Orie and Jane, husband and wife, operate a sole proprietorship. They expect their taxable income next year to be $450,000, of which $250,000 is attributed

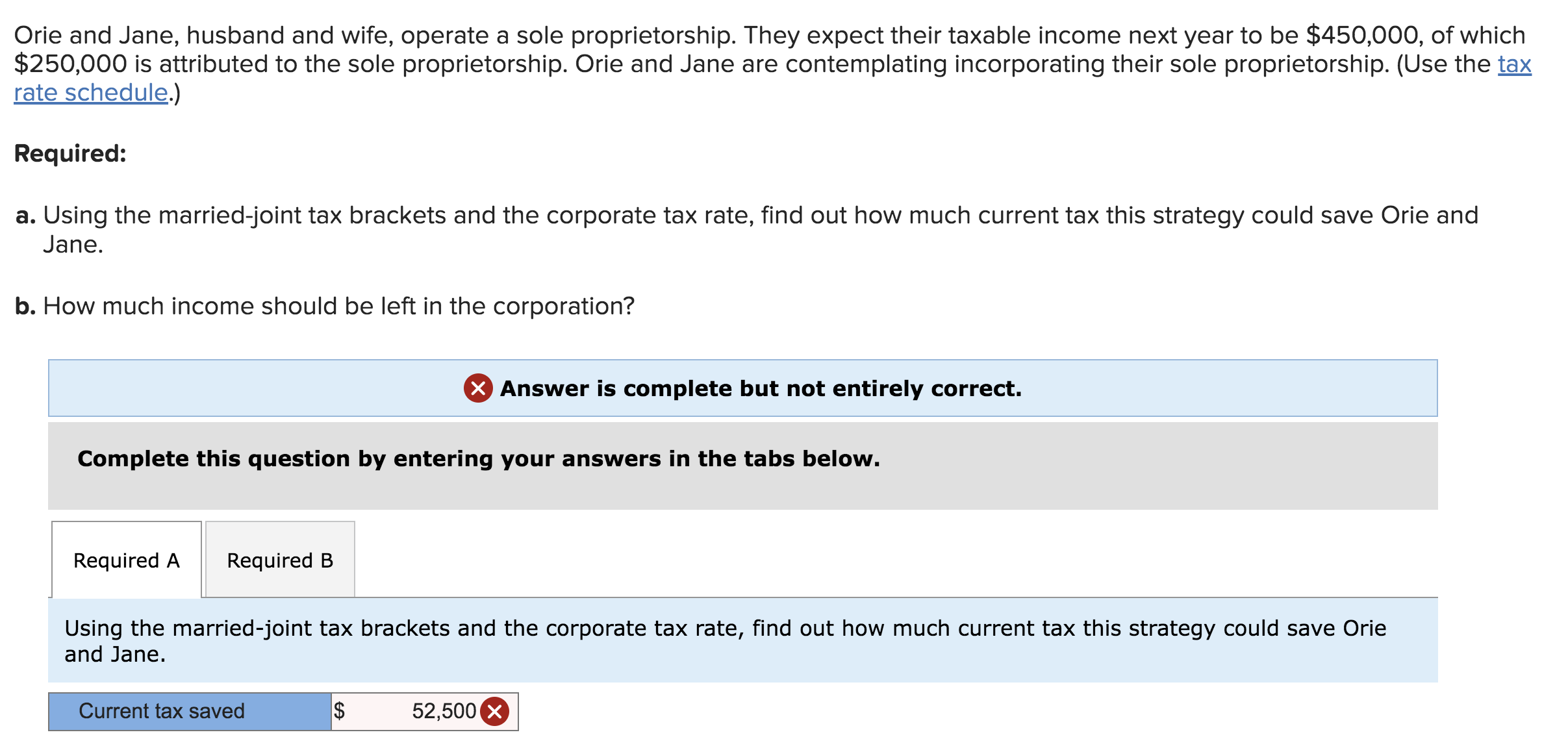

Orie and Jane, husband and wife, operate a sole proprietorship. They expect their taxable income next year to be $450,000, of which $250,000 is attributed to the sole proprietorship. Orie and Jane are contemplating incorporating their sole proprietorship. (Use the tax rate schedule.)

Required:

- Using the married-joint tax brackets and the corporate tax rate, find out how much current tax this strategy could save Orie and Jane.

- How much income should be left in the corporation?

2023 Tax Rate Schedules

IndividualsSchedule X-Single

| If taxable income is over: | But not over: | The tax is: |

|---|---|---|

| $ 0 | $11,000 | 10% of taxable income |

| $ 11,000 | $ 44,725 | $1,100 plus 12% of the excess over $11,000 |

| $ 44,725 | $ 95,375 | $5,147 plus 22% of the excess over $44,725 |

| $ 95,375 | $ 182,100 | $16,290 plus 24% of the excess over $95,375 |

| $ 182,100 | $ 231,250 | $37,104 plus 32% of the excess over $182,100 |

| $ 231,250 | $ 578,125 | $52,832 plus 35% of the excess over $231,250 |

| $ 578,125 | ? | $174,238.25 plus 37% of the excess over $578,125 |

Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse

| If taxable income is over: | But not over: | The tax is: |

|---|---|---|

| $ 0 | $ 22,000 | 10% of taxable income |

| $ 22,000 | $ 89,450 | $2,200 plus 12% of the excess over $22,000 |

| $ 89,450 | $ 190,750 | $10,294 plus 22% of the excess over $89,450 |

| $ 190,750 | $ 364,200 | $32,580 plus 24% of the excess over $190,750 |

| $ 364,200 | $ 462,500 | $74,208 plus 32% of the excess over $364,200 |

| $ 462,500 | $ 693,750 | $105,664 plus 35% of the excess over $462,500 |

| $ 693,750 | ? | $186,601.5 plus 37% of the excess over $693,750 |

Schedule Z-Head of Household

| If taxable income is over: | But not over: | The tax is: |

|---|---|---|

| $ 0 | $ 15,700 | 10% of taxable income |

| $ 15,700 | $ 59,850 | $1,570 plus 12% of the excess over $15,700 |

| $ 59,850 | $ 95,350 | $6,868 plus 22% of the excess over $59,850 |

| $ 95,350 | $ 182,100 | $14,678 plus 24% of the excess over $95,350 |

| $ 182,100 | $ 231,250 | $35,498 plus 32% of the excess over $182,100 |

| $ 231,250 | $ 578,100 | $51,226 plus 35% of the excess over $231,250 |

| $ 578,100 | ? | $172,623.5 plus 37% of the excess over $578,100 |

Schedule Y-2-Married Filing Separately

Orie and Jane, husband and wife, operate a sole proprietorship. They expect their taxable income next year to be $450,000, of which $250,000 is attributed to the sole proprietorship. Orie and Jane are contemplating incorporating their sole proprietorship. (Use the tax rate schedule.) Required: a. Using the married-joint tax brackets and the corporate tax rate, find out how much current tax this strategy could save Orie and Jane. b. How much income should be left in the corporation? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Using the married-joint tax brackets and the corporate tax rate, find out how much current tax this strategy could save Orie and Jane. Current tax saved $ 52,500 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assist you with the question I will need to calculate the tax liability for Orie and Jane as a sole proprietorship and then as a corporation to est...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started