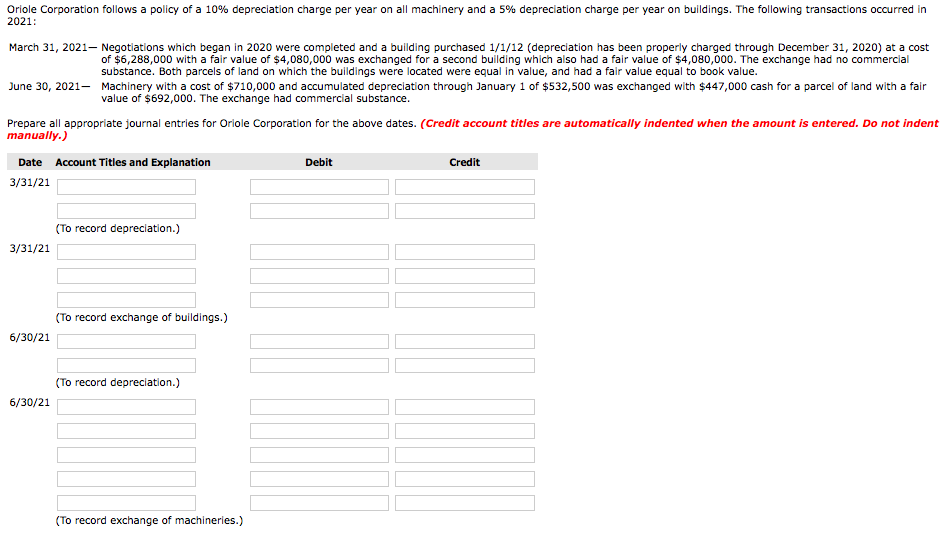

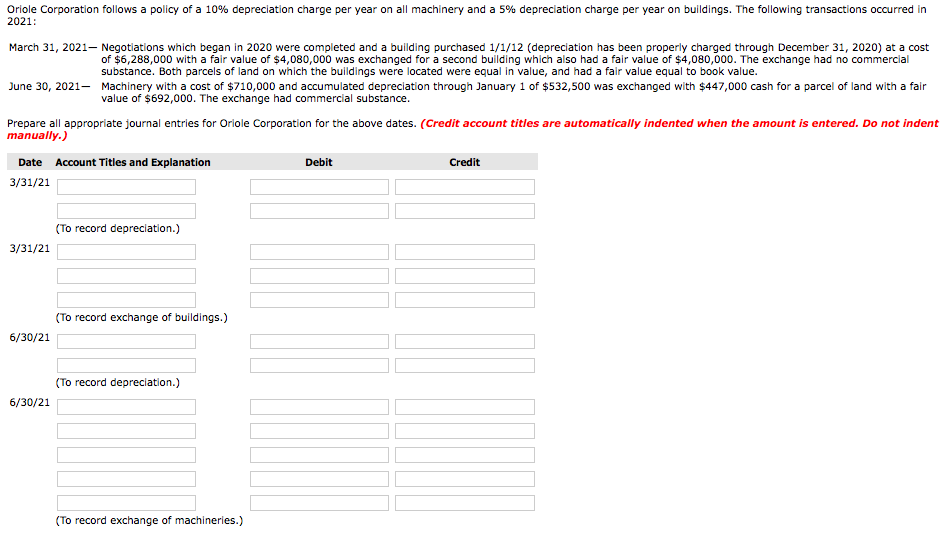

Oriole Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2021 March 31, 2021- Negotlations which began in 2020 were completed and a building purchased 1/1/12 (depreciation has been properly charged through December 31, 2020) at a cost of $6,288,000 with a fair value of $4,080,000 was exchanged for a second building which also had a fair value of $4,080,000. The exchange had no commercial substance. Both parcels of land on which the buildings were located were equal in value, and had a fair value equal to book value. Machinery with a cost of $710,000 and accumulated depreciation through January 1 of $532,500 was exchanged with $447,000 cash for a parcel of land with a fair value of $692,000. The exchange had commercial substance. June 30, 2021- Prepare all appropriate journal entries for Oriole Corporation for the above dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Credit Debit Date 3/31/21 (To record depreciation.) 3/31/21 (To record exchange of buildings.) 6/30/21 (To record depreciation.) 6/30/21 (To record exchange of machineries.) Oriole Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2021 March 31, 2021- Negotlations which began in 2020 were completed and a building purchased 1/1/12 (depreciation has been properly charged through December 31, 2020) at a cost of $6,288,000 with a fair value of $4,080,000 was exchanged for a second building which also had a fair value of $4,080,000. The exchange had no commercial substance. Both parcels of land on which the buildings were located were equal in value, and had a fair value equal to book value. Machinery with a cost of $710,000 and accumulated depreciation through January 1 of $532,500 was exchanged with $447,000 cash for a parcel of land with a fair value of $692,000. The exchange had commercial substance. June 30, 2021- Prepare all appropriate journal entries for Oriole Corporation for the above dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Credit Debit Date 3/31/21 (To record depreciation.) 3/31/21 (To record exchange of buildings.) 6/30/21 (To record depreciation.) 6/30/21 (To record exchange of machineries.)