Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Orchid Limited (ORL) acquired a factory a few years ago. The factory has the following assets as at 30 September 2021: ORL determines that the

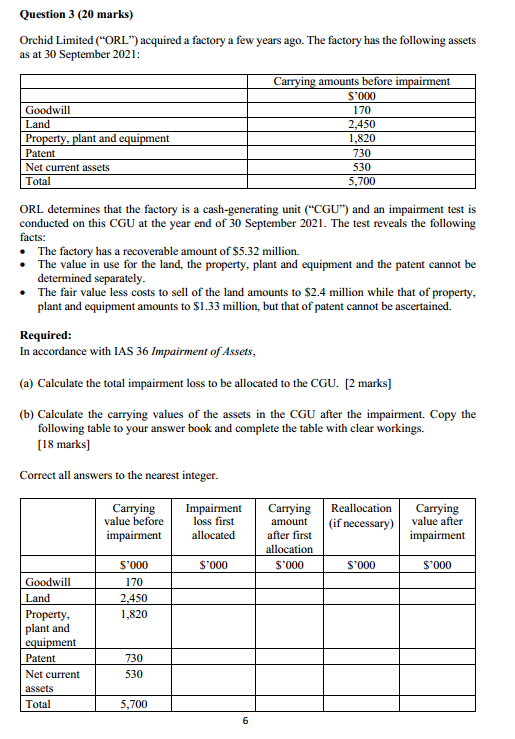

Orchid Limited ("ORL") acquired a factory a few years ago. The factory has the following assets as at 30 September 2021: ORL determines that the factory is a cash-generating unit ("CGU") and an impairment test is conducted on this CGU at the year end of 30 September 2021. The test reveals the following facts: - The factory has a recoverable amount of $5.32 million. - The value in use for the land, the property, plant and equipment and the patent cannot be determined separately. - The fair value less costs to sell of the land amounts to $2.4 million while that of property, plant and equipment amounts to $1.33 million, but that of patent cannot be ascertained. Required: In accordance with IAS 36 Impairment of Assets, (a) Calculate the total impairment loss to be allocated to the CGU. [2 marks] (b) Calculate the carrying values of the assets in the CGU after the impairment. Copy the following table to your answer book and complete the table with clear workings. [18 marks] Correct all answers to the nearest integer

Orchid Limited ("ORL") acquired a factory a few years ago. The factory has the following assets as at 30 September 2021: ORL determines that the factory is a cash-generating unit ("CGU") and an impairment test is conducted on this CGU at the year end of 30 September 2021. The test reveals the following facts: - The factory has a recoverable amount of $5.32 million. - The value in use for the land, the property, plant and equipment and the patent cannot be determined separately. - The fair value less costs to sell of the land amounts to $2.4 million while that of property, plant and equipment amounts to $1.33 million, but that of patent cannot be ascertained. Required: In accordance with IAS 36 Impairment of Assets, (a) Calculate the total impairment loss to be allocated to the CGU. [2 marks] (b) Calculate the carrying values of the assets in the CGU after the impairment. Copy the following table to your answer book and complete the table with clear workings. [18 marks] Correct all answers to the nearest integer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started