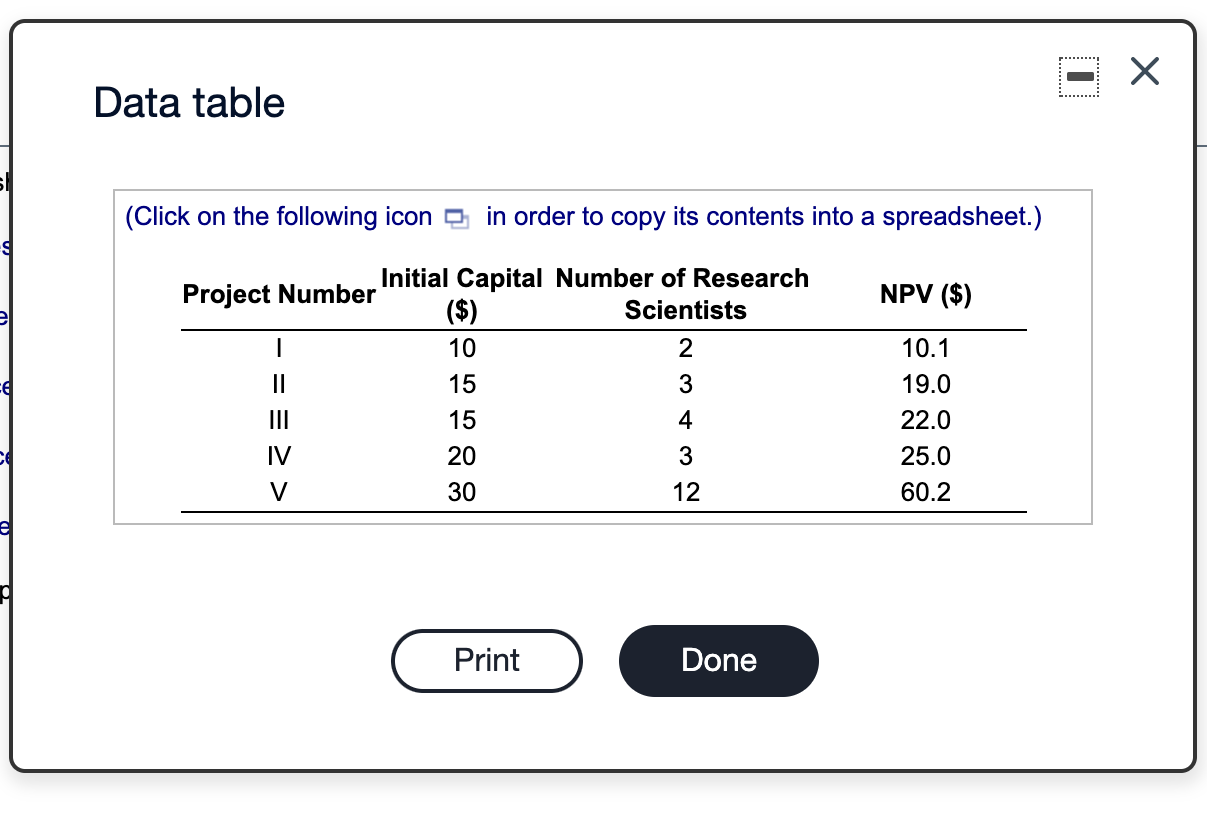

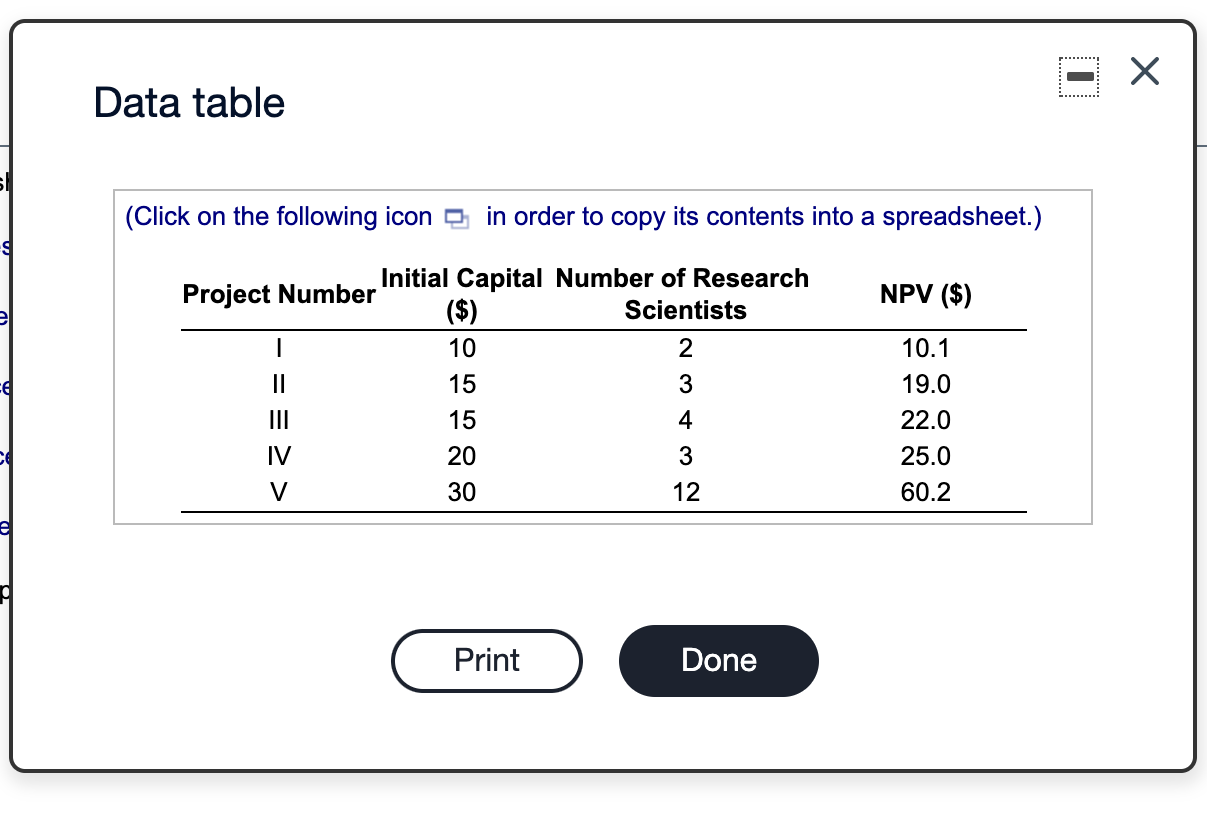

Orchid Biotech Company is evaluating several different development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects: B.Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars). a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects? b. Suppose that Orchid currently has 12 research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects? a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects? The profitability index for Project lis (Round to two decimal places.) The profitability index for Project Ilis (Round to two decimal places.) The profitability index for Project III is (Round to two decimal places.) The profitability index for Project IV is. (Round to two decimal places.) The profitability index for Project Vis D. (Round to two decimal places.) Based on the profitability index, how should Orchid Biotech Company prioritize these projects? (Select from the drop-down menus.) Selected first Selected second Selected third b. Suppose that Orchid currently has 12 research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects? The NPV/headcount ratio for Project lis J. (Round to one decimal place.) Orchid Biotech Company is evaluating several different development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects:..Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (al cost values are given in millions of dollars). a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects? b. Suppose that Orchid currently has 12 research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects? LL Selected third b. Suppose that Orchid currently has 12 research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects? The NPV/headcount ratio for Project is . (Round to one decimal place.) The NPV/headcount ratio for Project Il is - (Round to one decimal place.) The NPV/headcount ratio for Project III is (Round to one decimal place.) The NPV/headcount ratio for Project IV is (Round to one decimal place.) The NPV/headcount ratio for Project Vis (Round to one decimal place.) Based on the NPV/headcount ratio, how should Orchid Biotech Company prioritize these projects? (Select from the drop-down menus.) Selected first 7 Selected second Selected third Selected fourth Data table (Click on the following icon in order to copy its contents into a spreadsheet.) NPV ($) Project Number Initial Capital Number of Research ($) Scientists I 10 II 15 III 15 IV 20 V 30 12 NooN 10.1 19.0 22.0 25.0 60.2 Print Done