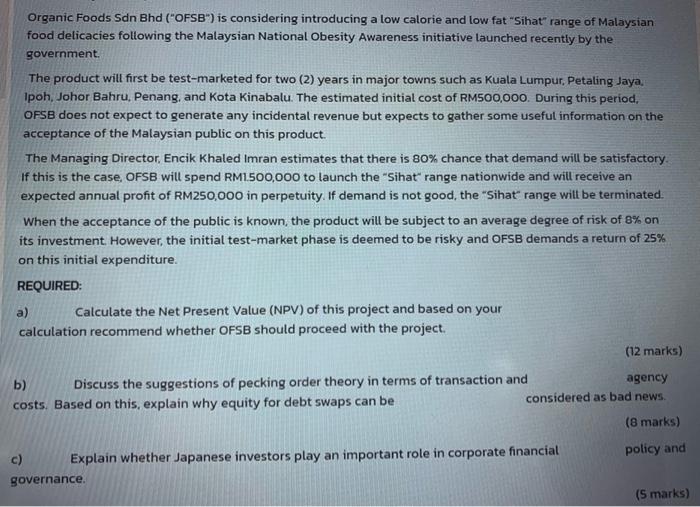

Organic Foods Sdn Bhd ("OFSB") is considering introducing a low calorie and low fat "Sihat range of Malaysian food delicacies following the Malaysian National Obesity Awareness initiative launched recently by the government. The product will first be test-marketed for two (2) years in major towns such as Kuala Lumpur, Petaling Jaya, Ipoh, Johor Bahru, Penang, and Kota Kinabalu. The estimated initial cost of RM500,000. During this period, OFSB does not expect to generate any incidental revenue but expects to gather some useful information on the acceptance of the Malaysian public on this product. The Managing Director, Encik Khaled Imran estimates that there is 80% chance that demand will be satisfactory If this is the case, OFSB will spend RM1,500,000 to launch the "Sihat range nationwide and will receive an expected annual profit of RM250,000 in perpetuity. If demand is not good, the "Sihat range will be terminated. When the acceptance of the public is known, the product will be subject to an average degree of risk of 8% on its investment. However, the initial test-market phase is deemed to be risky and OFSB demands a return of 25% on this initial expenditure. REQUIRED: a) Calculate the Net Present Value (NPV) of this project and based on your calculation recommend whether OFSB should proceed with the project. (12 marks) b) Discuss the suggestions of pecking order theory in terms of transaction and agency costs. Based on this, explain why equity for debt swaps can be considered as bad news. (8 marks) policy and c) Explain whether Japanese investors play an important role in corporate financial governance. (5 marks) Organic Foods Sdn Bhd ("OFSB") is considering introducing a low calorie and low fat "Sihat range of Malaysian food delicacies following the Malaysian National Obesity Awareness initiative launched recently by the government. The product will first be test-marketed for two (2) years in major towns such as Kuala Lumpur, Petaling Jaya, Ipoh, Johor Bahru, Penang, and Kota Kinabalu. The estimated initial cost of RM500,000. During this period, OFSB does not expect to generate any incidental revenue but expects to gather some useful information on the acceptance of the Malaysian public on this product. The Managing Director, Encik Khaled Imran estimates that there is 80% chance that demand will be satisfactory If this is the case, OFSB will spend RM1,500,000 to launch the "Sihat range nationwide and will receive an expected annual profit of RM250,000 in perpetuity. If demand is not good, the "Sihat range will be terminated. When the acceptance of the public is known, the product will be subject to an average degree of risk of 8% on its investment. However, the initial test-market phase is deemed to be risky and OFSB demands a return of 25% on this initial expenditure. REQUIRED: a) Calculate the Net Present Value (NPV) of this project and based on your calculation recommend whether OFSB should proceed with the project. (12 marks) b) Discuss the suggestions of pecking order theory in terms of transaction and agency costs. Based on this, explain why equity for debt swaps can be considered as bad news. (8 marks) policy and c) Explain whether Japanese investors play an important role in corporate financial governance