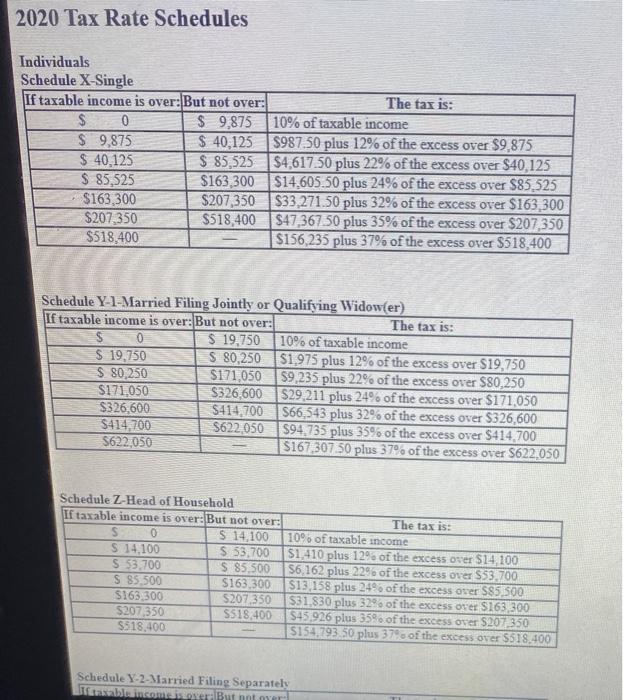

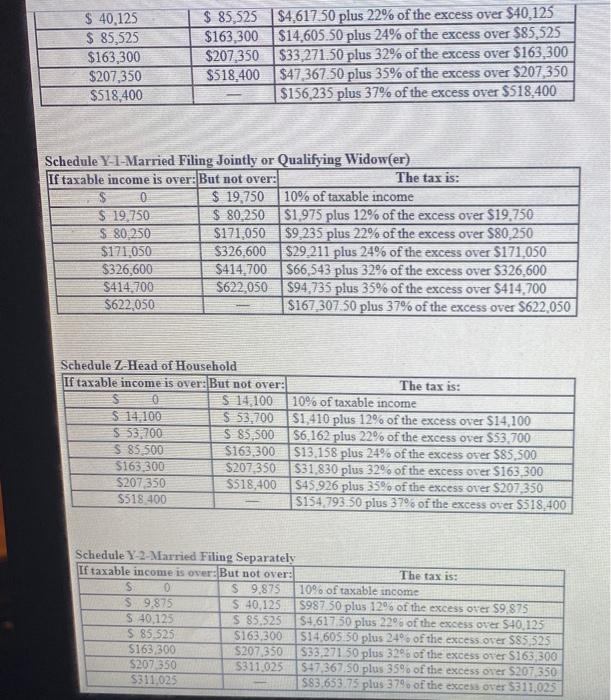

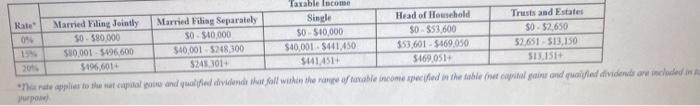

ork Saved Required information (The following information applies to the questions displayed below) Henrich is a single taxpayer In 2020, his taxable income is $454,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) a. All of his income is salary from his employer Income tax Neinvestment income tax Total taxablity $ 40,125 $ 85,525 $163,300 $207,350 $518,400 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $163,300 $14,605,50 plus 24% of the excess over $85,525 $207,350 $33,271.50 plus 32% of the excess over $163,300 $518,400 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518.400 Schedule Y-1-Married Filing Jointly or Qualifying Widower) If taxable income is over: But not over: The tax is: $ 0 $ 19.750 10% of taxable income $ 19,750 $ 80.250 1.975 plus 12% of the excess over $19.750 $ 80,250 $171,050 $9.235 plus 22% of the excess over $80,250 $171.050 $326.600 $29.211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167 307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over:But not over: The tax is: S 0 $ 14,100 10% of taxable income $ 14.100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $53,700 $ 85,500 $6,162 plus 22% of the excess over $53.7 S 85.500 $163,300 $13,158 plus 24% of the excess over $85,500 S163,300 $207,350 $31.830 plus 32% of the excess over S163,300 S207 350 5518.400 345,926 plus 35% of the excess over $207,350 $518.400 $154,793 50 plus 37% of the excess over $518,400 Schedule Y-2 Married Filing Separately If taxable income is over: But not over: The tax is: S 0 S 9.875 10% of taxable income S 9.875 $ 40,125 S987.50 plus 12% of the excess over $9.875 $ 40,125 S 85.525 54.61750 plus 229 of the excess over $40,125 S 85.525 S163 300 $14,605 50 plus 2.4% of the excess over $85 525 S163 300 $207 350 $33,271 50 plus 32% of the excess over $163 300 $207 350 5311.025 $47.367.50 plus 35% of the excess over $207 350 $311,025 583.653.75 plus 379 of the excess over $311.025 ork Saved Required information (The following information applies to the questions displayed below) Henrich is a single taxpayer In 2020, his taxable income is $454,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference (Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable.) a. All of his income is salary from his employer Income tax Neinvestment income tax Total taxablity $ 40,125 $ 85,525 $163,300 $207,350 $518,400 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $163,300 $14,605,50 plus 24% of the excess over $85,525 $207,350 $33,271.50 plus 32% of the excess over $163,300 $518,400 $47,367.50 plus 35% of the excess over $207,350 $156,235 plus 37% of the excess over $518.400 Schedule Y-1-Married Filing Jointly or Qualifying Widower) If taxable income is over: But not over: The tax is: $ 0 $ 19.750 10% of taxable income $ 19,750 $ 80.250 1.975 plus 12% of the excess over $19.750 $ 80,250 $171,050 $9.235 plus 22% of the excess over $80,250 $171.050 $326.600 $29.211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167 307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over:But not over: The tax is: S 0 $ 14,100 10% of taxable income $ 14.100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $53,700 $ 85,500 $6,162 plus 22% of the excess over $53.7 S 85.500 $163,300 $13,158 plus 24% of the excess over $85,500 S163,300 $207,350 $31.830 plus 32% of the excess over S163,300 S207 350 5518.400 345,926 plus 35% of the excess over $207,350 $518.400 $154,793 50 plus 37% of the excess over $518,400 Schedule Y-2 Married Filing Separately If taxable income is over: But not over: The tax is: S 0 S 9.875 10% of taxable income S 9.875 $ 40,125 S987.50 plus 12% of the excess over $9.875 $ 40,125 S 85.525 54.61750 plus 229 of the excess over $40,125 S 85.525 S163 300 $14,605 50 plus 2.4% of the excess over $85 525 S163 300 $207 350 $33,271 50 plus 32% of the excess over $163 300 $207 350 5311.025 $47.367.50 plus 35% of the excess over $207 350 $311,025 583.653.75 plus 379 of the excess over $311.025