Answered step by step

Verified Expert Solution

Question

1 Approved Answer

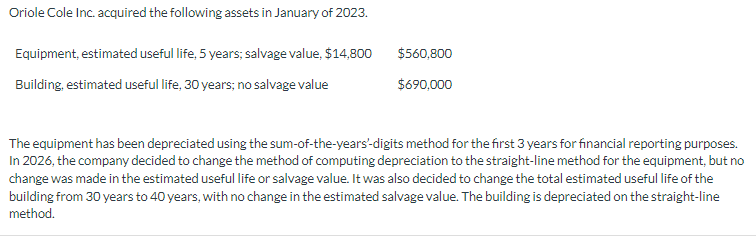

Oriole Cole Inc. acquired the following assets in January of 2023. Equipment, estimated useful life, 5 years; salvage value, $14,800 Building, estimated useful life,

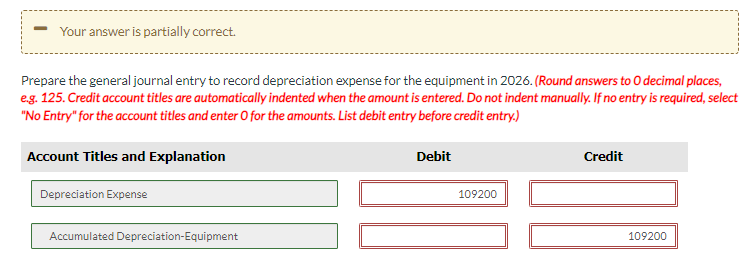

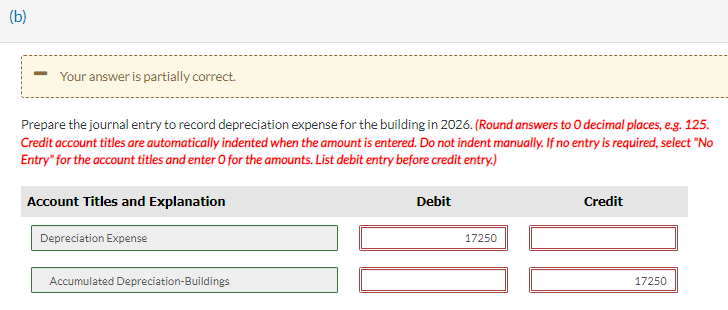

Oriole Cole Inc. acquired the following assets in January of 2023. Equipment, estimated useful life, 5 years; salvage value, $14,800 Building, estimated useful life, 30 years; no salvage value $560,800 $690,000 The equipment has been depreciated using the sum-of-the-years-digits method for the first 3 years for financial reporting purposes. In 2026, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated useful life or salvage value. It was also decided to change the total estimated useful life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. - Your answer is partially correct. Prepare the general journal entry to record depreciation expense for the equipment in 2026. (Round answers to O decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Depreciation Expense Accumulated Depreciation-Equipment Debit 109200 Credit 109200 (b) Your answer is partially correct. Prepare the journal entry to record depreciation expense for the building in 2026. (Round answers to O decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Depreciation Expense Accumulated Depreciation-Buildings Debit 17250 Credit 17250 * Your answer is incorrect. On January 1, 2025, Cullumber Corporation changed to the percentage-of-completion method of income recognition. This change is justified by Cullumber Corporation. On December 31, 2024, Cullumber's Retained Earnings balance was $1640000. Cullumber calculated that, if the percentage-of-completion method had been used, the accumulated impact on net income (before taking into consideration any income tax effects) would have been an additional $340000 of revenue in 2024. If Cullumber's income tax rate is 25%, one of the impacts of this accounting change would be an increase to Income Tax Payable of $85000. a decrease to Income Tax Payable of $85000. an increase to Income Tax Expense of $85000 in 2025. an increase to Construction in Progress of $255000 on December 31, 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started