Answered step by step

Verified Expert Solution

Question

1 Approved Answer

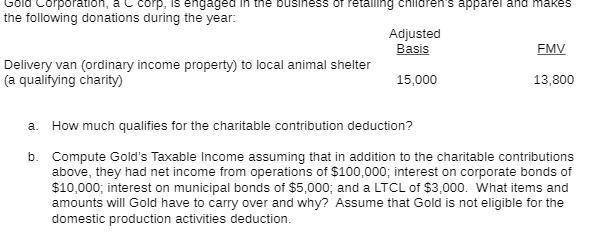

orporation, corp, is engaged in the business of retalling children's apparel and makes the following donations during the year: Delivery van (ordinary income property)

orporation, corp, is engaged in the business of retalling children's apparel and makes the following donations during the year: Delivery van (ordinary income property) to local animal shelter (a qualifying charity) Adjusted Basis 15,000 FMV 13,800 a. How much qualifies for the charitable contribution deduction? b. Compute Gold's Taxable income assuming that in addition to the charitable contributions above, they had net income from operations of $100,000; interest on corporate bonds of $10,000; interest on municipal bonds of $5,000; and a LTCL of $3,000. What items and amounts will Gold have to carry over and why? Assume that Gold is not eligible for the domestic production activities deduction.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Determine the deductible amount for a donation of property Adjusted Basis 15000 Fair Market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started