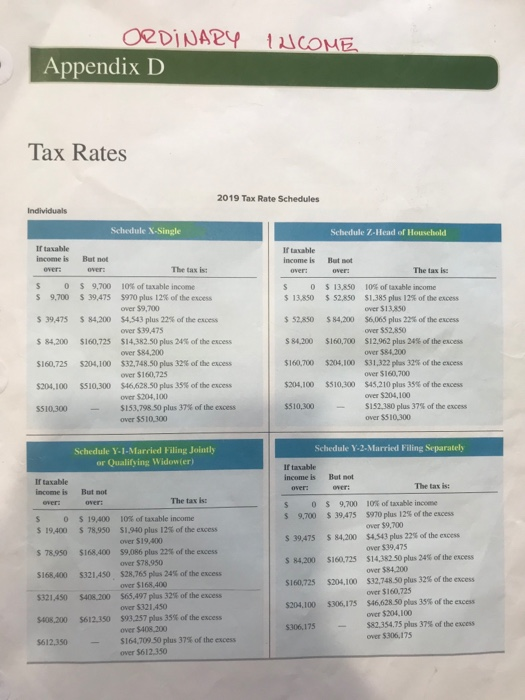

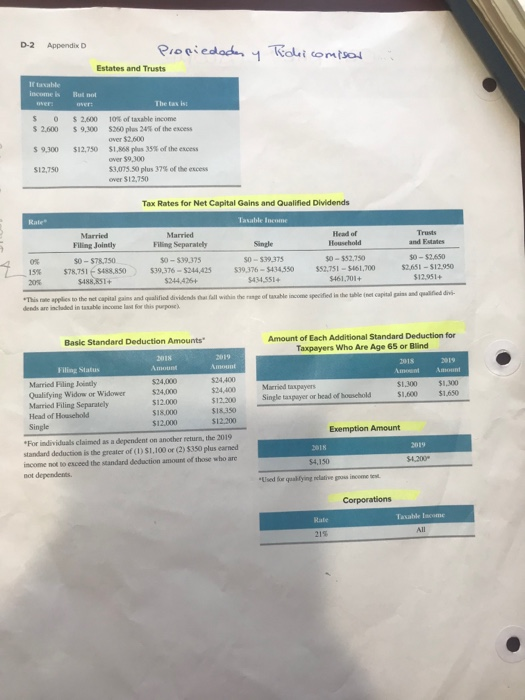

ORDINARY INCOME Appendix D Tax Rates 2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household Ir taxable income is But not over: The taxis $ 0$ 9,700 10% of taxable income $ 9,700 $ 39,475 5970 plus 12% of the excess over 59,700 $ 39,475 $ 84,200 $4,543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14.382.50 plus 24% of the excess over $84.200 $160,725 5204,100 $32,748.50 plus 32% of the excess over $160,725 $204.100 5510,300 $46,628.50 plus 35% of the excess over $204,100 5510,300 $153.798 50 plus 37% of the excess over $510,300 If taxable income is But not over over! The tax is: S 0 $ 13,850 10% of taxable income $13.850 $ 52,850 $1,385 plus 12% of the excess over 150 $ 52.850 $ 84,200 $6,005 plus 22 of the excess over $52,850 $84.200 $160,700 $12.962 plus 24% of the excess Over $84.300 $160,700 $204,100 $31,322 plus 32% of the excess over $160,700 $204,100 $510,300 $45.210 plus 35% of the excess over S204,100 $510,300 S152,380 plus 37% of the excess over $510,300 Schedule Y. 1. Married Filing Jointly or Qualifying Widower) Ir taxable income is over But not over The tax is: $ 0 $ 19,400 10% of taxable income $ 19.400 $ 78,950 $1.940 plus 125 of the excess over $19,400 $ 78.950 $168.400 59,086 plus 22% of the excess over $78,950 $168.400 S321450 $28,765 plus 245 of the excess over $168.400 5321.450 $408.200 565,497 plus 32% of the excess over 5321.450 $408.200 $612.350 593.257 plus 35% of the excess over $408 200 $612.350 $164,709 50 plus 37 of the excess over $612.350 Schedule Y-2- Married Filing Separately If taxable Income is But not over Over: The tax is: 5 OS 9,700 10% of taxable income $ 9,700 $ 39,475 5970 plus 12% of the excess over $9,700 $ 39,475 $ 84,200 $4.543 plus 22% of the excess over $39,475 $ 84,200 $160,725 $14,382.50 plus 245 of the excess over $84.200 $160,725 $204,100 $32,748.50 plus 32% of the excess over $160.725 $204.100 $306,175 $46,628 50 plus 35% of the excess Over $204.100 $306,175 $82,354,75 plus 37 of the excess over $306,175 D-2 Todki comisar Appendix D Propiedades Estates and Trusts table income is But not The tax is! S 0 $ 2,600 10% of taxable income $ 2.600 $ 9,300 $260 plus 24% of the excess over $2.600 59,300 $12.750 1.868 plus 35% of the excess over $9,300 S12,750 53,075.50 plus 37% of the excess over $12.750 Tax Rates for Net Capital Gains and Qualified Dividends Kale Tasable Income Married Married Head of Trusts Filing Jointly Filing Separately Single Household and Estates 0% 50 - 578.750 50 - 599.375 50 - 599,375 $0-52.750 50 - 52.650 15 $78,751488.850 $39,376 - 244,425 599,376 - 5434350 $52.751 - $161.700 52.51 - $12.950 20 $488,51+ $244.425+ $434.551 $461,701+ $12.951 *This replies to the net capital gains and qualified dividends that all within the range of table income specified in the table net capital and qualified dib. dends are included in the income last for this purpose Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2018 Married taxpayers Single taxpayer or head of household $1,300 $1.000 $1,100 $1.650 Basic Standard Deduction Amounts 2013 2019 Filing Status Amount Am Married Filing body 524.000 524400 Qualifying Widow or Widower 534,000 $34,400 Married Filing Separately $12.000 $12.200 Head of Household S18000 SIR 350 Single $12.000 $12.200 "For individuals claimed as a dependent on another return, the 2019 standard deduction is the greater of (1) $1,100 or (2) $350 plus earned income not to exceed the standard deduction amount of those who are not dependent Exemption Amount $4,150 50200 Used for qualifying relative prouincome Corporations Taxable income Kale 215 All 35314 Time Remaining Return Next 11 1 point Child is 14 years old on 31 December 2019. For the year, Child earned $950 In wages from a part-time job, an amount which does not exceed one-half of Child's support for the year. Child also earned $4.900 in interest on bank deposits. Determine Child's income tax liability for the year, Type your answer. Previous Next 4 5 6 PM B 7 Search here o 35314 Time Remaining Return Next 11 1 point Child is 14 years old on 31 December 2019. For the year, Child earned $950 In wages from a part-time job, an amount which does not exceed one-half of Child's support for the year. Child also earned $4.900 in interest on bank deposits. Determine Child's income tax liability for the year, Type your answer. Previous Next 4 5 6 PM B 7 Search here o