Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oriole Company provides the following selected information related to its defined benefit pension plan for 2 0 2 5 . Pension asset / liability (

Oriole Company provides the following selected information related to its defined benefit pension plan for

Pension assetliability January $ Cr

Accumulated benefit obligation December

Actual and expected return on plan assets

Contributions funding in

Fair value of plan assets December

Settlement rate

Projected benefit obligation January

Service cost a

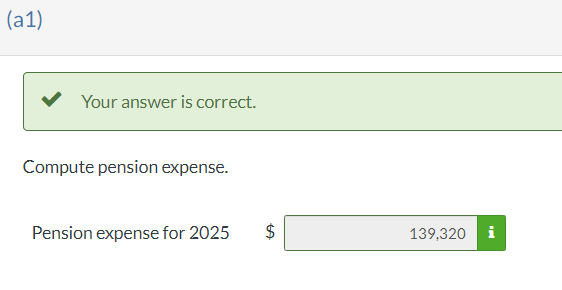

V Your answer is correct.

Compute pension expense.

Pension expense for

$ Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in

Preparation of a pension worksheet is not required. Benefits paid in were $Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the

account titles and enter O for the amounts. List all debit entries before credit entries.

Account Titles and Explanation

Debit

Credit

Pension Expense

Pension AssetLiability b

Indicate the pensionrelated amounts that would be reported in the company's income statement for

ORIOLE COMPANY

Income Statement Partial

$

Instructions

a Compute pension expense.

b Prepare the journal entry to record pension expense and the employers contribution to the pension plan in Preparation of a pension worksheet is not required. Benefits paid in were $

c Indicate the pension related amounts that would be reported in the companys income statement for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started