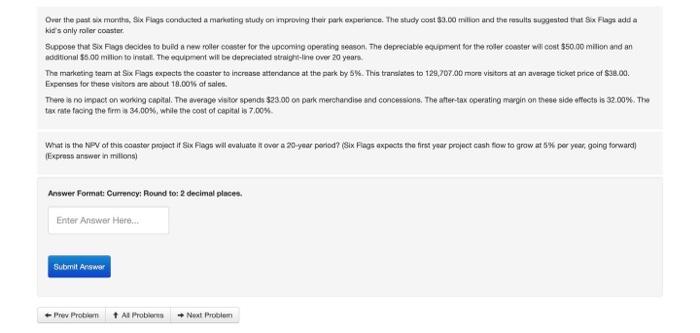

Orar the past six. months, Six Fiags condusted a markuting study ce improving their park experience. The study oost 33.00 milion and the rasults suggested trat Sx. Flags add a kiats anty roler coaster. Suppose that Six Flags decides to buid a new roler ccaster for the upcoming operating season. The depreciable equpment tor the roler coaster wili cest $50 go milion and an additional 55.00 milion to inetal. The equiprevet wit be deprecialed atraigtr-the over 20 years. The markoting taam at Sx. Fags cxpacts the coastor to incrnase attendanoe at the park by 5%. This tranalates to 129,707 . 00 moru visitors at an average ticket price of S3t. O0. Expensas for thesen visitors are about 18.00\% of sales. There is no irpact on working capital. The everage vistor spends 523.00 on park merchandise and concessions. The atter-tax cperating margin on these side effects is 32.00\%. The tas rate facing the firm a 34.00%, ahile the cost of cepital is 7.00%. What is the NPV of this coaster poject if Six Fisgs will evaluate to over a zo-year period? (\$ix Flags axpects the first year project cash tow to grow at 5% per year, going forward) (Exprass answer in miltons) Answer Format: Currenoy: Round to: 2 decimal places. Orar the past six. months, Six Fiags condusted a markuting study ce improving their park experience. The study oost 33.00 milion and the rasults suggested trat Sx. Flags add a kiats anty roler coaster. Suppose that Six Flags decides to buid a new roler ccaster for the upcoming operating season. The depreciable equpment tor the roler coaster wili cest $50 go milion and an additional 55.00 milion to inetal. The equiprevet wit be deprecialed atraigtr-the over 20 years. The markoting taam at Sx. Fags cxpacts the coastor to incrnase attendanoe at the park by 5%. This tranalates to 129,707 . 00 moru visitors at an average ticket price of S3t. O0. Expensas for thesen visitors are about 18.00\% of sales. There is no irpact on working capital. The everage vistor spends 523.00 on park merchandise and concessions. The atter-tax cperating margin on these side effects is 32.00\%. The tas rate facing the firm a 34.00%, ahile the cost of cepital is 7.00%. What is the NPV of this coaster poject if Six Fisgs will evaluate to over a zo-year period? (\$ix Flags axpects the first year project cash tow to grow at 5% per year, going forward) (Exprass answer in miltons) Answer Format: Currenoy: Round to: 2 decimal places