Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oriole Company is considering a long-term investment project called ZIP. ZIP will require an investment of $128,000. It will have a useful life of

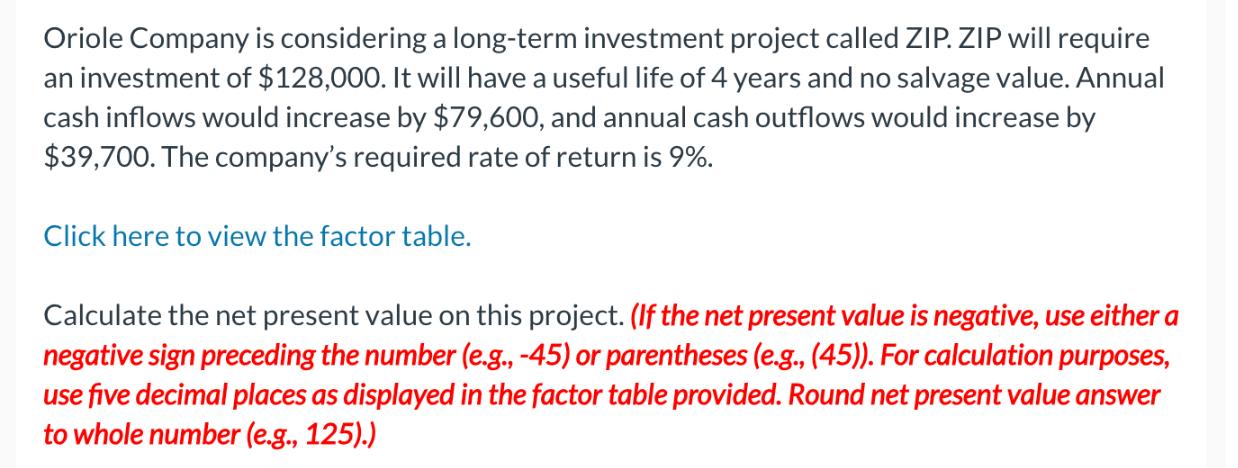

Oriole Company is considering a long-term investment project called ZIP. ZIP will require an investment of $128,000. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,600, and annual cash outflows would increase by $39,700. The company's required rate of return is 9%. Click here to view the factor table. Calculate the net present value on this project. (If the net present value is negative, use either a negative sign preceding the number (e.g., -45) or parentheses (e.g., (45)). For calculation purposes, use five decimal places as displayed in the factor table provided. Round net present value answer to whole number (e.g., 125).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how we can do it Calculate the annual net cash flow Subtract the annual cash outflows from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e94a964d73_954383.pdf

180 KBs PDF File

663e94a964d73_954383.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started