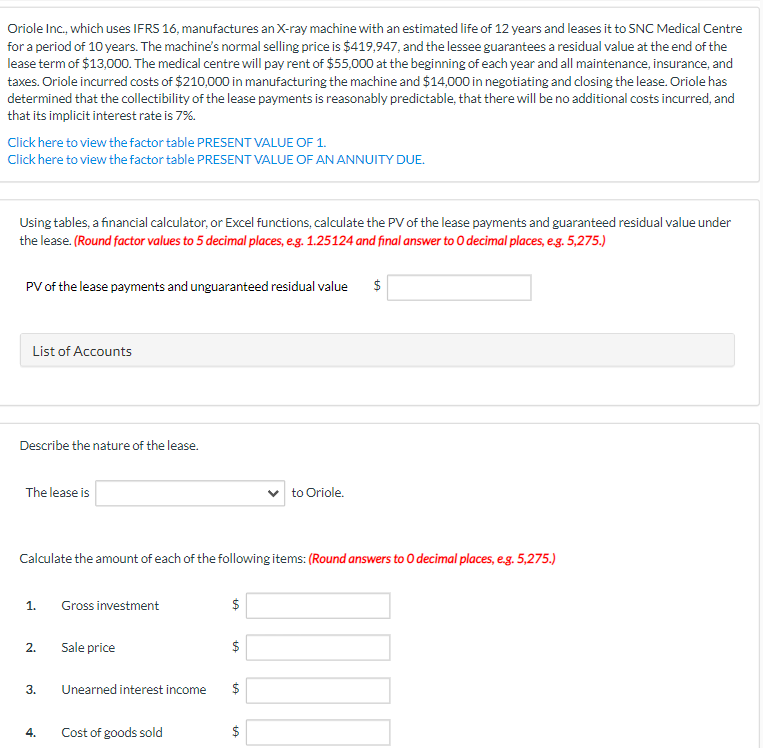

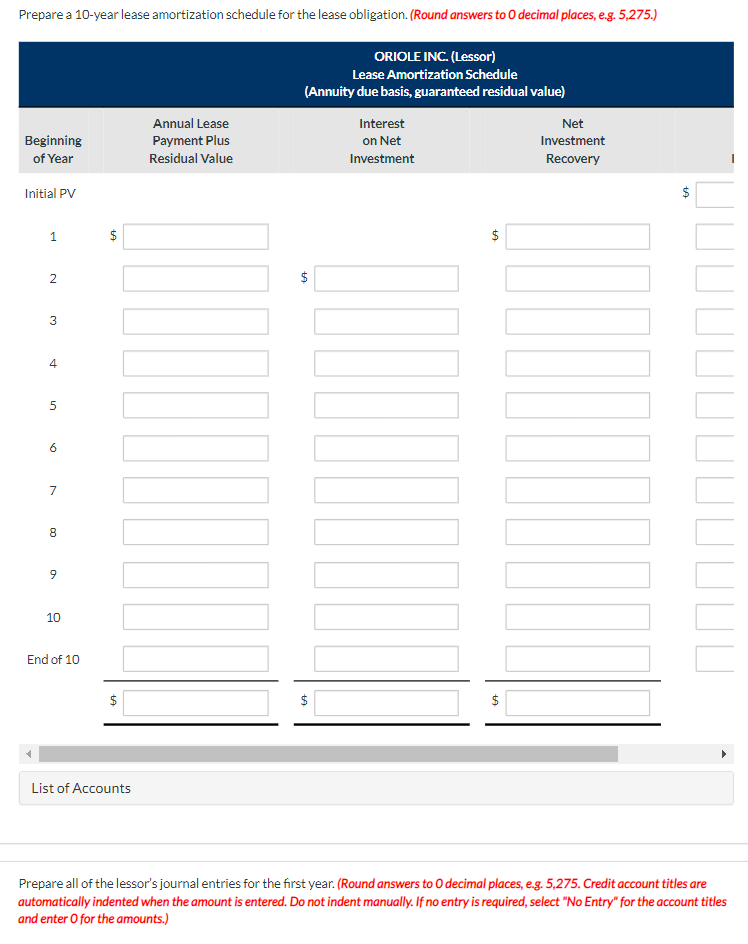

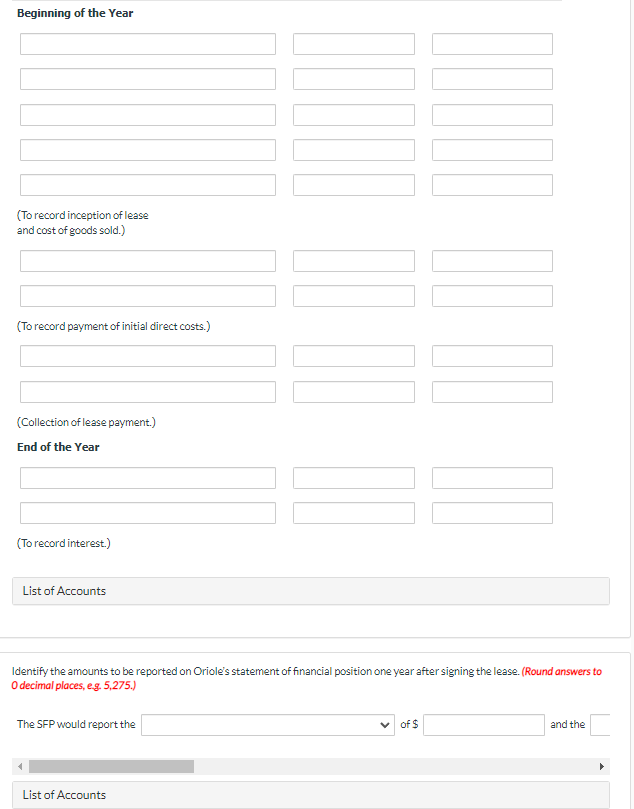

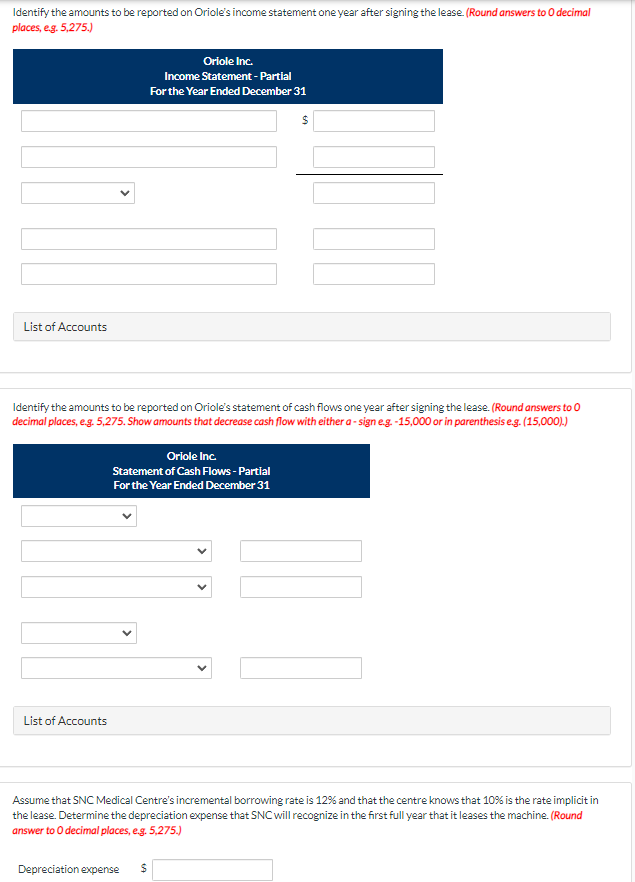

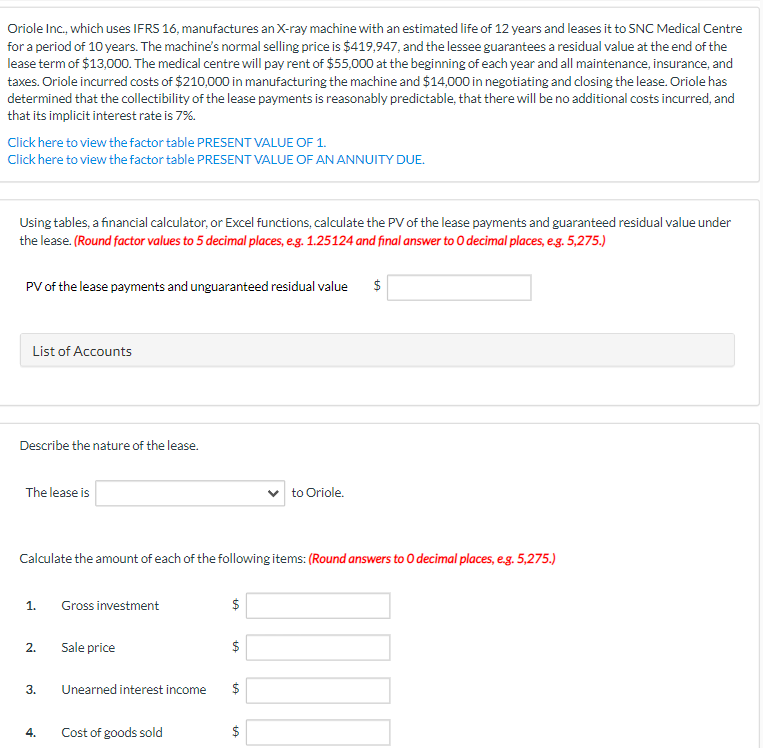

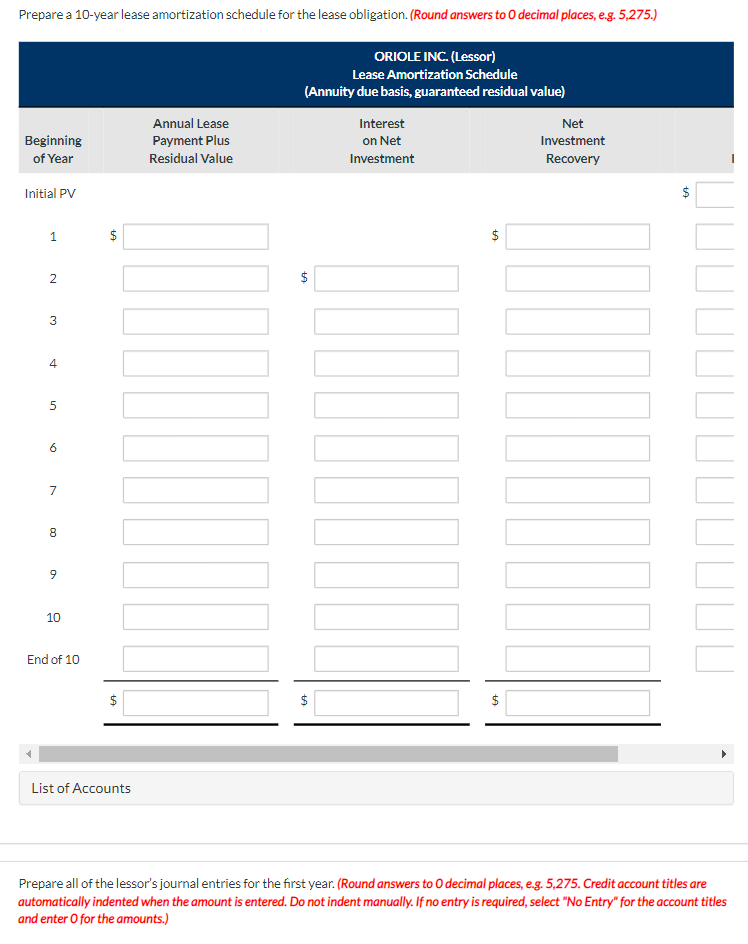

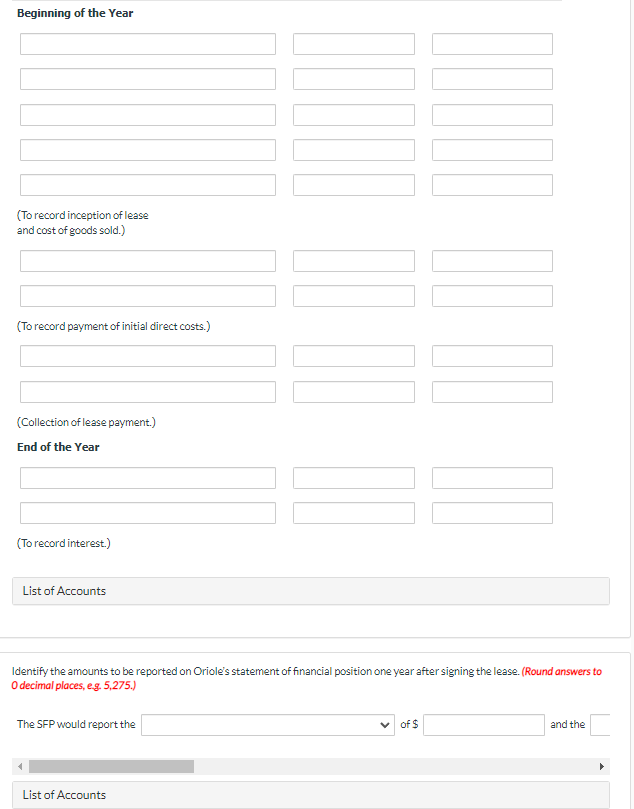

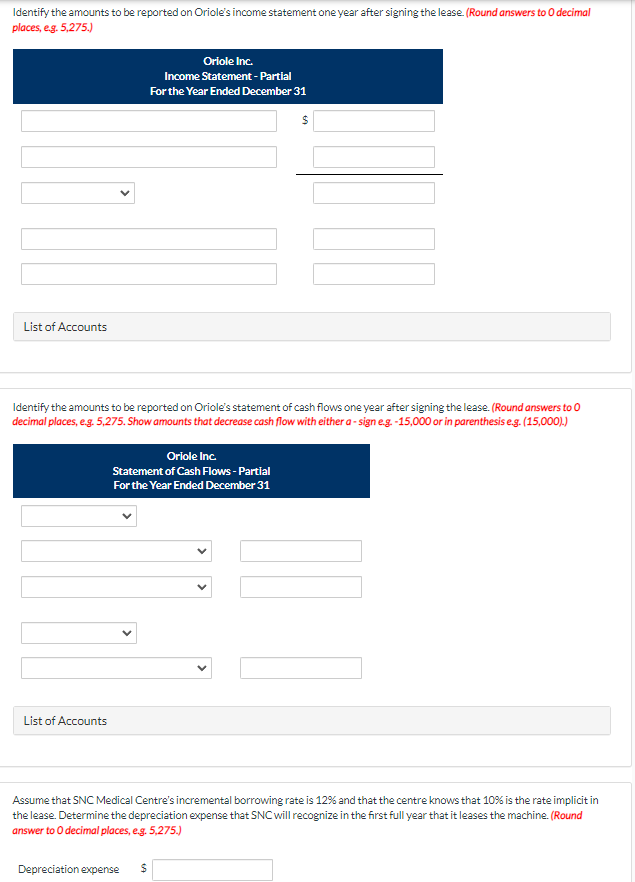

Oriole Inc., which uses IFRS 16, manufactures an X-ray machine with an estimated life of 12 years and leases it to SNC Medical Centre for a period of 10 years. The machine's normal selling price is $419,947, and the lessee guarantees a residual value at the end of the lease term of $13,000. The medical centre will pay rent of $55,000 at the beginning of each year and all maintenance, insurance, and taxes. Oriole incurred costs of $210,000 in manufacturing the machine and $14,000 in negotiating and closing the lease. Oriole has determined that the collectibility of the lease payments is reasonably predictable, that there will be no additional costs incurred, and that its implicit interest rate is 7%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using tables, a financial calculator, or Excel functions, calculate the PV of the lease payments and guaranteed residual value under the lease. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to decimal places, eg. 5,275.) PV of the lease payments and unguaranteed residual value $ $ List of Accounts Describe the nature of the lease. The lease is to Oriole. Calculate the amount of each of the following items: (Round answers to decimal places, eg. 5,275.) 1. Gross investment $ $ 2. Sale price $ 3. Unearned interest income $ 4. Cost of goods sold $ $ Prepare a 10-year lease amortization schedule for the lease obligation. (Round answers to decimal places, e.g. 5,275.) ORIOLE INC. (Lessor) Lease Amortization Schedule (Annuity due basis, guaranteed residual value) Beginning of Year Annual Lease Payment Plus Residual Value Interest on Net Investment Net Investment Recovery Initial PV $ 1 $ GA $ 2 $ $ IN 3 4 5 6 7 8 9 10 End of 10 $ $ $ List of Accounts Prepare all of the lessor's journal entries for the first year. (Round answers to decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Beginning of the Year | (To record inception of lease and cost of goods sold.) (To record payment of initial direct costs.) (Collection of lease payment.) End of the Year (To record interest.) List of Accounts Identify the amounts to be reported on Oriole's statement of financial position one year after signing the lease. (Round answers to O decimal places, e.g. 5,275.) The SFP would report the of $ and the List of Accounts Identify the amounts to be reported on Oriole's income statement one year after signing the lease. (Round answers to decimal places, eg. 5,275.) Oriole Inc Income Statement - Partial For the Year Ended December 31 $ List of Accounts Identify the amounts to be reported on Oriole's statement of cash flows one year after signing the lease. (Round answers to decimal places, eg. 5,275. Show amounts that decrease cash flow with either a - signe.g.-15,000 or in parenthesis e.g. (15,000).) Oriole Inc Statement of Cash Flows - Partial For the Year Ended December 31