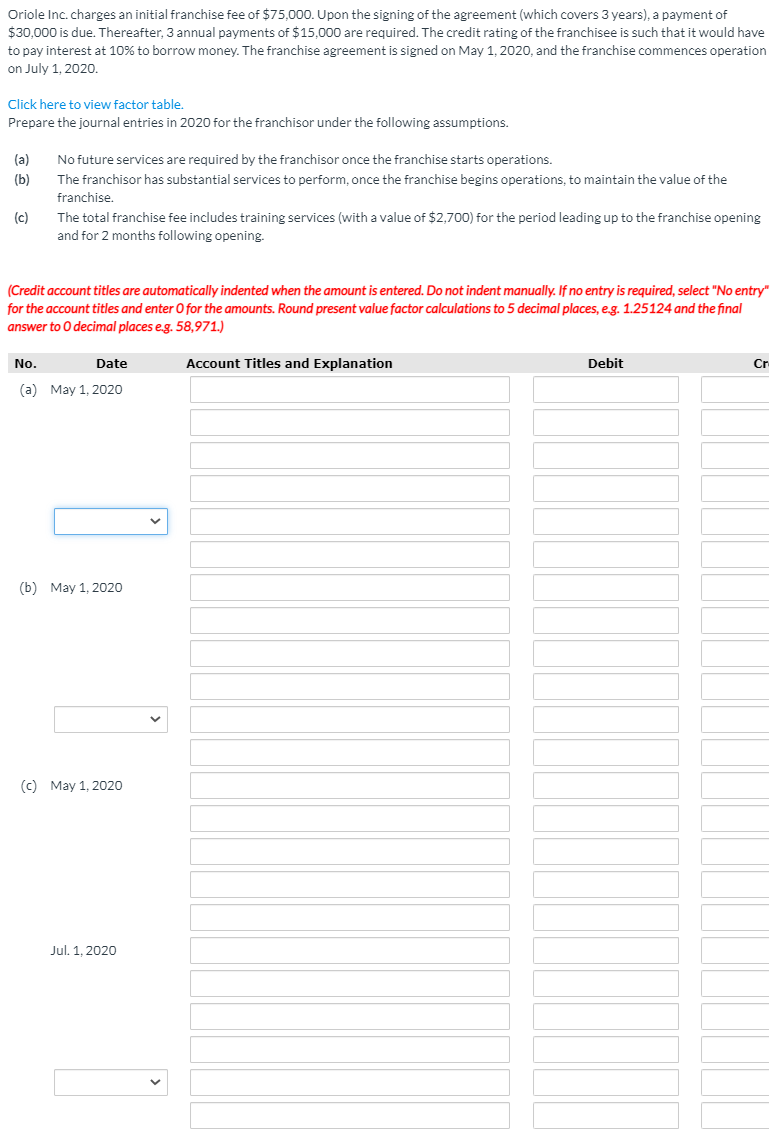

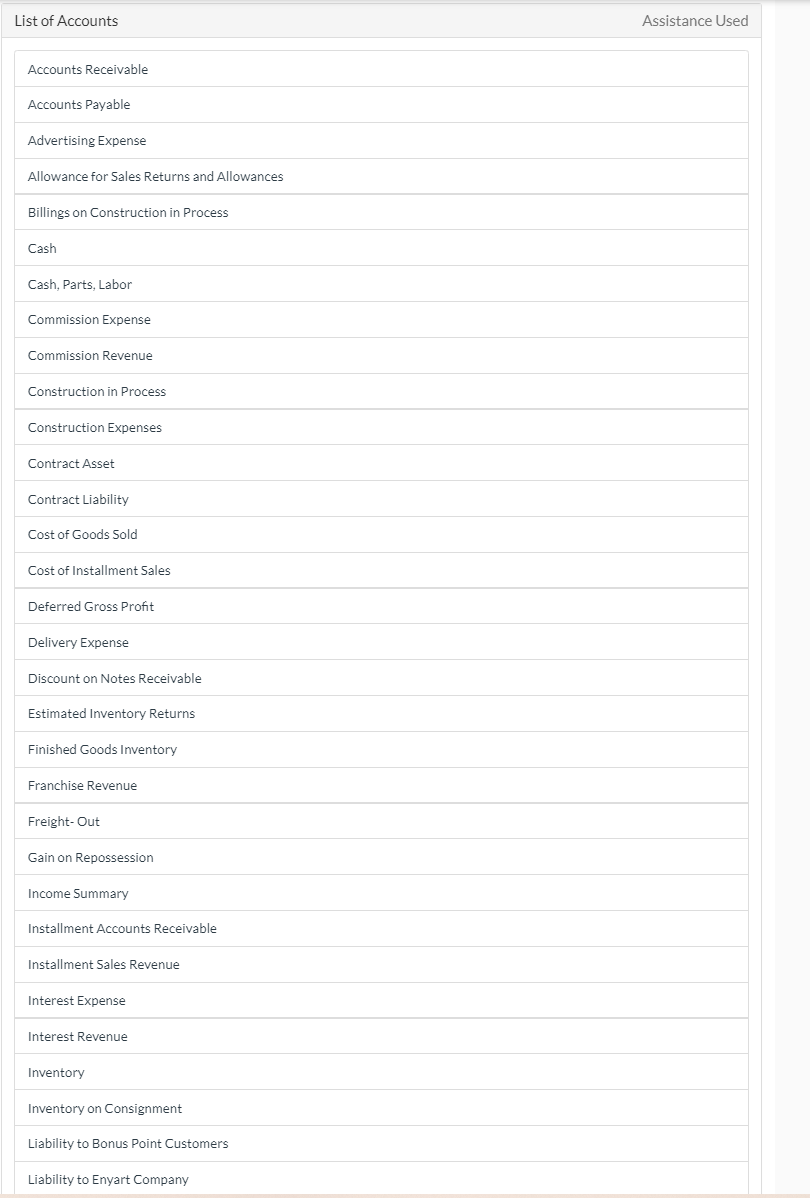

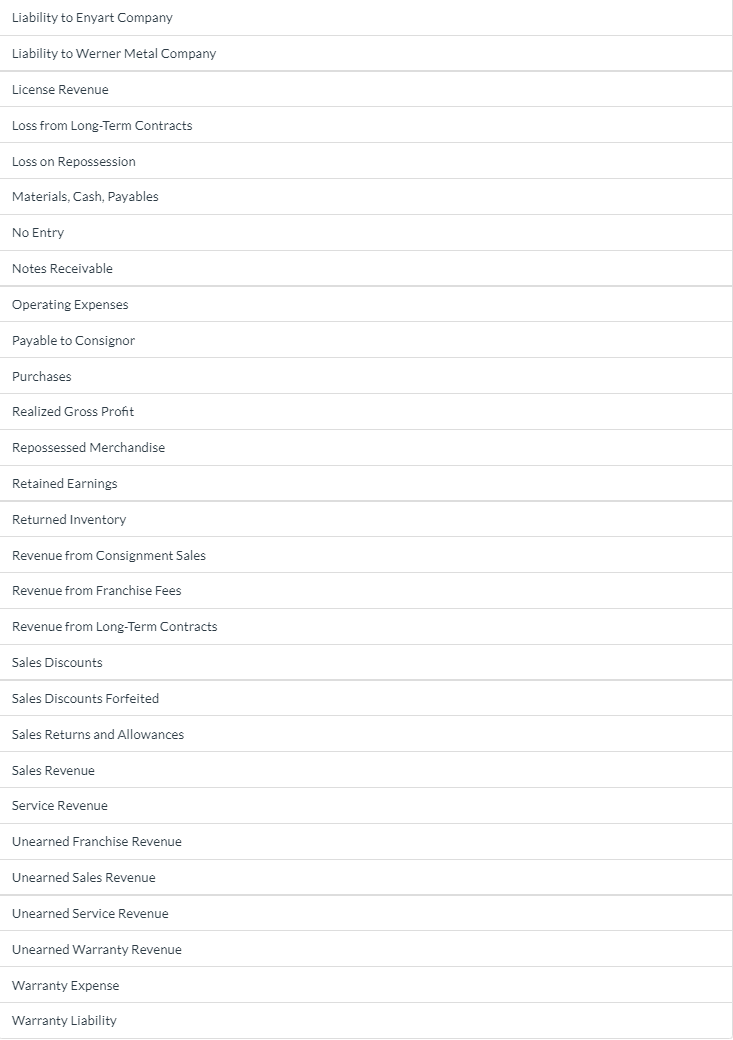

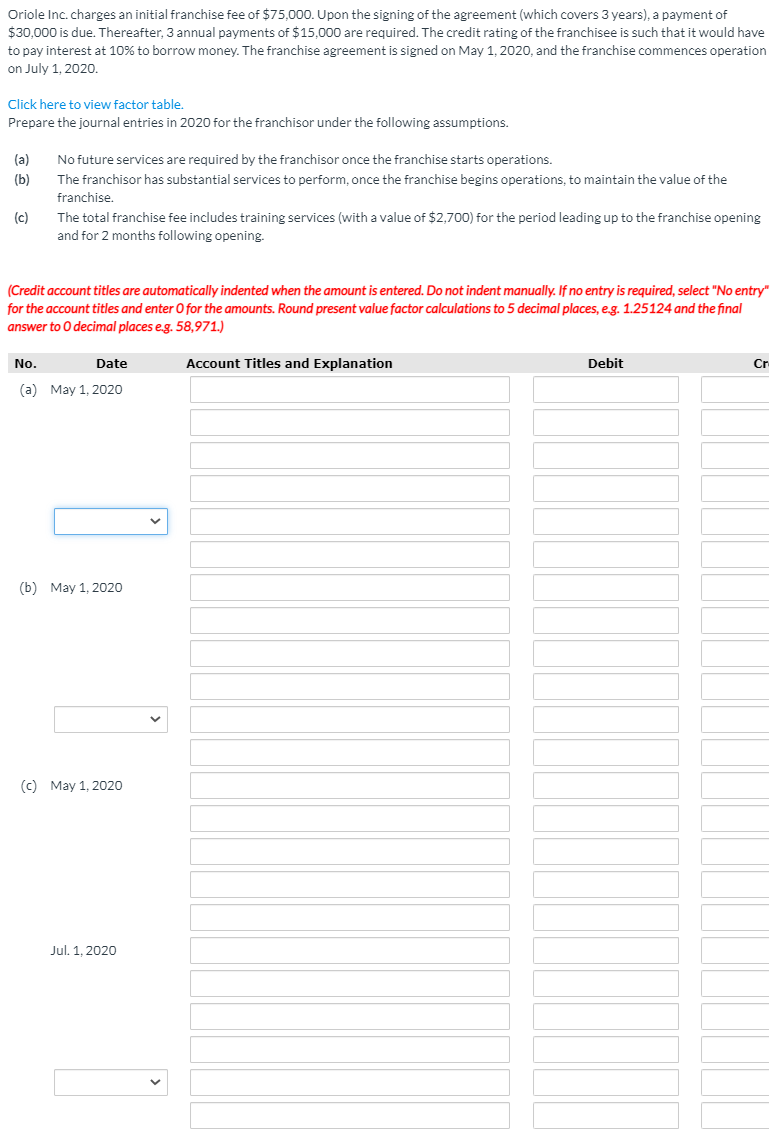

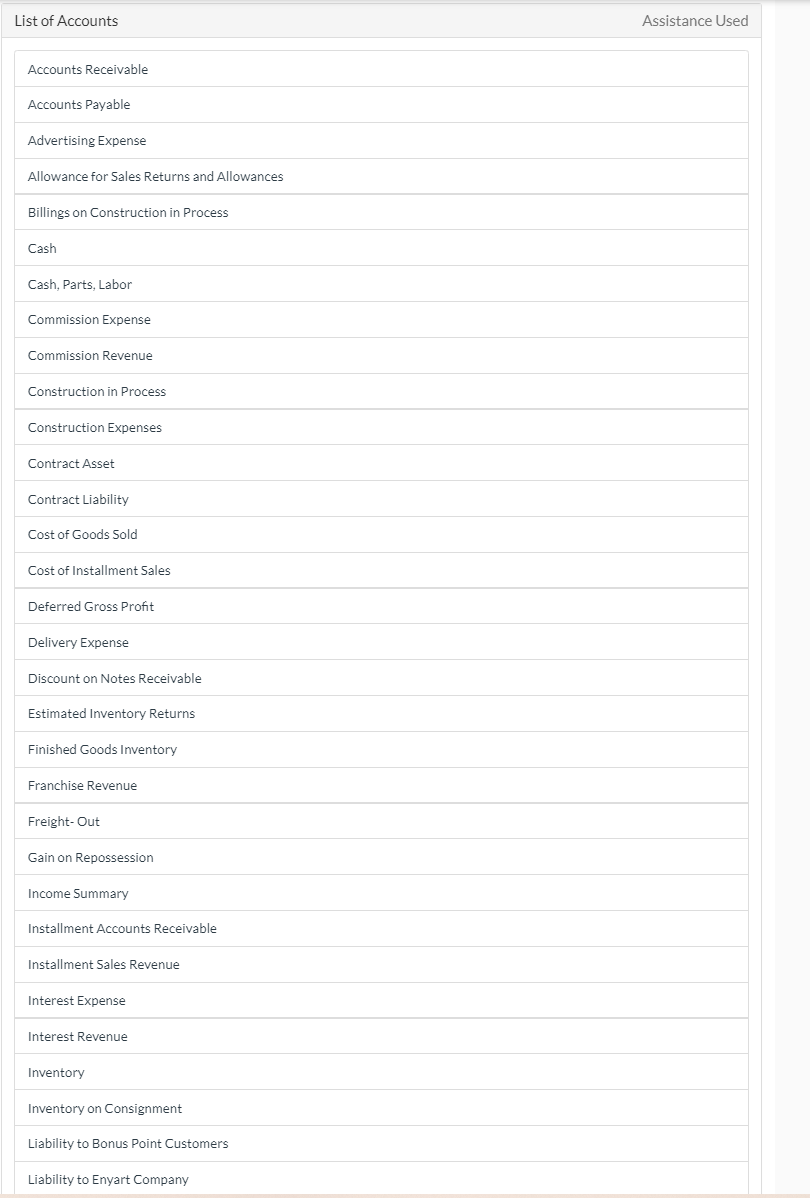

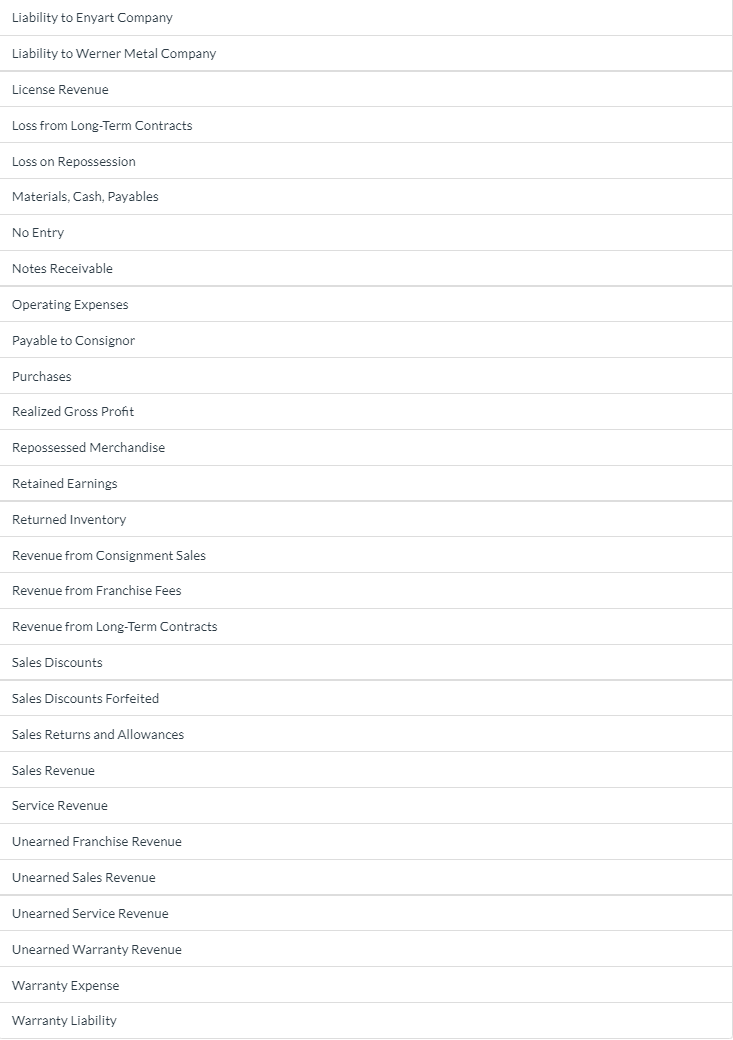

Oriole Inc. charges an initial franchise fee of $75,000. Upon the signing of the agreement (which covers 3 years), a payment of $30,000 is due. Thereafter, 3 annual payments of $15,000 are required. The credit rating of the franchisee is such that it would have to pay interest at 10% to borrow money. The franchise agreement is signed on May 1, 2020, and the franchise commences operation on July 1, 2020. Click here to view factor table. Prepare the journal entries in 2020 for the franchisor under the following assumptions. (a) (b) No future services are required by the franchisor once the franchise starts operations. The franchisor has substantial services to perform, once the franchise begins operations, to maintain the value of the franchise. The total franchise fee includes training services (with a value of $2,700) for the period leading up to the franchise opening and for 2 months following opening. (c) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971.) No. Date Account Titles and Explanation Debit Cr (a) May 1, 2020 (b) May 1, 2020 (c) May 1, 2020 Jul. 1. 2020 List of Accounts Assistance Used Accounts Receivable Accounts Payable Advertising Expense Allowance for Sales Returns and Allowances Billings on Construction in Process Cash Cash, Parts, Labor Commission Expense Commission Revenue Construction in Process Construction Expenses Contract Asset Contract Liability Cost of Goods Sold Cost of Installment Sales Deferred Gross Profit Delivery Expense Discount on Notes Receivable Estimated Inventory Returns Finished Goods Inventory Franchise Revenue Freight-Out Gain on Repossession Income Summary Installment Accounts Receivable Installment Sales Revenue Interest Expense Interest Revenue Inventory Inventory on Consignment Liability to Bonus Point Customers Liability to Enyart Company Liability to Enyart Company Liability to Werner Metal Company License Revenue Loss from Long-Term Contracts Loss on Repossession Materials, Cash, Payables No Entry Notes Receivable Operating Expenses Payable to Consignor Purchases Realized Gross Profit Repossessed Merchandise Retained Earnings Returned Inventory Revenue from Consignment Sales Revenue from Franchise Fees Revenue from Long-Term Contracts Sales Discounts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Unearned Franchise Revenue Unearned Sales Revenue Unearned Service Revenue Unearned Warranty Revenue Warranty Expense Warranty Liability