Question

Organizational Finance Fact Situation: You are the new CFO of ABC Company and you have been asked by the President to analyze the companys performance

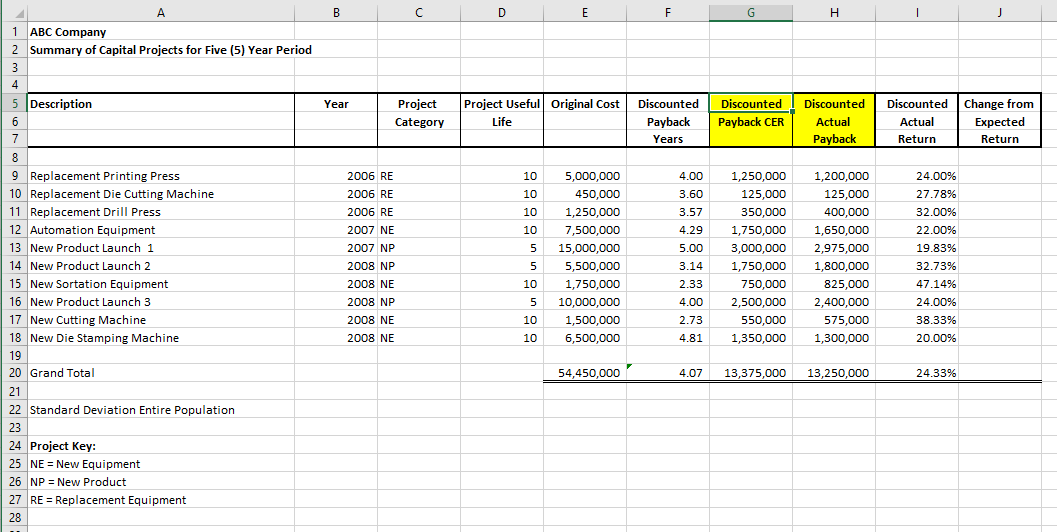

Organizational Finance

Fact Situation: You are the new CFO of ABC Company and you have been asked by the President to analyze the companys performance regarding the success or failure of capital projects. Your senior accountant gives you a spreadsheet entitled ABC company summary of capital projects (see worksheet for details) based on post completion reviews of the various projects over a five (5) year period. Your preliminary analysis is that the company has had mixed success in implementing capital projects, but you wish to perform more analysis. You decide that analyzing the projects by major category might yield insights into how the projects performed. You therefore analyze the projects by major category to determine project performance.

Required: Perform a preliminary analysis on the capital projects which indicates how the actual project results performed relative to the expected returns and compute the mean and standard deviation for the projects, along with a graphical representation of the results (this could be a line graph, bar graph or bell curve). Next, sort the projects by major category and determine actual versus expected results for each category. Finally, make a recommendation to the President about whether the projects should be examined in total or broken down by category, giving reasons for your decision. Also, provide the President with an assessment about whether or not the capital program is working, as well as any changes which might improve capital project performance. The following items should be addressed in the assessment: 1. Why is it necessary to rank projects by type? 2. What type of risks are associated with capital budgeting? 3. Why is it necessary to perform post completion reviews for each project? 4. The development of NPV, IRR and payback for projects that will be included in the budget is a great deal of work. Why should this work be done?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started