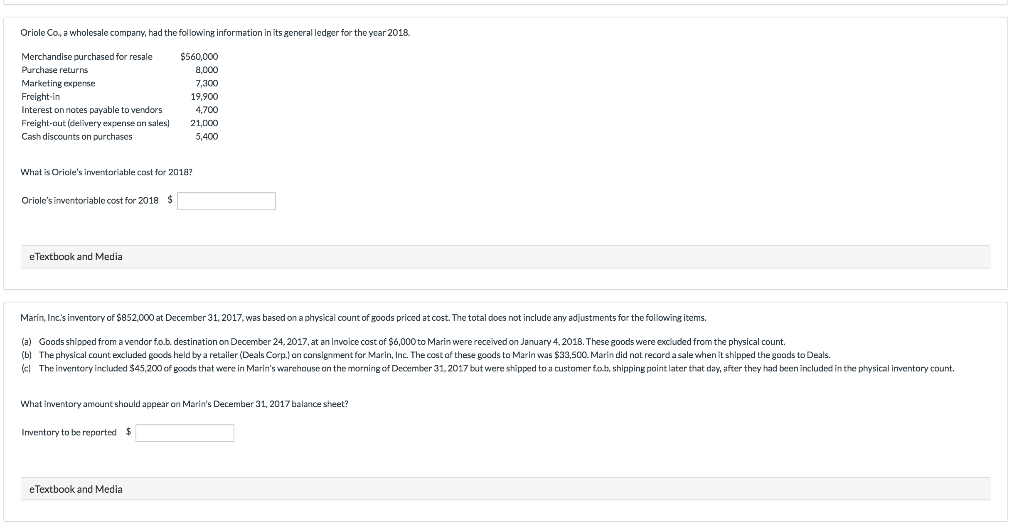

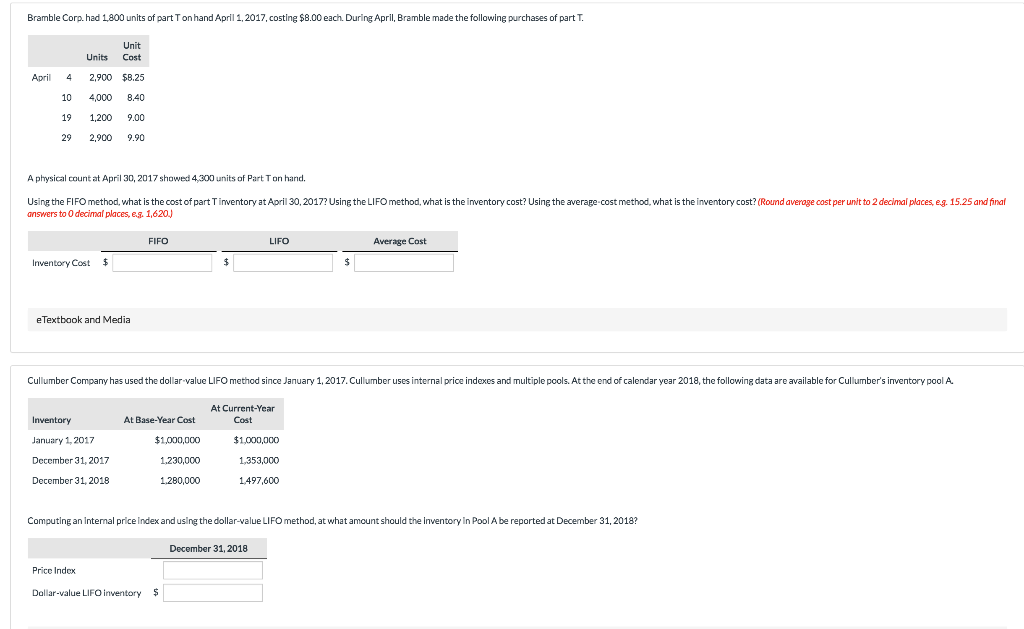

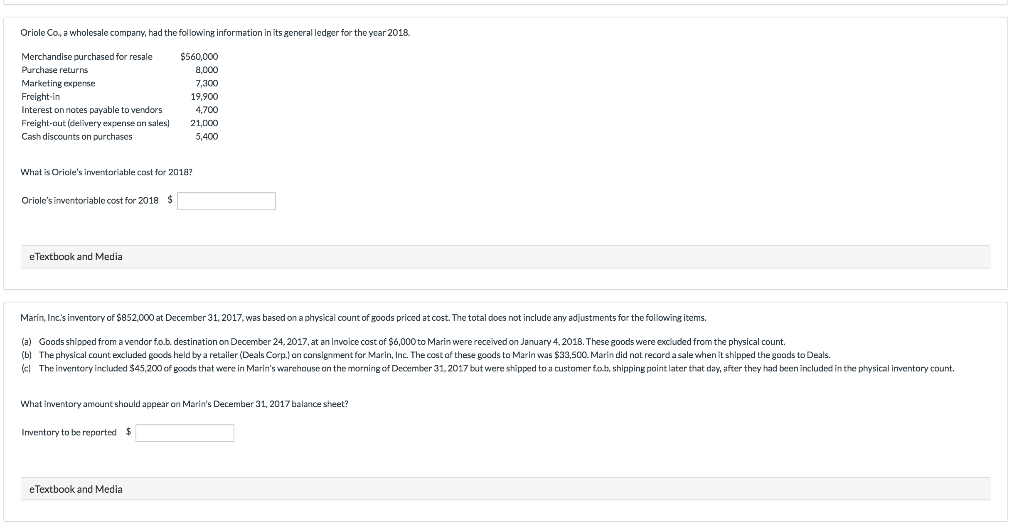

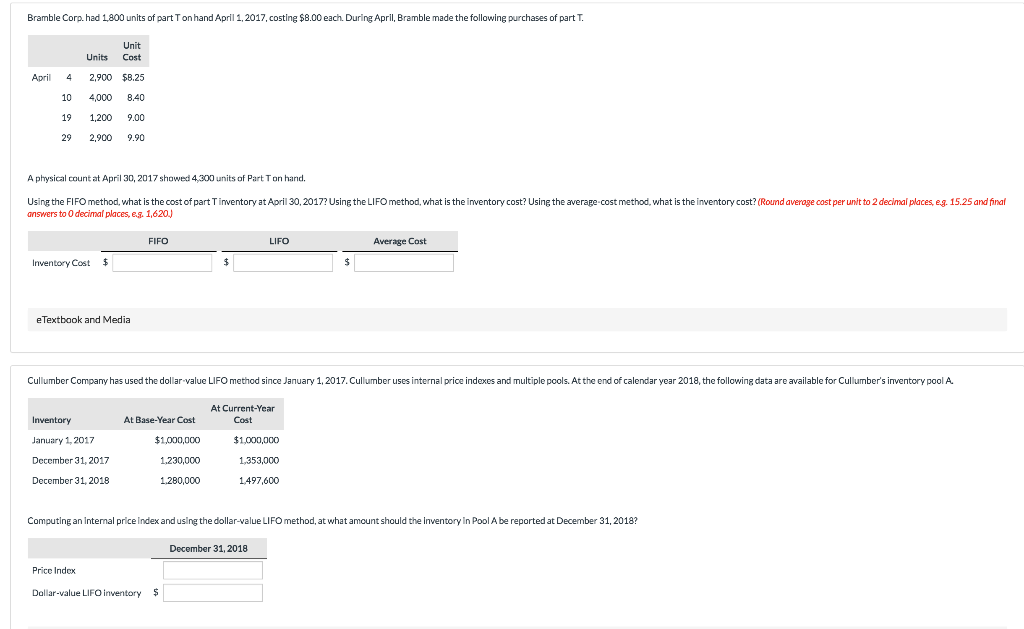

Oriole Co, a wholesale company, had the following information in its general ledger for the year 2018. Merchandise purchased for resale Purchase returns Marketing expense Freight-in Interest on notes payable to vendors Freight-aut (delivery expense onsales Cash discounts on purchases $560,000 8,000 7,300 19,900 4,700 21,000 5,400 What is Oriale's inventoriable cost for 2018 Oriole's inventoriable cost for 2018 $ eTextbook and Media Marin, Inc.s inventory of $852,000 at December 31, 2017, was based on a physical count of goods priced at cost. The total does not include any adjustments for the following items. (a) Goods shipped from a wendor fo.b. destination on December 24,2017,at an invoice cost of $6,000 to Marin were received on January 4,2018. These goods were excluded from the physical count. (b] The physical count excluded goods held by a retailer (Deals Corp.on consignment for Marin, Inc. The cost of these goods to Marin was $33,500. Marin did not record a sale when it shipped the goods to Deals. (cl The inventory included $45,200 of gocds that were in Marin's warehouse on the morning of December 31,2017 but were shipped to a customer fob, shipping point later that day, after they had been included in the physical inventory count. What inventory amount should appear on Marin's December 31, 2017 balance sheet? Inventory to be reported $ eTextbook and Media Bramble Corp. had 1800 units of part Tonhand April 1,2017, costing $8.00 each. During April, Bramble made the following purchases of part T. Unit Units Cost Apri 4 2,900 $8.25 10 4,000 8.40 19 1,200 9.00 29 2,900 9.90 A physical count at April 30, 2017 showed 4,300 units of Part T on harid. Using the FIFO method, what is the cost of part Tinventory at April 30,2017? Using the LIFO method, what is the inventory cost? Using the average-cost method, what is the inventory cost? (Round average cost per unit to 2 decimai places, eg. 15.25 and finaf answers to 0 decimal places, eg. 1,620) FIFO LIFO Average Cost Inventory Cost eTextbook and Media Cullumber Company has used the dollar value LIFO method since January 1, 2017. Cullumber uses internal price indexes and multiple pools. Atthe end of calendar year 2018, the following data are available for Cullumber's inventorypool A. At Base-Year Cost Cost January 1,2017 December 31,2017 December 31, 2018 $1,000,000 1,230,000 1.280,000 $1,000,000 1,353,000 1497,600 Computing an Internal price Index and using the dollar-value LIFO method, at what amount should the inventory In Pool A be reported at December 31, 2018? December 31,2018 Price Index Dallar-value LIFO inventory