Question

Orlole Company purchases $55.000 af raw materials on account, and it incurs 566.000 of factory labor costs. Supporting records show that (al the Assembly

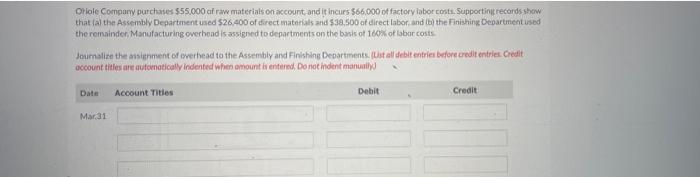

Orlole Company purchases $55.000 af raw materials on account, and it incurs 566.000 of factory labor costs. Supporting records show that (al the Assembly Department used 526,400 of direct materials and $38,500 of direct labor, and (b) the Finishing Deoartment used the remainder, Manufacturing overhead is assigned to departments on the basis of 160% of labor costs Journalize the ansignment of overhead to the Assembly and Finishing Departments. (List all debit entries before credit entries. Credit account titles are automatically indented when omount is entered, Do not indent manually) Date Account Titles Debit Credit Mar.31

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution Date Account tiltle and explan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools for business decision making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

6th Edition

978-0470477144, 1118096894, 9781118214657, 470477148, 111821465X, 978-1118096895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App