Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Orange Vaal Limited carries on business as a cartage contractor. On 30 November 2019 one of its delivery vans was written off in an

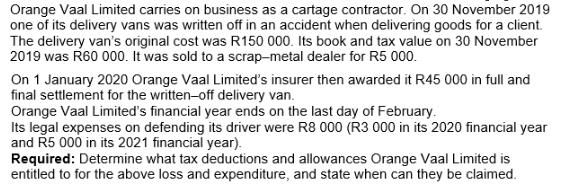

Orange Vaal Limited carries on business as a cartage contractor. On 30 November 2019 one of its delivery vans was written off in an accident when delivering goods for a client. The delivery van's original cost was R150 000. Its book and tax value on 30 November 2019 was R60 000. It was sold to a scrap-metal dealer for R5 000. On 1 January 2020 Orange Vaal Limited's insurer then awarded it R45 000 in full and final settlement for the written-off delivery van. Orange Vaal Limited's financial year ends on the last day of February. Its legal expenses on defending its driver were R8 000 (R3 000 in its 2020 financial year and R5 000 in its 2021 financial year). Required: Determine what tax deductions and allowances Orange Vaal Limited is entitled to for the above loss and expenditure, and state when can they be claimed.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information Orange Vaal Limited is entitled to tax deductions and allowances for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started