Question

Oros owners currently demand a return of 18 percent of the market price of the copper. a. If the current market price of copper is

Oros owners currently demand a return of 18 percent of the market price of the copper.

Oros owners currently demand a return of 18 percent of the market price of the copper.

a. If the current market price of copper is $10 per ton, what is Oros target cost per ton?

b. Given the $10 market price, should either of the mines be opened?

c. The engineer working on Site Z believes that if a custom conveyor system is installed, the variable extraction cost could be reduced to $3.50 per ton. The purchase price of the system is $2000, but the costs to restore the size will increase to $30,000 if it is installed. Given the current $10 market price, should Oro install the conveyor and open Site Z ?

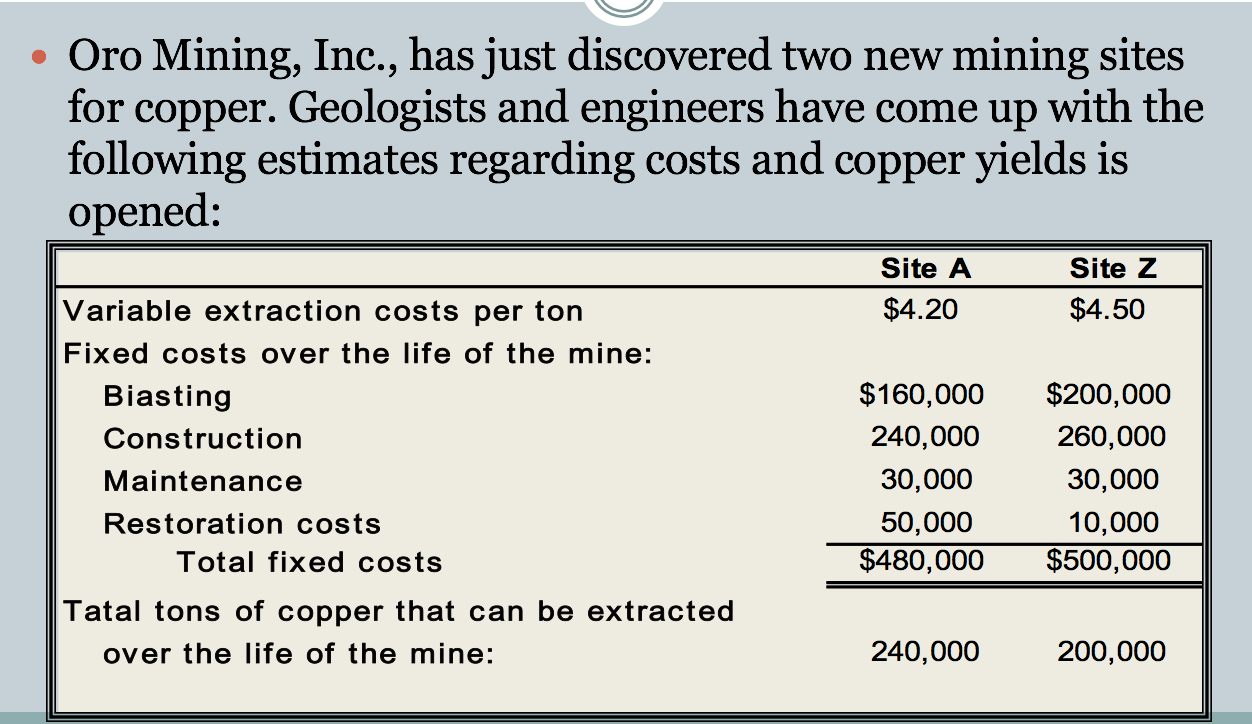

Oro Mining, Inc., has just discovered two new mining sites for copper. Geologists and engineers have come up with the following estimates regarding costs and copper yields is opened: Site A Site Z $4.50 $4.20 Variable extraction costs per ton Fixed costs over the life of the mine: Biasting Constructior Maintenance Restoration costs $160,000 $200,000 260,000 30,000 10,000 $480,000 $500,000 240,000 30,000 50,000 Total fixed costs Tatal tons of copper that can be extracted over the life of the mine: 240,000 200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started