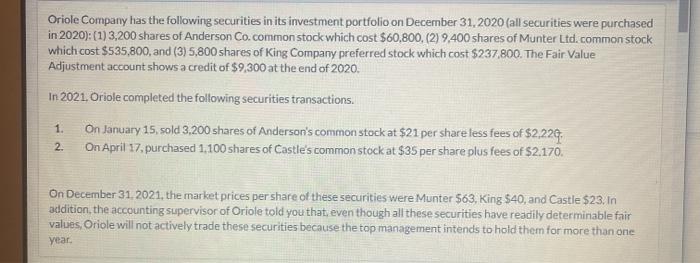

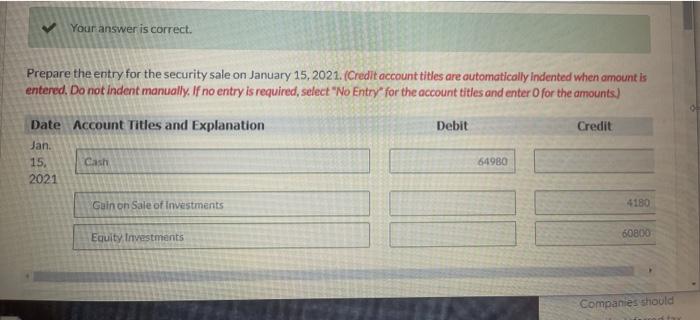

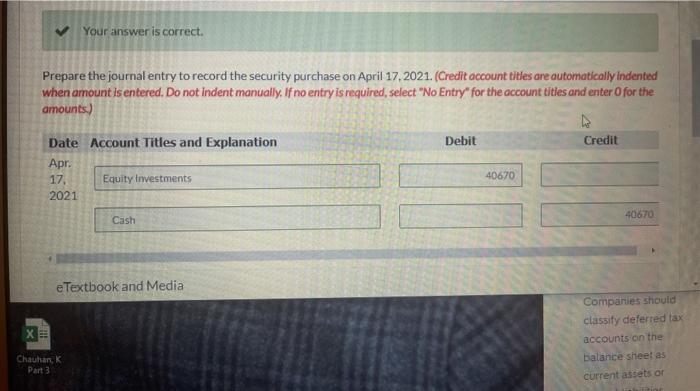

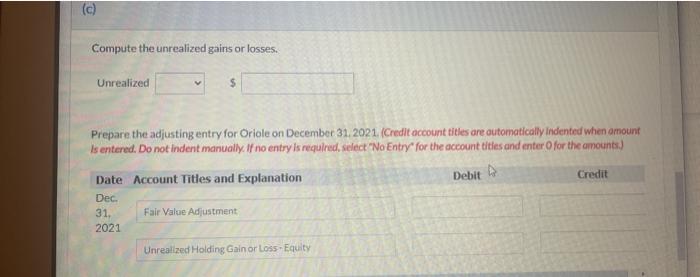

Oriole Company has the following securities in its investment portfolio on December 31, 2020 (all securities were purchased in 2020): (1) 3,200 shares of Anderson Co.common stock which cost $60,800, (2) 9,400 shares of Munter Ltd. common stock which cost $535,800, and (3) 5,800 shares of King Company preferred stock which cost $237,800. The Fair Value Adjustment account shows a credit of $9,300 at the end of 2020. In 2021, Oriole completed the following securities transactions 1 On January 15, sold 3,200 shares of Anderson's common stock at $21 per share less fees of $2,229 On April 17, purchased 1.100 shares of Castle's common stock at $35 per share plus fees of $2.170. 2. On December 31, 2021, the market prices per share of these securities were Munter 563, King $40, and Castle $23. In addition, the accounting supervisor of Oriole told you that even though all these securities have readily determinable fair values, Oriole will not actively trade these securities because the top management intends to hold them for more the hone year. Your answer is correct. Prepare the entry for the security sale on January 15, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation Jan. 15, Cash 2021 64980 Gain on Sale of investments 4180 Equity Investments 60800 Companies should Your answer is correct. Prepare the journal entry to record the security purchase on April 17,2021. (Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account tities and enter for the amounts) Debit Credit Date Account Titles and Explanation Apr. 17 Equity Investments 2021 40670 40670 Cash e Textbook and Media X Companies should classity deferred tax accounts on the balance sheet as current assets or Chauhan Part 3 (c) Compute the unrealized gains or losses. Unrealized $ Prepare the adjusting entry for Oriole on December 31, 2021. (Credit account titles are automatically indented when amount Is entered. Do not indent manually. If no entry is required. select "No Entry for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation Dec 31. Fair Value Adjustment 2021 Unrealized Holding Gainor Loss Equity