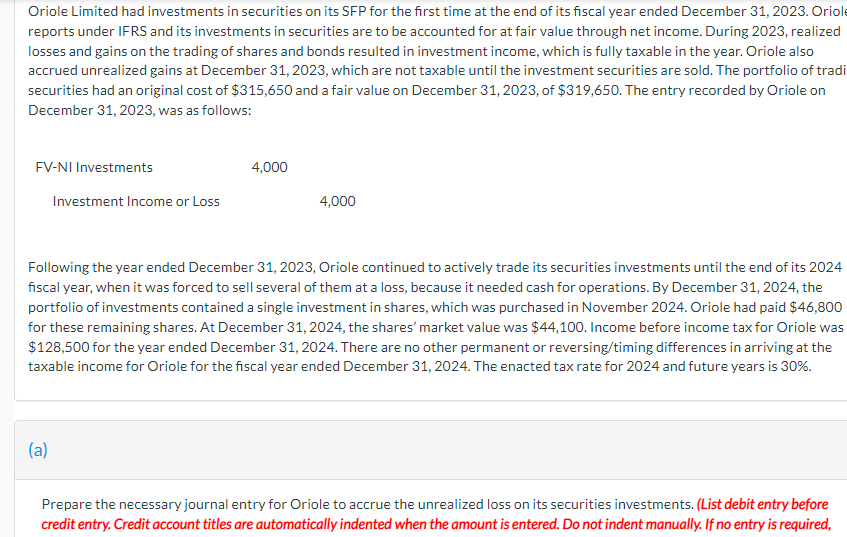

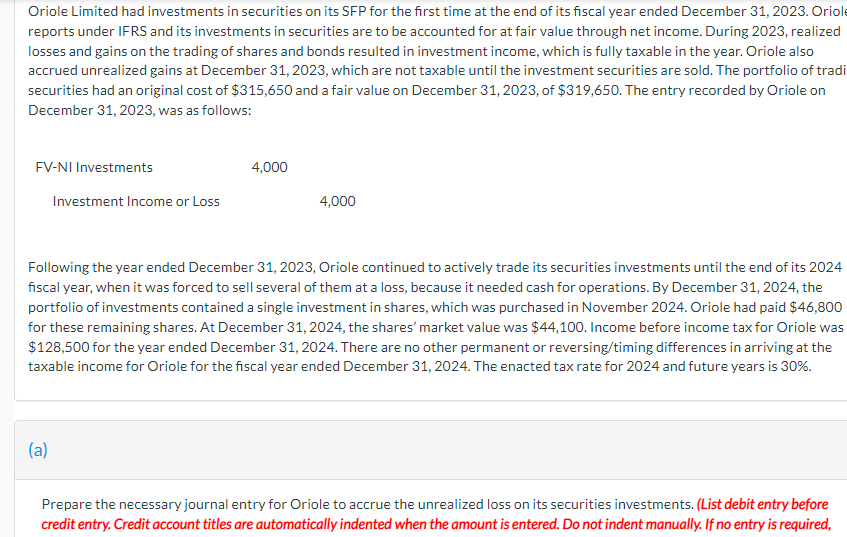

Oriole Limited had investments in securities on its SFP for the first time at the end of its fiscal year ended December 31,2023. Oriol reports under IFRS and its investments in securities are to be accounted for at fair value through net income. During 2023 , realized losses and gains on the trading of shares and bonds resulted in investment income, which is fully taxable in the year. Oriole also accrued unrealized gains at December 31, 2023, which are not taxable until the investment securities are sold. The portfolio of trad securities had an original cost of $315,650 and a fair value on December 31,2023 , of $319,650. The entry recorded by Oriole on December 31, 2023, was as follows: Following the year ended December 31, 2023, Oriole continued to actively trade its securities investments until the end of its 2024 fiscal year, when it was forced to sell several of them at a loss, because it needed cash for operations. By December 31, 2024, the portfolio of investments contained a single investment in shares, which was purchased in November 2024 . Oriole had paid $46,800 for these remaining shares. At December 31,2024 , the shares' market value was $44,100. Income before income tax for Oriole was $128,500 for the year ended December 31, 2024. There are no other permanent or reversing/timing differences in arriving at the taxable income for Oriole for the fiscal year ended December 31, 2024. The enacted tax rate for 2024 and future years is 30%. (a) Prepare the necessary journal entry for Oriole to accrue the unrealized loss on its securities investments. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, Oriole Limited had investments in securities on its SFP for the first time at the end of its fiscal year ended December 31,2023. Oriol reports under IFRS and its investments in securities are to be accounted for at fair value through net income. During 2023 , realized losses and gains on the trading of shares and bonds resulted in investment income, which is fully taxable in the year. Oriole also accrued unrealized gains at December 31, 2023, which are not taxable until the investment securities are sold. The portfolio of trad securities had an original cost of $315,650 and a fair value on December 31,2023 , of $319,650. The entry recorded by Oriole on December 31, 2023, was as follows: Following the year ended December 31, 2023, Oriole continued to actively trade its securities investments until the end of its 2024 fiscal year, when it was forced to sell several of them at a loss, because it needed cash for operations. By December 31, 2024, the portfolio of investments contained a single investment in shares, which was purchased in November 2024 . Oriole had paid $46,800 for these remaining shares. At December 31,2024 , the shares' market value was $44,100. Income before income tax for Oriole was $128,500 for the year ended December 31, 2024. There are no other permanent or reversing/timing differences in arriving at the taxable income for Oriole for the fiscal year ended December 31, 2024. The enacted tax rate for 2024 and future years is 30%. (a) Prepare the necessary journal entry for Oriole to accrue the unrealized loss on its securities investments. (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required