Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oriole Manufacturing's sales decreased significantly in 2021 due to increased online purchasing. The company's income statement showed the following results from selling 386,000 units

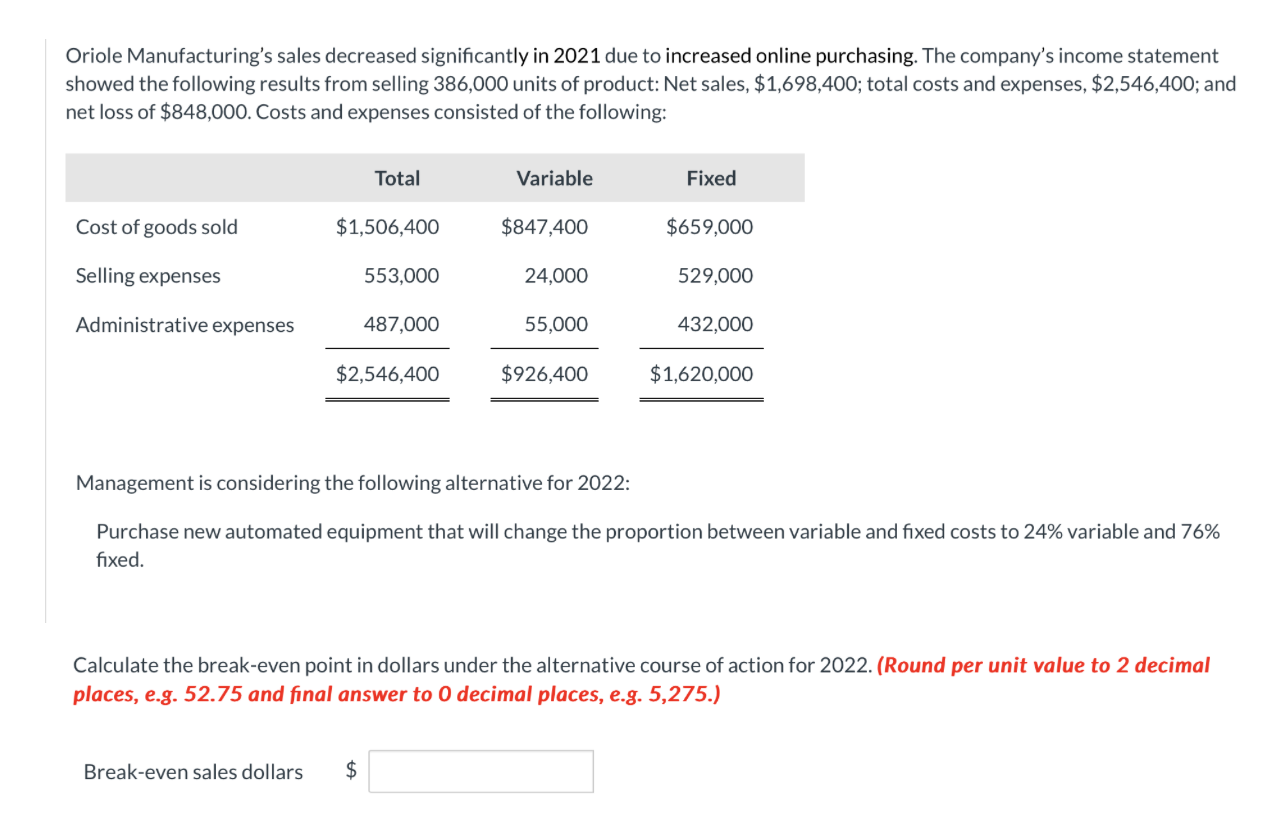

Oriole Manufacturing's sales decreased significantly in 2021 due to increased online purchasing. The company's income statement showed the following results from selling 386,000 units of product: Net sales, $1,698,400; total costs and expenses, $2,546,400; and net loss of $848,000. Costs and expenses consisted of the following: Total Variable Fixed Cost of goods sold $1,506,400 $847,400 $659,000 Selling expenses 553,000 24,000 529,000 Administrative expenses 487,000 55,000 432,000 $2,546,400 $926,400 $1,620,000 Management is considering the following alternative for 2022: Purchase new automated equipment that will change the proportion between variable and fixed costs to 24% variable and 76% fixed. Calculate the break-even point in dollars under the alternative course of action for 2022. (Round per unit value to 2 decimal places, e.g. 52.75 and final answer to 0 decimal places, e.g. 5,275.) Break-even sales dollars $

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the breakeven point in dollars under the alternative course of action for 2022 we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started