Answered step by step

Verified Expert Solution

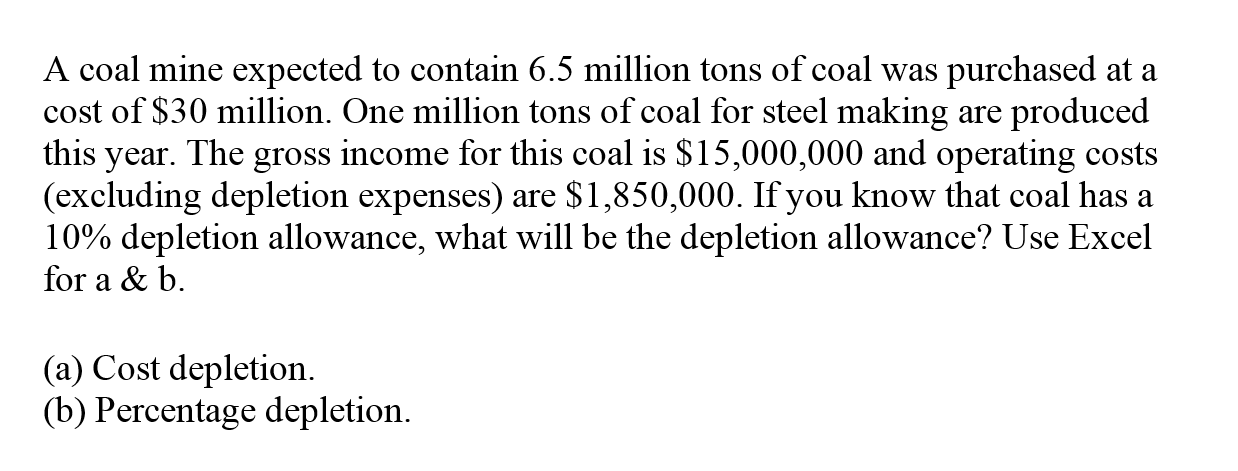

Question

1 Approved Answer

Ore Mining Cost basis ($) Salvage value ($) $ - Total recoverable volume (tons) Amount sold this year (tons) Gross income this year ($) Mining

| Ore Mining | |

| Cost basis ($) | |

| Salvage value ($) | $ - |

| Total recoverable volume (tons) | |

| Amount sold this year (tons) | |

| Gross income this year ($) | |

| Mining expenses this year($) | |

| Percentage allowance (%) | |

| Depletion rate per ton | |

| Fiscal year (this year) | |

| Cost depletion | |

| Fiscal year (this year) | |

| Percentage depletion | |

| Gross income | $ - |

| Depletion rate | |

| Computed % depletion | $ - |

| Maximum depletion deduction | |

| Gross income | $ - |

| Expenses | $ - |

| Taxable income | $ - |

| Deduction limit (50%) | 50% |

| Maximum depletion deduction | $ - |

| Allowable percentage deduction | $ - |

| Optimal deletion expense to use | |

please fill the table and show how to find results in each cell

please fill the table and show how to find results in each cell

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started