Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THE LINKS WONT WORK BECAUSE THIS IS A SCREENSHOT, IVE ATTACHED THE SCREENSHOTS WITHIN THE LINKS BELOW: A company is producing a high-volume item that

THE LINKS WONT WORK BECAUSE THIS IS A SCREENSHOT, IVE ATTACHED THE SCREENSHOTS WITHIN THE LINKS BELOW:

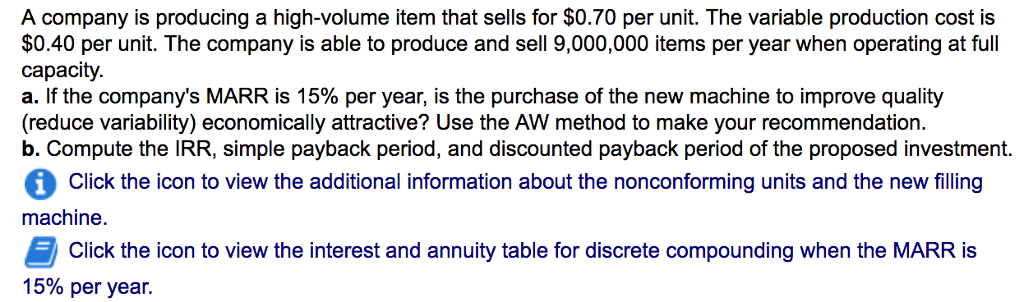

A company is producing a high-volume item that sells for $0.70 per unit. The variable production cost is $0.40

per unit. The company is able to produce and sell 9,000,000 items per year when operating at full capacity.

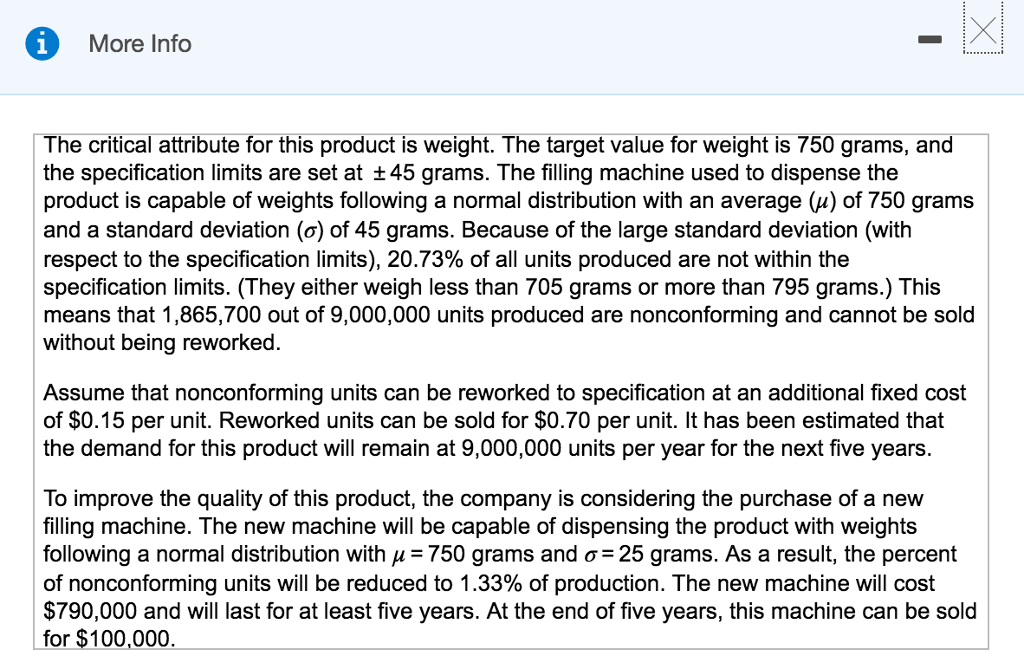

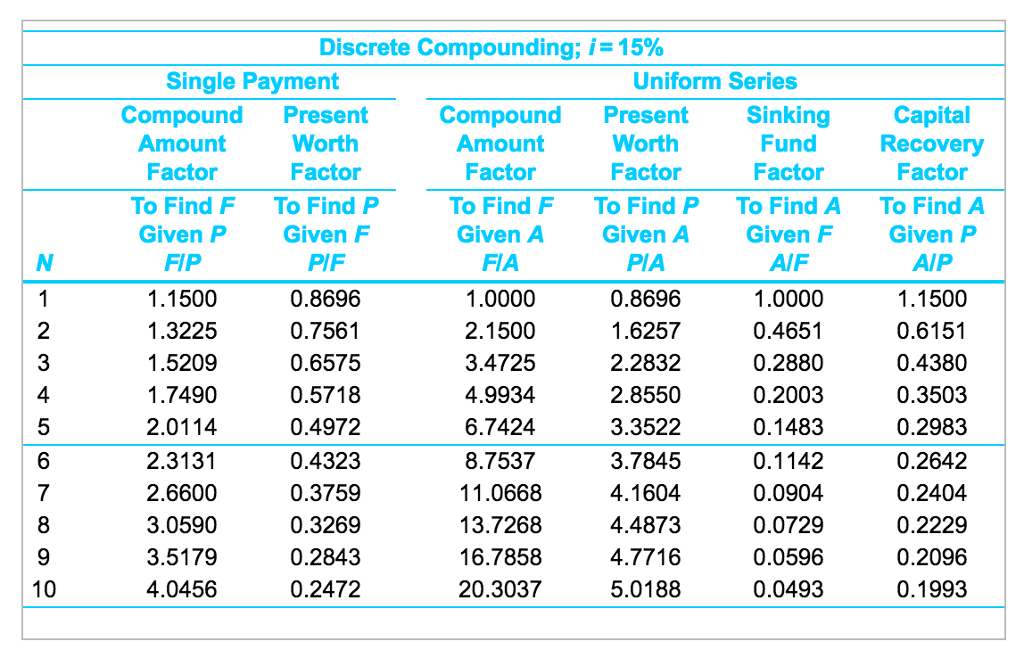

A company is producing a high-volume item that sells for $0.70 per unit. The variable production cost is $0.40 per unit. The company is able to produce and sell 9,000,000 items per year when operating at full capacity. a. If the company's MARR is 15% per year, is the purchase of the new machine to improve quality (reduce variability) economically attractive? Use the AW method to make your recommendation. b. Compute the IRR, simple payback period, and discounted payback period of the proposed investment. Click the icon to view the additional information about the nonconforming units and the new filling machine E Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started