Answered step by step

Verified Expert Solution

Question

1 Approved Answer

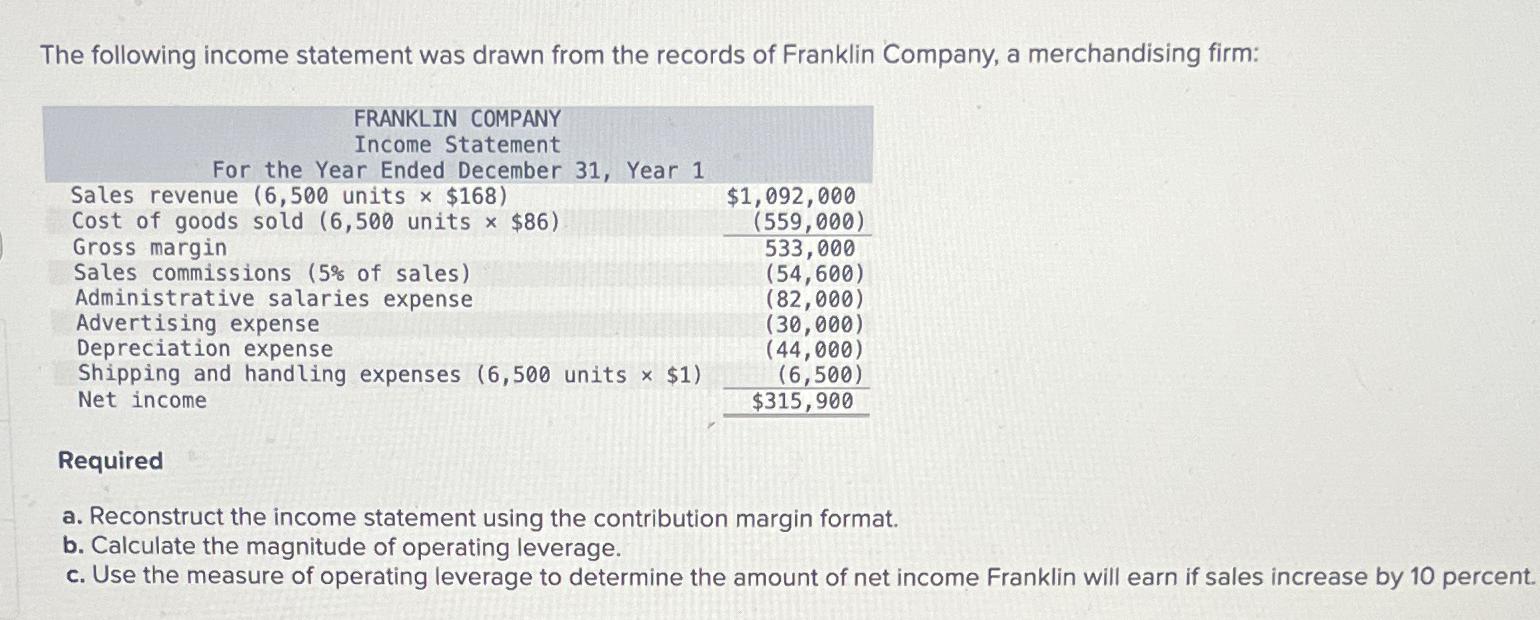

The following income statement was drawn from the records of Franklin Company, a merchandising firm: FRANKLIN COMPANY Income Statement For the Year Ended December

The following income statement was drawn from the records of Franklin Company, a merchandising firm: FRANKLIN COMPANY Income Statement For the Year Ended December 31, Year 1 $1,092,000 Sales revenue (6,500 units x $168) Cost of goods sold (6,500 units x $86). Gross margin Sales commissions (5% of sales) Administrative salaries expense Advertising expense Depreciation expense Shipping and handling expenses (6,500 units x $1) Net income Required (559,000) 533,000 (54,600) (82,000) (30,000) (44,000) (6,500) $315,900 a. Reconstruct the income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net income Franklin will earn if sales increase by 10 percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Reconstructing the income statement using the contribution margin format FRANKLIN COMPANY Contribu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started