Question

Oriole Ltd. purchased a delivery truck on July 1, 2021. The list price of the new truck was $87,000. Oriole offered a used truck as

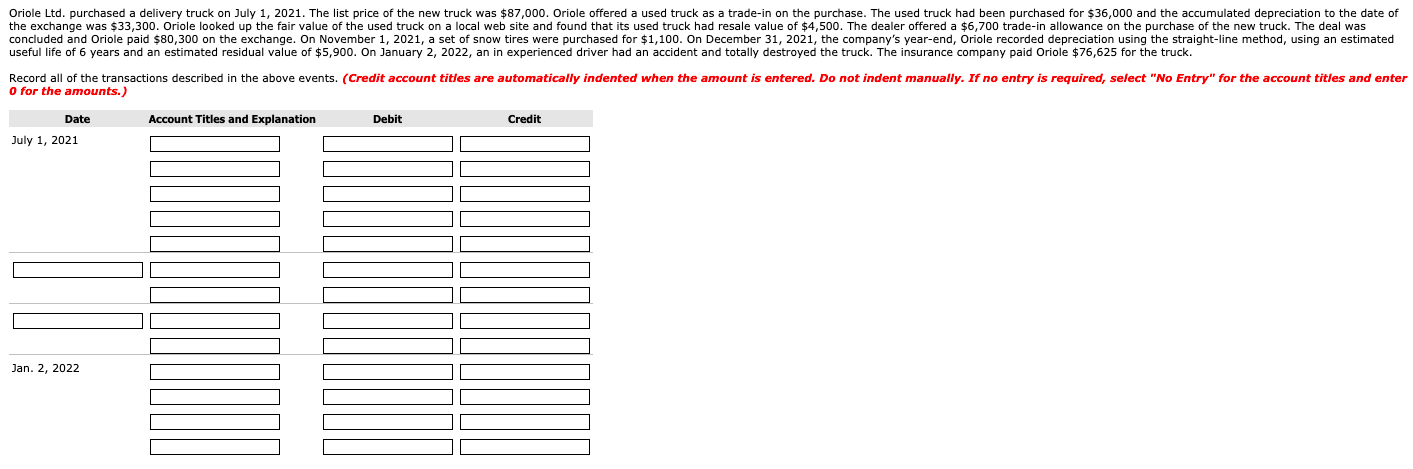

Oriole Ltd. purchased a delivery truck on July 1, 2021. The list price of the new truck was $87,000. Oriole offered a used truck as a trade-in on the purchase. The used truck had been purchased for $36,000 and the accumulated depreciation to the date of the exchange was $33,300. Oriole looked up the fair value of the used truck on a local web site and found that its used truck had resale value of $4,500. The dealer offered a $6,700 trade-in allowance on the purchase of the new truck. The deal was concluded and Oriole paid $80,300 on the exchange. On November 1, 2021, a set of snow tires were purchased for $1,100. On December 31, 2021, the companys year-end, Oriole recorded depreciation using the straight-line method, using an estimated useful life of 6 years and an estimated residual value of $5,900. On January 2, 2022, an in experienced driver had an accident and totally destroyed the truck. The insurance company paid Oriole $76,625 for the truck.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started