Answered step by step

Verified Expert Solution

Question

1 Approved Answer

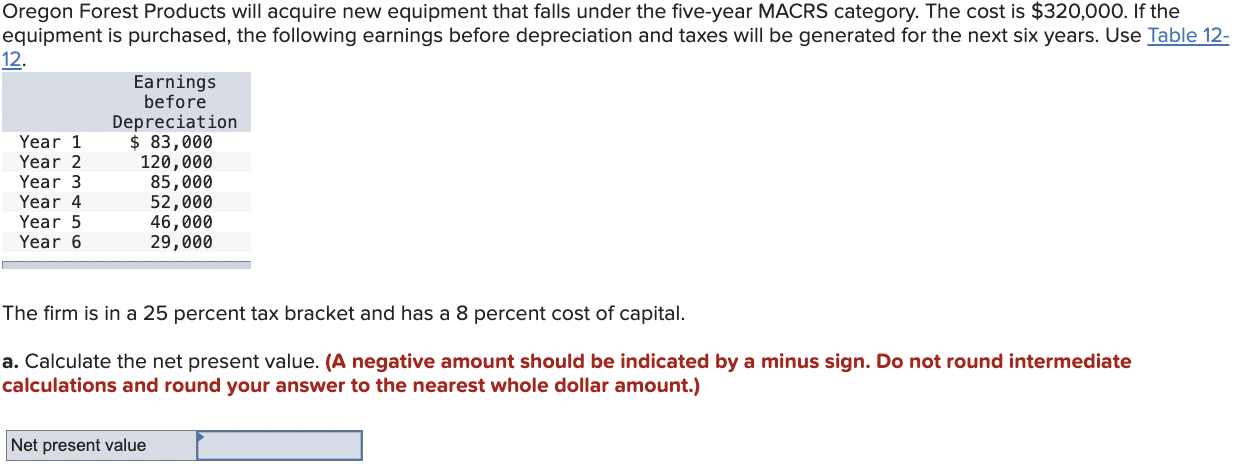

Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $320,000. If the equipment is purchased, the following

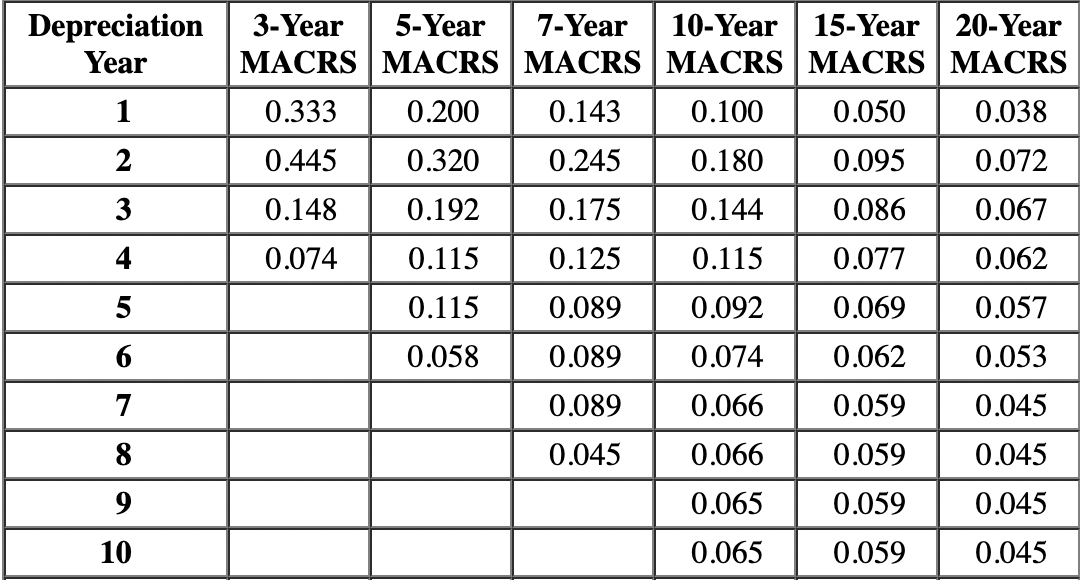

Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $320,000. If the equipment is purchased, the following earnings before depreciation and taxes will be generated for the next six years. Use Table 12 12. The firm is in a 25 percent tax bracket and has a 8 percent cost of capital. a. Calculate the net present value. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole dollar amount.) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{c} Depreciation \\ Year \end{tabular} & \begin{tabular}{c} 3-Year \\ MACRS \end{tabular} & \begin{tabular}{c} 5-Year \\ MACRS \end{tabular} & \begin{tabular}{c} 7-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 10-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 15-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 20-Year \\ MACRS \end{tabular} \\ \hline 1 & 0.333 & 0.200 & 0.143 & 0.100 & 0.050 & 0.038 \\ \hline 2 & 0.445 & 0.320 & 0.245 & 0.180 & 0.095 & 0.072 \\ \hline 3 & 0.148 & 0.192 & 0.175 & 0.144 & 0.086 & 0.067 \\ \hline 4 & 0.074 & 0.115 & 0.125 & 0.115 & 0.077 & 0.062 \\ \hline 5 & & 0.115 & 0.089 & 0.092 & 0.069 & 0.057 \\ \hline 6 & & 0.058 & 0.089 & 0.074 & 0.062 & 0.053 \\ \hline 7 & & & 0.089 & 0.066 & 0.059 & 0.045 \\ \hline 8 & & & 0.045 & 0.066 & 0.059 & 0.045 \\ \hline 9 & & & & 0.065 & 0.059 & 0.045 \\ \hline 10 & & & & 0.065 & 0.059 & 0.045 \\ \hline \end{tabular}

Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $320,000. If the equipment is purchased, the following earnings before depreciation and taxes will be generated for the next six years. Use Table 12 12. The firm is in a 25 percent tax bracket and has a 8 percent cost of capital. a. Calculate the net present value. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole dollar amount.) \begin{tabular}{|c|c|c|c|c|c|c|} \hline \begin{tabular}{c} Depreciation \\ Year \end{tabular} & \begin{tabular}{c} 3-Year \\ MACRS \end{tabular} & \begin{tabular}{c} 5-Year \\ MACRS \end{tabular} & \begin{tabular}{c} 7-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 10-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 15-Year \\ MACRS \end{tabular} & \begin{tabular}{l} 20-Year \\ MACRS \end{tabular} \\ \hline 1 & 0.333 & 0.200 & 0.143 & 0.100 & 0.050 & 0.038 \\ \hline 2 & 0.445 & 0.320 & 0.245 & 0.180 & 0.095 & 0.072 \\ \hline 3 & 0.148 & 0.192 & 0.175 & 0.144 & 0.086 & 0.067 \\ \hline 4 & 0.074 & 0.115 & 0.125 & 0.115 & 0.077 & 0.062 \\ \hline 5 & & 0.115 & 0.089 & 0.092 & 0.069 & 0.057 \\ \hline 6 & & 0.058 & 0.089 & 0.074 & 0.062 & 0.053 \\ \hline 7 & & & 0.089 & 0.066 & 0.059 & 0.045 \\ \hline 8 & & & 0.045 & 0.066 & 0.059 & 0.045 \\ \hline 9 & & & & 0.065 & 0.059 & 0.045 \\ \hline 10 & & & & 0.065 & 0.059 & 0.045 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started