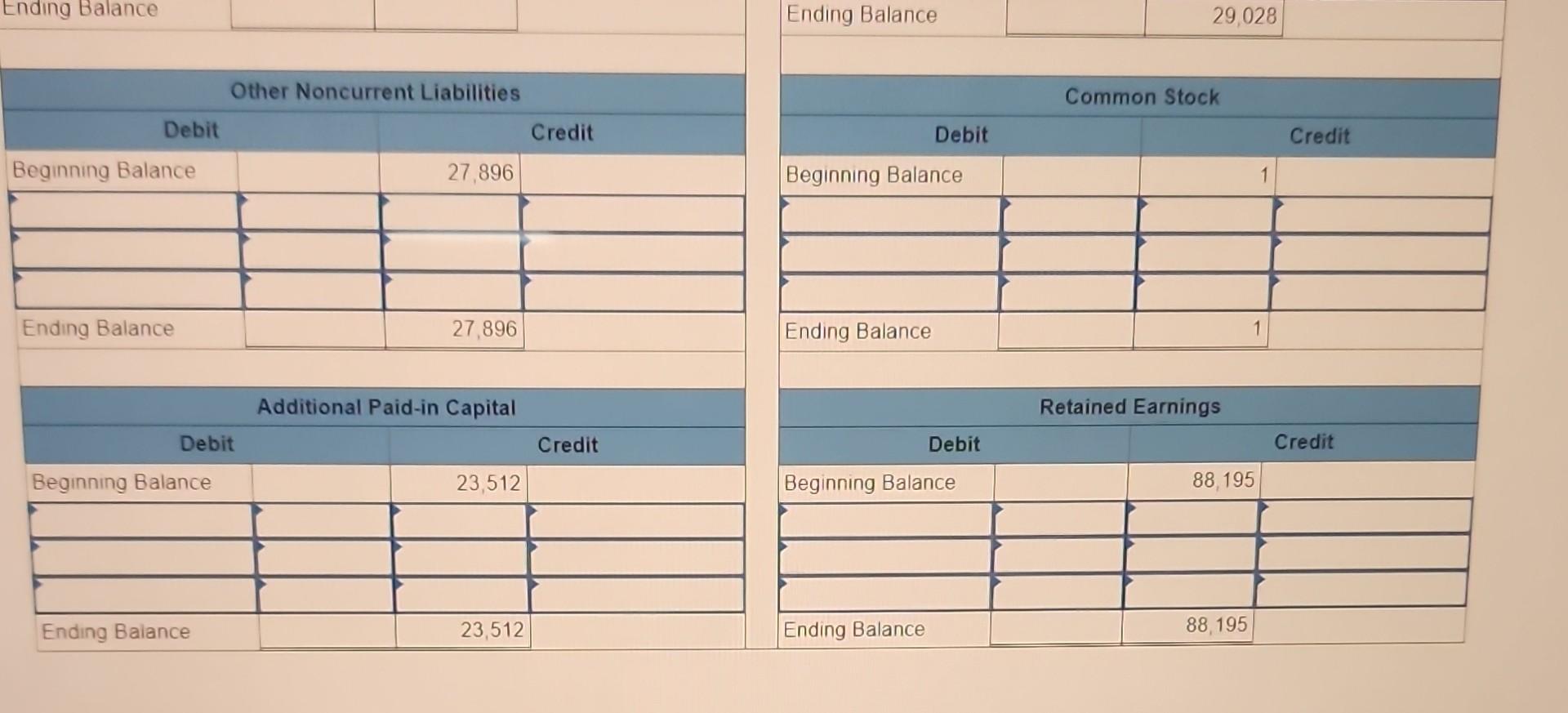

Orange Incorporated, headquartered in Cupertino, California, designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories, and sells a variety of related services. The following is Orange's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). Required: 2. Post each transaction to the appropriate T-accounts. Note: Enter your answers in millions. Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26. 2020): a. Borrowed $18,268 from banks due in two years. b. Purchased additional investments for $21,200 cash; one-fifth were long term and the rest were short term. c. Purchased property, plant, and equipment; paid $9,573 in cash and signed a short-term note for $1,413. d. Issued additional shares of common stock for $1,472 in cash; total par value was $1 and the rest was in excess of par value. e. Sold short-term investments costing $19,010 for $19,010 cash. f. Declared $11,129 in dividends to be paid at the beginning of the next fiscal year. P2-5 Part 1 Required: 1. Prepare a journal entry for each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Property, Plant, and Equipment } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|r|}{ Credit } \\ \hline Beginning Balance & 20,653 & & \\ \hline & & & \\ \hline 5 & & & \\ \hline Ending Balance & 20,653 & & \\ \hline \multicolumn{4}{|c|}{ Accounts Payable } \\ \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|r|}{ Credit } \\ \hline Beginning Balance & & 30,239 & \\ \hline 5 & & & \\ \hline F & & & \\ \hline Ending Balance & & 30,239 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Accrued Expenses } \\ \hline Debit & \multicolumn{2}{|c|}{ Credit } \\ \hline Beginning Balance & 18,479 & \\ \hline F & & \\ \hline 5 & & \\ \hline Ending Balance & 18,479 & \\ \hline \end{tabular} Unearned Revenue Short-term Debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started