Answered step by step

Verified Expert Solution

Question

1 Approved Answer

orchad mill development case study Case 37 Corporate Financial Restructuring Orchard Mill Development ba Data I, CriarchaDaiyaayaa ( -lepiable.dipoai 10 - , eating atta fide,dhe

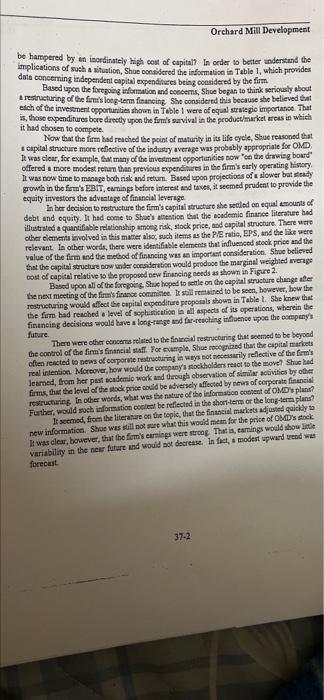

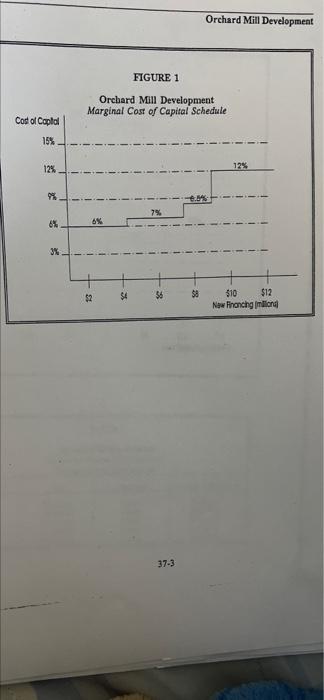

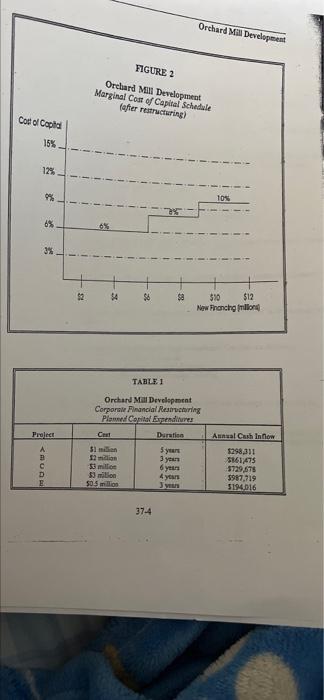

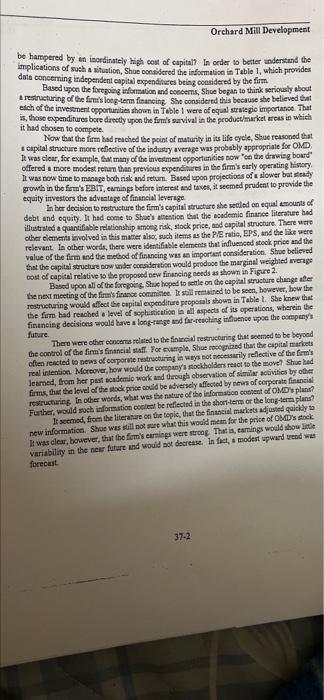

orchad mill development case study

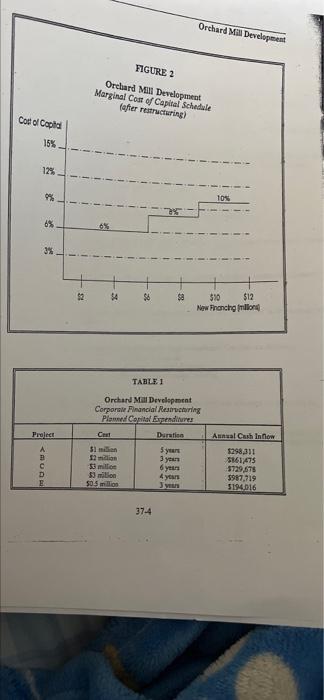

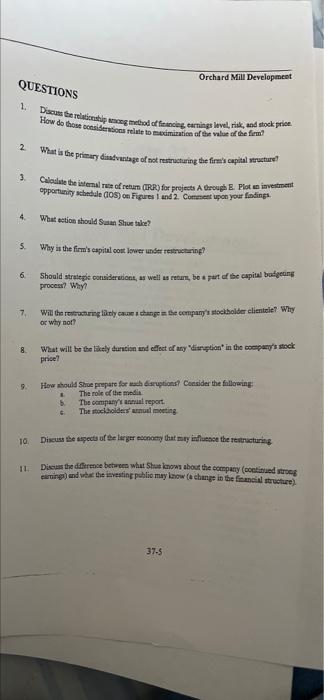

Case 37 Corporate Financial Restructuring Orchard Mill Development ba Data I, CriarchaDaiyaayaa ( -lepiable.dipoai 10 - , eating atta fide,dhe believed deepes Maalai tips matalystal em propered the site for de commentiem divide lead in this process och pal ol Tal Tele orc weataletate, maayatha titaintal. as Naala aale Da attaa ial W - , , Sales due to import Shoe Figuel 1 ial laalla level what we preprosto the cost of capital for the form. So wondered where would the bone capital projets. This speciale apal budgeting proces should be would ap Road -e-ute- fimis capital structure wat die moeite werd how retare . for the cel capital even 37-1 Orchard Mill Development be hampered by an inordinately high cost of capital? In order to better understand the implications of such a situation, Shue considered the information in Table 1, which provides data concerning independent capital expenditures being considered by the firm Based upon the foregoing informatice and concerns, Shoe began to think seriously about each of the investment opportunities shown in Table I were of equal strategic importance. That restructuring of the firm's long-term financing She considered this because she believed at it had chosen to compete those expenditures bere directly upon the fom's survival in the product market areas in which Now that the firm had reached the point of maturity in its life cycle, Shue reasoned that capital structure more reflective of the industry average was probably appropriate for OMD It was clear, for example, that many of the investment opportunities now on the driwwing bourd' offered a more modest return than previous expenditures in the firm's early operating history It was now time to manage both risk and return. Based upon projections of slower battery growth in the firm's EBIT, cumings before interest and taxes, it seemed prudent to provide the equity investors the advantage of financial leverage In her decision to restructure the firm's capital structure she settled on equal mounts of debt and equity. It had come to Shue's stention that the condemic finance literature had illustrated a quantifiable relationship among risk, stock price, and capital structure. There were other elements involved in this matter also such items as the Perio, EPS, and the like were relevant. In other words, there were identifiable elements that influenced stock price and the value of the firm and the method of financing was an important consideration. She believed that the capital structure sonder consideration would produce the marginal weighted average cost of capital relative to the proposed new financing needs as shown in Figure 2. Based upon all of the foregoing. She hoped to settle on the capital structure change the next meeting of the firm's finance committee. It still remained to be seen, however, how the restructuring would affect the capital expenditure proposals shown in Table 1. She knew that the firm had reached a level of sophistication in all aspects of its operations, wherein the financing decisions would have a long-range and far-reaching intence upon the company's future There were other enorm related to the financial restructuring that seemed to be beyond the control of the firm's financial staff For example, Shercognized that the capital markets often reacted to news of corporaterestructuring in ways not necessarily reflective of the firm's real intention. Moreover, how would the company's stockholders react to the move? Shu had Searned, from her past scademic work and through observation of similar activities by other firms that the level of the stock price could be adversely affected by news of corporate financial restructuring In other words, what was the nature of the information content OMD's pluna? Further, would such information cost be reflected in the short-term or the long-term plans? It seemed, from the literature on the topit, that the financial markets adjusted quicly to new information. She was still not sure what this would means for the price of OMD's stock It was clear, bowever, that the firm's camins were strong That is, amnings would showide variability in the near future and would not decrease. In fact, a modest upward end we forecast 37-2 Orchard Mill Development FIGURE 1 Orchard Mill Development Marginal Cost of Capital Schedule Cost of Copla 15% 12% 12% * 8% 6% $4 $2 $8 56 $10 $12 New Fronchimona 37-3 Orchard Mill Development FIGURE 2 Orchard MM Development Marginal Cost of Capital Schedule fafter restructuring) Cool Copla 15% 12% % 105 6% 63 * 3% $2 $4 $8 $8 $50 $12 Now Franchillo TABLE 1 Prolet Annual Cash Innow Orchard Mal Development Corporate Financial Remching Powd Contal Endre Cat Duration Similian 5 years 12 min 3 years 53 mille 6 years millon 4 years 50 Sinos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started