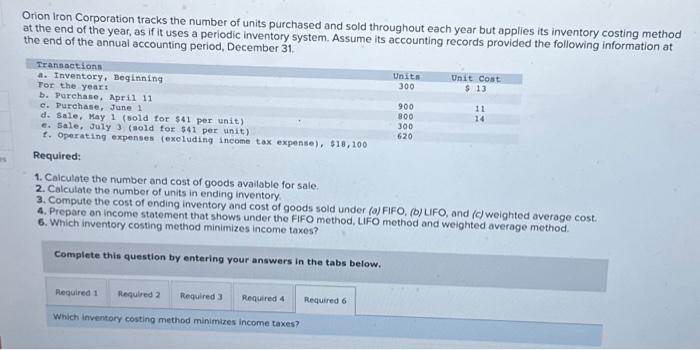

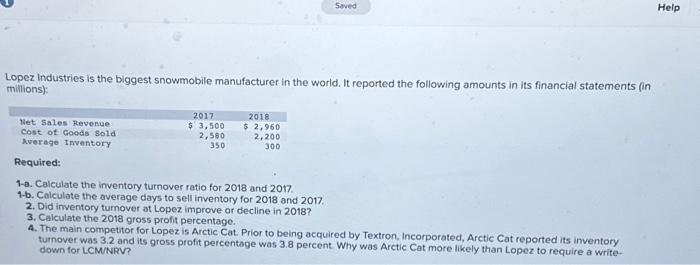

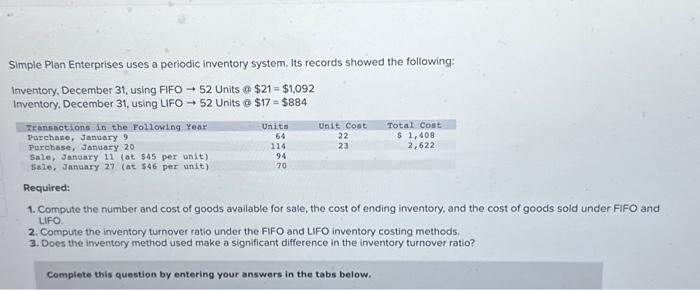

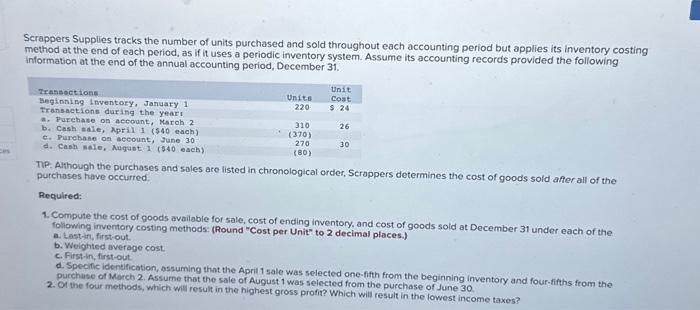

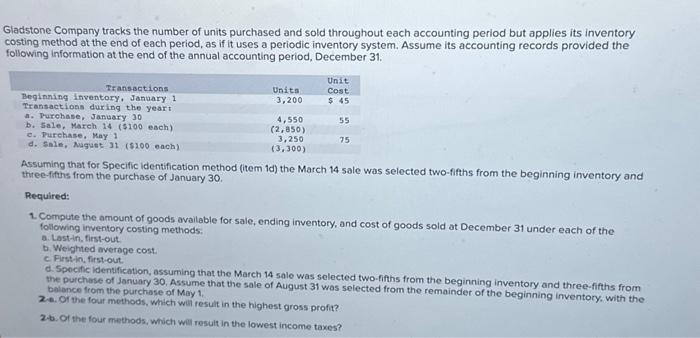

Orion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 . 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) UFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Complete this question by entering your answers in the tabs below. Which inventory costing method minimizes income taxes? -opez Industries is the biggest snowmobile manufacturer in the world. It reported the following amounts in its financial statements (in militions): Hequired: 1-a. Calculate the inventory turnover ratio for 2018 and 2017 1 .b. Calculate the average days to sell inventory for 2018 and 2017 2. Did inventory tumover at Lopez improve or decline in 2018 ? 3. Calculate the 2018 gross profit percentage. 4. The main competitor for Lopez is Arctic Cat. Prior to being acquired by Textron, Incorporated, Arctic Cat reported its inventory turnover was 3.2 and its gross profit percentoge was 3.8 percent. Why was Arctic Cat more likely than Lopez to require a write. down for LCMNRR? Simple Plan Enterprises uses a periodic inventory system. Its records showed the following: Inventory, December 31 , using FIFO 52 Units $21=$1,092 Inventory, December 31 , using LIFO 52 Units @$17=$884 Required: 1. Compute the number and cost of goods available for sale, the cost of ending inventory, and the cost of goods sold under FiFO and LIFO. 2. Compute the inventory turnover ratio under the FIFO and LIFO inventory costing methods. 3. Does the inventory method used make a significant difference in the imventory turnover ratio? Complete this question by entering your answers in the tabs below. Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. TP. Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold affer all of the purchases have occurred. Required: 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the foliowing inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Lastin, first-out. b. Weighted average cost. c. Firstiln, first-out. d. Specific identification, ossuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of Morch 2. Assume that the sale of August 1 was selected from the purchase of June 30 2. Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes? Sladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fitths from the purchase of January 30 . Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: a. Lost-in, first-out. b. Weighted average cost. C. Firstin, first-out. d. Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30 , Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the 2 . Or the four methods, which way 1, 26. Of the four methods, which wel result in the lowest income taxes