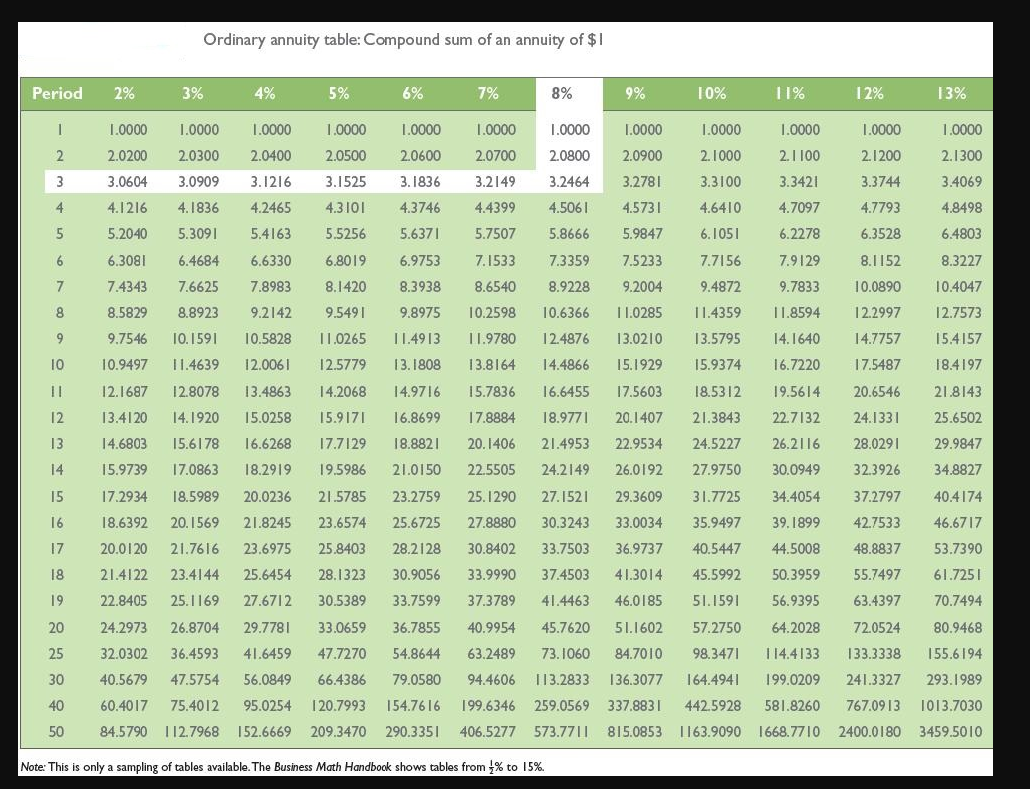

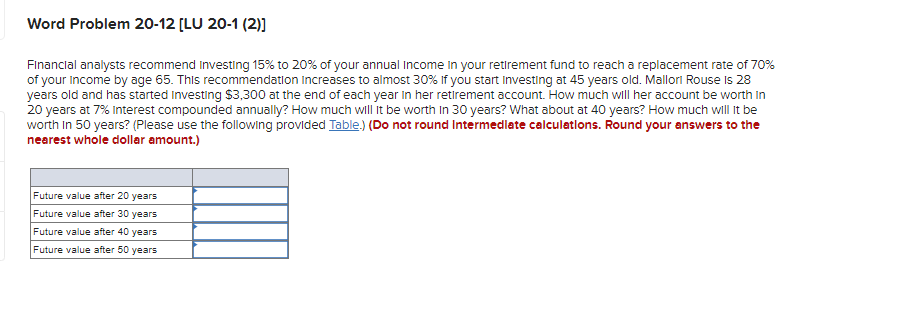

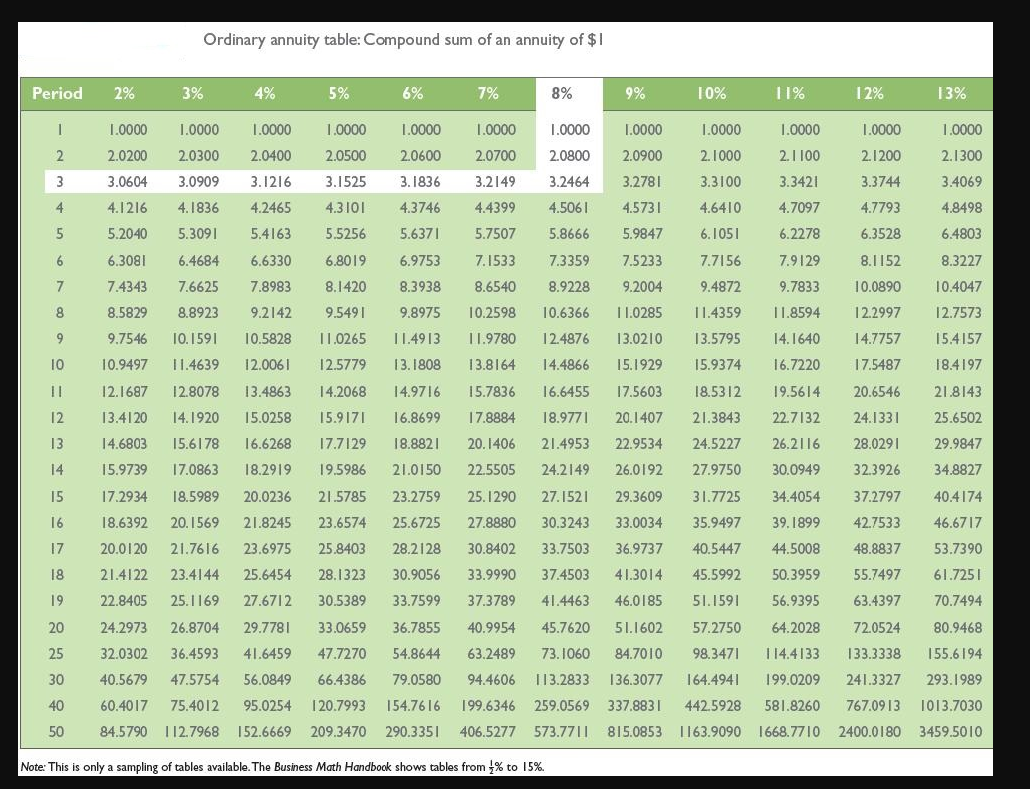

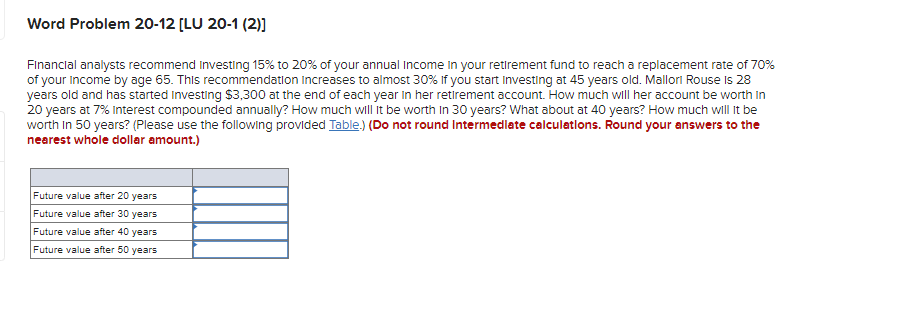

Ordinary annuity table: Compound sum of an annuity of $1 Period 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1 2. 2.0200 2.0300 2.0400 2.0500 2.0700 2.0800 2.0900 2.1 100 2.1200 2.1300 2.0600 3.1836 2..1000 3.3100 3 3.0604 3.0909 3.1525 3.2149 3.2464 3.2781 3.3421 3.3744 3.4069 4 4.4399 3.1216 4.2465 5.4163 4.5061 4.7097 4.7793 4.8498 4.1216 5.2040 6.3081 4.1836 5.3091 4.3101 5.5256 4.3746 5.6371 4.5731 5.9847 4.6410 6.1051 5 5.7507 5.8666 6.2278 6.3528 6.4803 6 6.4684 6.6330 6.8019 6.9753 7. 1533 7.3359 7.5233 7.7156 7.9129 8.3227 7 7.4343 7.6625 7.8983 8.1420 8.3938 8.6540 8.9228 9.4872 9.7833 8.1152 10.0890 12.2997 9.2004 11.0285 10.4047 8 8.5829 8.8923 9.5491 9.8975 10.2598 10.6366 11.4359 12.7573 9.2142 10.5828 9 9.7546 10.1591 11.0265 11.4913 11.9780 12.4876 13.0210 13.5795 11.8594 14.1640 16.7220 14.7757 15.4157 10 10.9497 11.4639 12.0061 12.5779 13.1808 13.8164 14.4866 15.1929 15.9374 17.5487 18.4197 I! 12.1687 14.2068 15.7836 16.6455 17.5603 19.5614 12.8078 14.1920 14.9716 16.8699 18.5312 21.3843 21.8143 25.6502 12 13.4120 15.9171 17.8884 18.9771 20.1 407 22.7132 13.4863 15.0258 16.6268 18.2919 20.6546 24.1331 28.0291 32.3926 13 14.6803 15.6178 18.8821 20.1406 21.4953 22.9534 24.5227 26.2116 29.9847 17.7129 19.5986 14 15.9739 17.0863 21.0150 22.5505 24.2149 26.0192 27.9750 30.0949 34.8827 15 17.2934 20.0236 21.5785 25.1290 29.3609 37.2797 40.4174 27.1521 30.3243 31.7725 35.9497 34.4054 39.1899 16 21.8245 23.2759 25.6725 28.2128 23.6574 33.0034 46.6717 18.5989 20.1569 21.7616 23.4144 18.6392 20.0120 21.4122 17 42.7533 48.8837 23.6975 27.8880 30.8402 33.9990 36.9737 40.5447 44.5008 25.8403 28.1323 53.7390 33.7503 37.4503 18 25.6454 41.3014 45.5992 61.7251 30.9056 33.7599 50.3959 56.9395 55.7497 63.4397 19 30.5389 37.3789 41.4463 46.0185 51.1591 70.7494 20 36.7855 45.7620 80.9468 40.9954 63.2489 25 33.0659 47.7270 66.4386 54.8644 73.1060 22.8405 25.1169 27.6712 24.2973 26.8704 29.7781 32.0302 36.4593 41.6459 40.5679 47.5754 56.0849 60.4017 75.4012 95.0254 84.5790 112.7968 152.6669 155.6194 30 79.0580 94.4606 113.2833 51.1602 57.2750 64.2028 72.0524 84.7010 98.3471 114.4133 133.3338 136.3077 164.4941 199.0209 241.3327 337.8831 442.5928 581.8260 767.0913 815.0853 1163.9090 1668.7710 2400.0180 293.1989 40 154.7616 1013.7030 120.7993 209.3470 199.6346 259.0569 406.5277 573.77|| 50 290.3351 3459.5010 Note: This is only a sampling of tables available. The Business Math Handbook shows tables from % to 15%. Word Problem 20-12 [LU 20-1 (2)] Financial analysts recommend Investing 15% to 20% of your annual Income in your retirement fund to reach a replacement rate of 70% of your Income by age 65. This recommendation Increases to almost 30% If you start Investing at 45 years old. Mallori Rouse is 28 years old and has started Investing $3,300 at the end of each year in her retirement account. How much will her account be worth in 20 years at 7% Interest compounded annually? How much will it be worth in 30 years? What about at 40 years? How much will it be worth In 50 years? (Please use the following provided Table. (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) Future value after 20 years Future value after 30 years Future value after 40 years Future value after 50 years