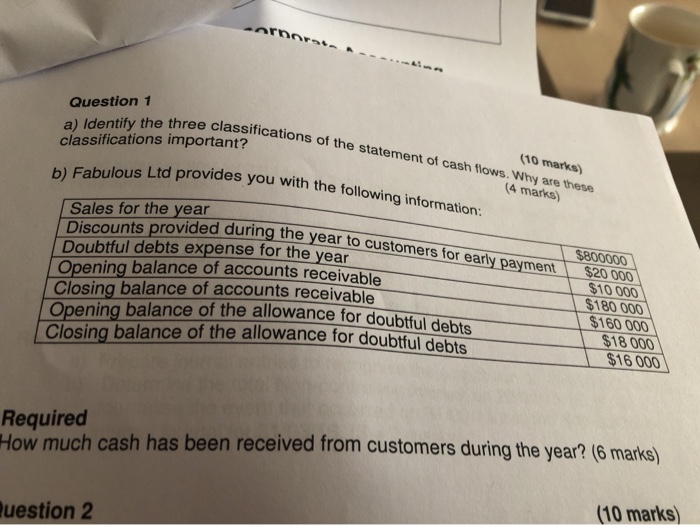

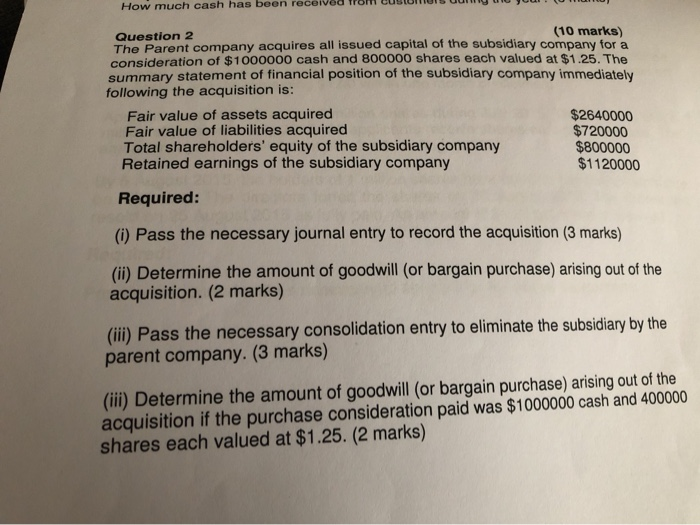

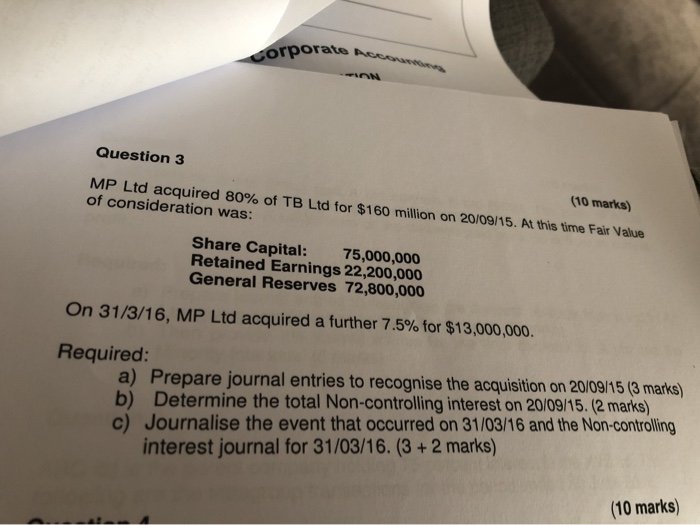

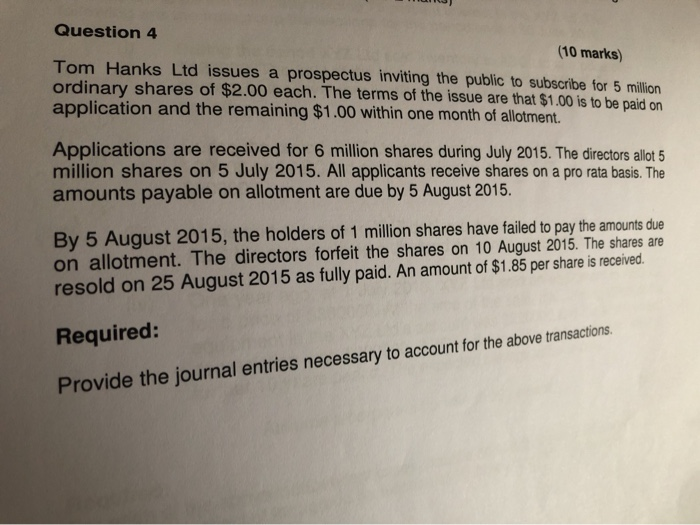

Ornorat. Question 1 a) Identify the three classifications of the statement of cash flows. Why are these (10 marks) classifications important? (4 marks) b) Fabulous Ltd provides you with the following information: Sales for the year Discounts provided during the year to customers for early payment $800000 $20 000 $10 000 $180 000 $160 000 $18 000 $16 000 Doubtful debts expense for the year Opening balance of accounts receivable Closing balance of accounts receivable Opening balance of the allowance for doubtful debts Closing balance of the allowance for doubtful debts Required How much cash has been received from customers during the year? (6 marks) (10 marks) uestion 2 How much cash has been receiv (10 marks) Question 2 The Parent company acquires all issued capital of the subsidiary company for a consideration of $1000000 cash and 800000 shares each valued at $1.25. The summary statement of financial position of the subsidiary company immediately following the acquisition is: $2640000 $720000 $800000 $1120000 Fair value of assets acquired Fair value of liabilities acquired Total shareholders' equity of the subsidiary company Retained earnings of the subsidiary company Required: (i) Pass the necessary journal entry to record the acquisition (3 marks) (ii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition. (2 marks) (iii)Pass the necessary consolidation entry to eliminate the subsidiary by the parent company. (3 marks) (iii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition if the purchase consideration paid was $1000000 cash and 400000 shares each valued at $1.25. (2 marks) Corporate Accounting Question 3 (10 marks) MP Ltd acquired 80% of TB Ltd for $160 million on 20/09/15. At this time Fair Value of consideration was: Share Capital: Retained Earnings 22,200,000 General Reserves 72,800,000 75,000,000 On 31/3/16, MP Ltd acquired a further 7.5% for $13,000,000. Required: a) Prepare journal entries to recognise the acquisition on 20/09/15 (3 marks) b) Determine the total Non-controlling interest on 20/09/15. (2 marks) c) Journalise the event that occurred on 31/03/16 and the Non-controlling interest journal for 31/03/16. (3+2 marks) (10 marks) Question 4 (10 marks) Tom Hanks Ltd issues a prospectus inviting the public to subscribe for 5 million ordinary shares of $2.00 each. The terms of the issue are that $1.00 is to be paid on application and the remaining $1.00 within one month of allotment. Applications are received for 6 million shares during July 2015. The directors allot 5 million shares on 5 July 2015. All applicants receive shares on a pro rata basis. The amounts payable on allotment are due by 5 August 2015. By 5 August 2015, the holders of 1 million shares have failed to pay the amounts due on allotment. The directors forfeit the shares on 10 August 2015. The shares resold on 25 August 2015 as fully paid. An amount of $1.85 per share is received are Required: Provide the journal entries necessary to account for the above transactions Ornorat. Question 1 a) Identify the three classifications of the statement of cash flows. Why are these (10 marks) classifications important? (4 marks) b) Fabulous Ltd provides you with the following information: Sales for the year Discounts provided during the year to customers for early payment $800000 $20 000 $10 000 $180 000 $160 000 $18 000 $16 000 Doubtful debts expense for the year Opening balance of accounts receivable Closing balance of accounts receivable Opening balance of the allowance for doubtful debts Closing balance of the allowance for doubtful debts Required How much cash has been received from customers during the year? (6 marks) (10 marks) uestion 2 How much cash has been receiv (10 marks) Question 2 The Parent company acquires all issued capital of the subsidiary company for a consideration of $1000000 cash and 800000 shares each valued at $1.25. The summary statement of financial position of the subsidiary company immediately following the acquisition is: $2640000 $720000 $800000 $1120000 Fair value of assets acquired Fair value of liabilities acquired Total shareholders' equity of the subsidiary company Retained earnings of the subsidiary company Required: (i) Pass the necessary journal entry to record the acquisition (3 marks) (ii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition. (2 marks) (iii)Pass the necessary consolidation entry to eliminate the subsidiary by the parent company. (3 marks) (iii) Determine the amount of goodwill (or bargain purchase) arising out of the acquisition if the purchase consideration paid was $1000000 cash and 400000 shares each valued at $1.25. (2 marks) Corporate Accounting Question 3 (10 marks) MP Ltd acquired 80% of TB Ltd for $160 million on 20/09/15. At this time Fair Value of consideration was: Share Capital: Retained Earnings 22,200,000 General Reserves 72,800,000 75,000,000 On 31/3/16, MP Ltd acquired a further 7.5% for $13,000,000. Required: a) Prepare journal entries to recognise the acquisition on 20/09/15 (3 marks) b) Determine the total Non-controlling interest on 20/09/15. (2 marks) c) Journalise the event that occurred on 31/03/16 and the Non-controlling interest journal for 31/03/16. (3+2 marks) (10 marks) Question 4 (10 marks) Tom Hanks Ltd issues a prospectus inviting the public to subscribe for 5 million ordinary shares of $2.00 each. The terms of the issue are that $1.00 is to be paid on application and the remaining $1.00 within one month of allotment. Applications are received for 6 million shares during July 2015. The directors allot 5 million shares on 5 July 2015. All applicants receive shares on a pro rata basis. The amounts payable on allotment are due by 5 August 2015. By 5 August 2015, the holders of 1 million shares have failed to pay the amounts due on allotment. The directors forfeit the shares on 10 August 2015. The shares resold on 25 August 2015 as fully paid. An amount of $1.85 per share is received are Required: Provide the journal entries necessary to account for the above transactions