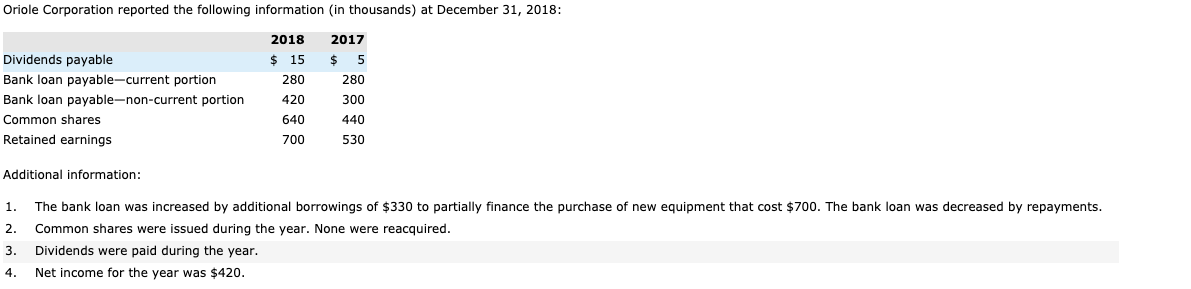

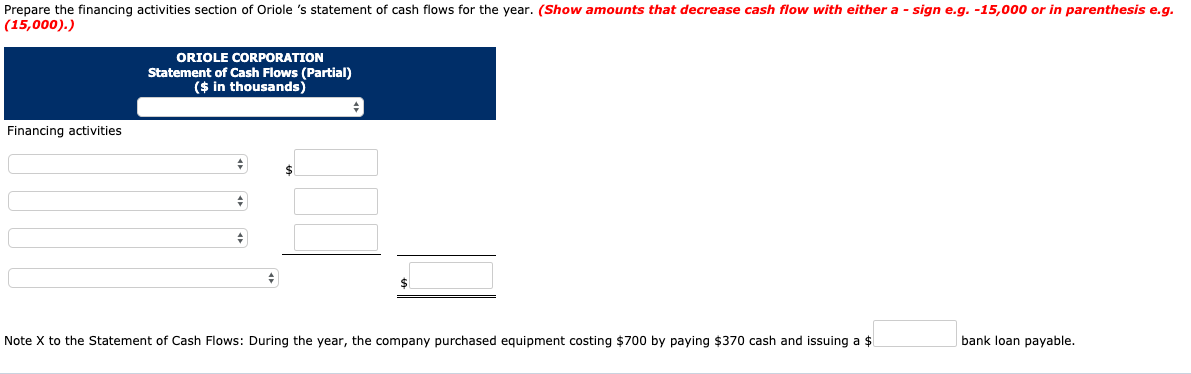

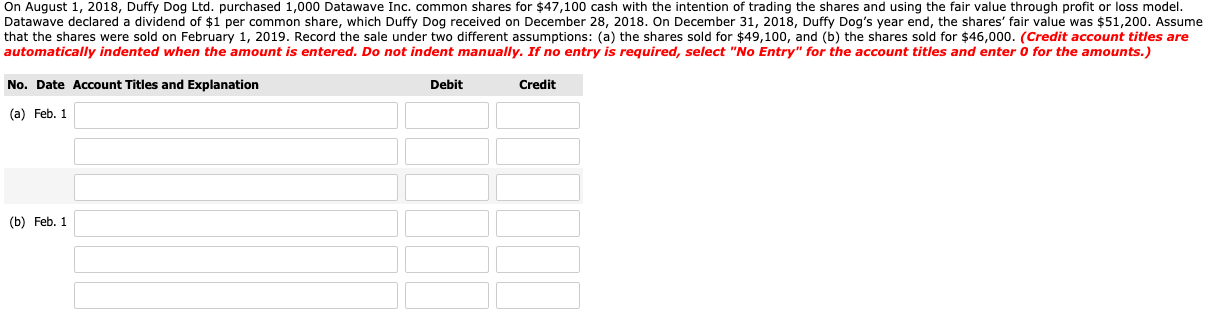

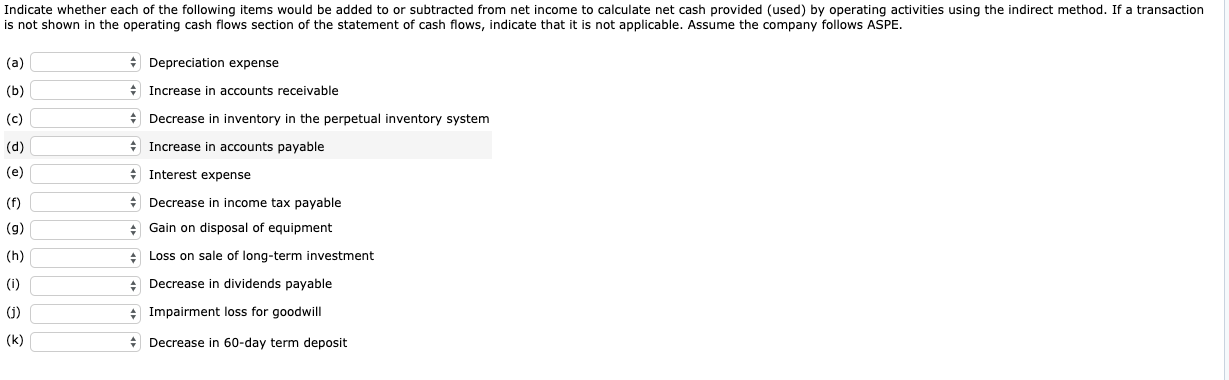

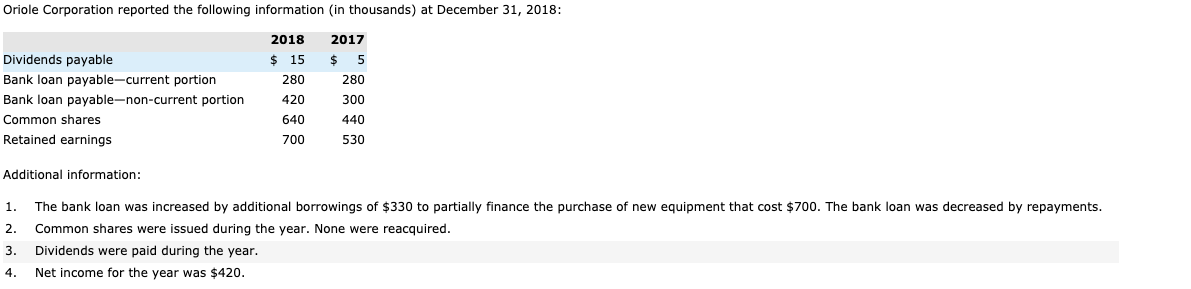

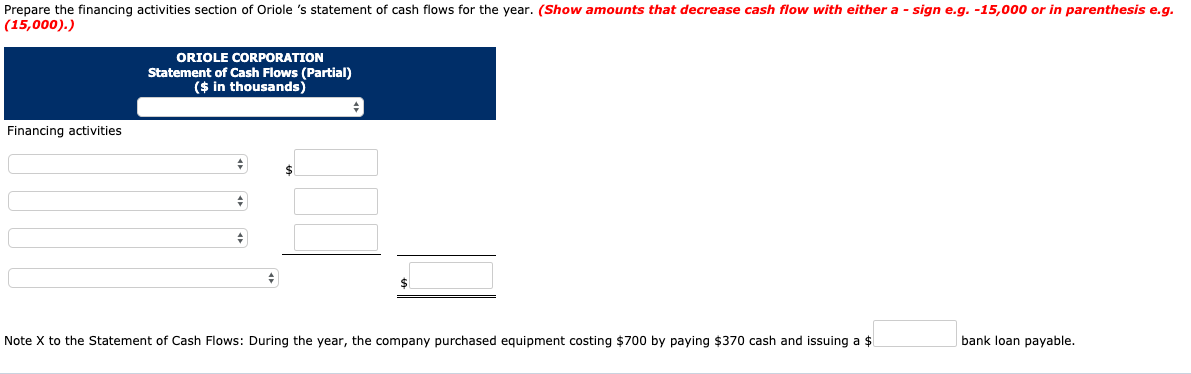

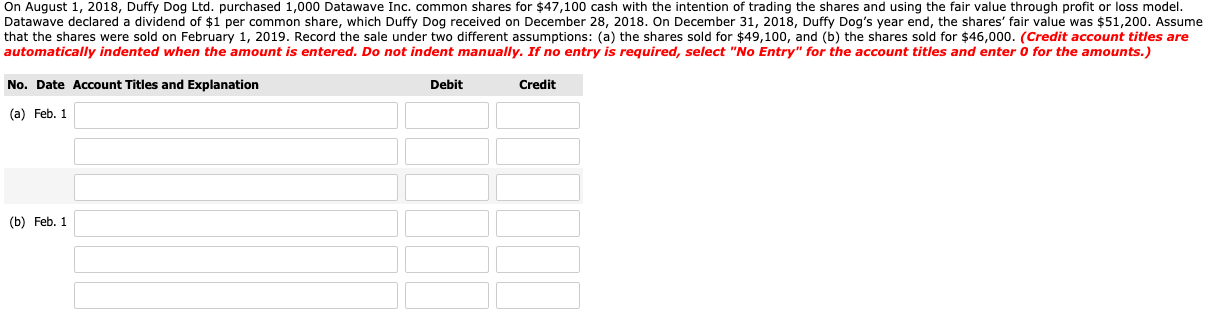

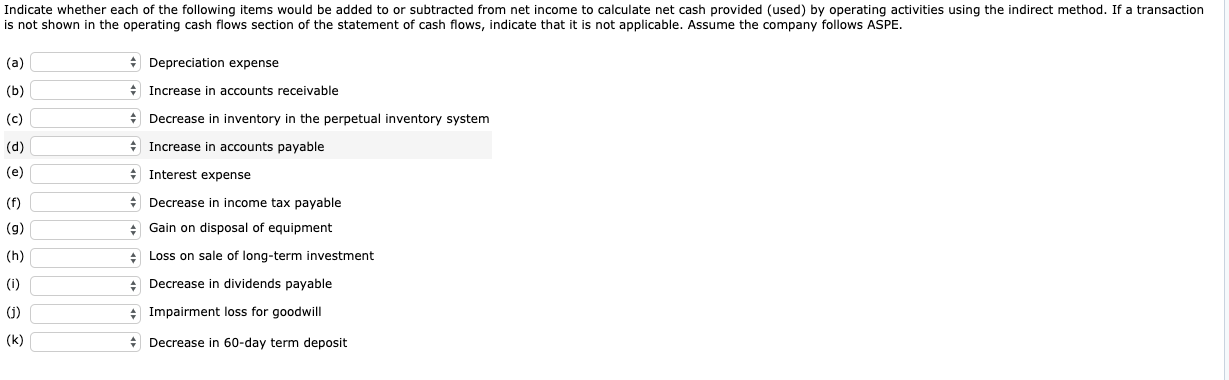

Oriole Corporation reported the following information (in thousands) at December 31, 2018: 2018 2017 Dividends payable $ 15 $ 5 Bank loan payable-current portion 280 280 Bank loan payable-non-current portion 420 300 Common shares 640 440 Retained earnings 700 Additional information: 1. The bank loan was increased by additional borrowings of $330 to partially finance the purchase of new equipment that cost $700. The bank loan was decreased by repayments. 2. Common shares were issued during the year. None were reacquired. 3. Dividends were paid during the year. 4. Net income for the year was $420. Prepare the financing activities section of Oriole's statement of cash flows for the year. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) ORIOLE CORPORATION Statement of Cash Flows (Partial) ($ in thousands) Financing activities Note X to the Statement of Cash Flows: During the year, the company purchased equipment costing $700 by paying $370 cash and issuing a $ bank loan payable. On August 1, 2018, Duffy Dog Ltd. purchased 1,000 Datawave Inc. common shares for $47,100 cash with the intention of trading the shares and using the fair value through profit or loss model. Datawave declared a dividend of $1 per common share, which Duffy Dog received on December 28, 2018. On December 31, 2018, Duffy Dog's year end, the shares' fair value was $51,200. Assume that the shares were sold on February 1, 2019. Record the sale under two different assumptions: (a) the shares sold for $49, 100, and (b) the shares sold for $46,000. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit No. Date Account Titles and Explanation (a) Feb. 1 (b) Feb. 1 Indicate whether each of the following items would be added to or subtracted from net income to calculate net cash provided (used) by operating activities using the indirect method. If a transaction is not shown in the operating cash flows section of the statement of cash flows, indicate that it is not applicable. Assume the company follows ASPE. (a) + Depreciation expense Increase in accounts receivable Decrease in inventory in the perpetual inventory system Increase in accounts payable Interest expense Decrease in income tax payable Gain on disposal of equipment @ # Loss on sale of long-term investment E = 5 Decrease in dividends payable Impairment loss for goodwill Decrease in 60-day term deposit