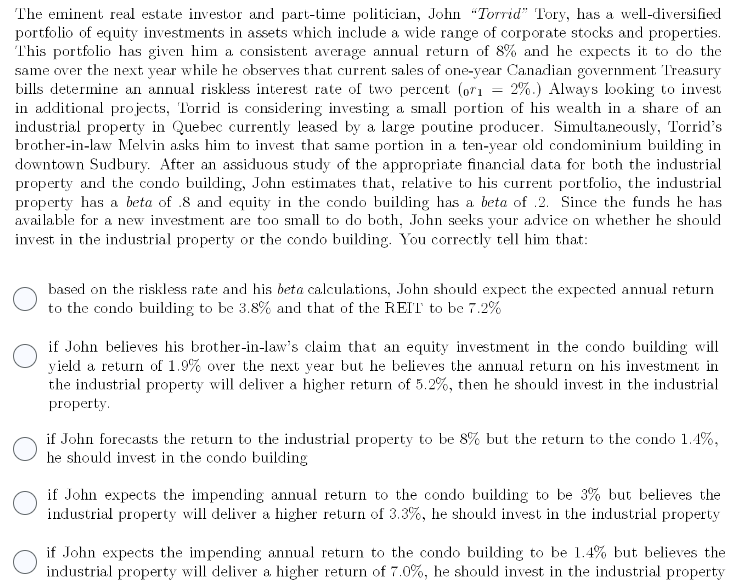

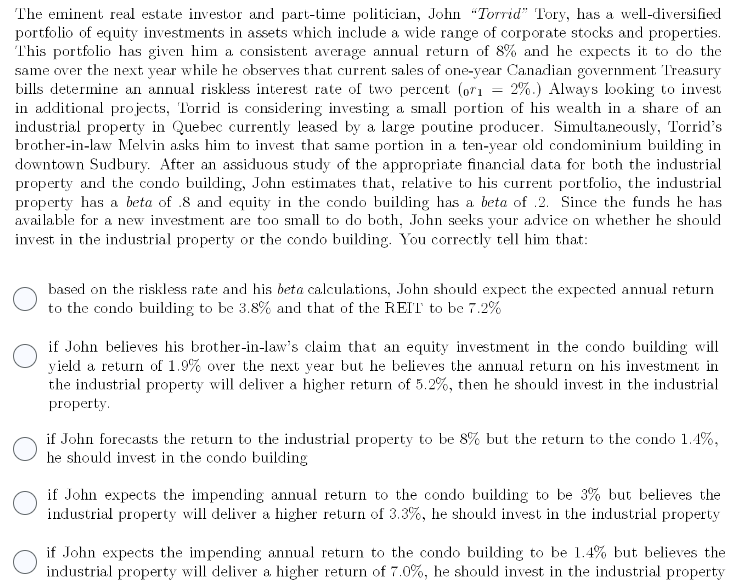

ortfolio of equity investments in assets which include a wide range of corporate stocks and properties. his portfolio has given him a consistent average annual return of 8% and he expects it to do the ame over the next year while he observes that current sales of one-year Canadian government 'Treasury ills determine an annual riskless interest rate of two percent (0r1=2%. ) Always looking to invest additional projects, 'Lorrid is considering investing a small portion of his wealth in a share of an adustrial property in Quebec currently leased by a large poutine producer. Simultaneously, Torrid's rother-in-law Melvin asks him to invest that same portion in a ten-year old condominium building in owntown Sudbury. After an assiduous study of the appropriate financial data for both the industrial roperty and the condo building, John estimates that, relative to his current portfolio, the industrial roperty has a beta of .8 and equity in the condo building has a beta of 2 . Since the funds he has vailable for a new investment are too small to do both, John seeks your advice on whether he should in the industrial property or the condo building. You correctly tell him that: based on the riskless rate and his beta calculations, John should expect the expected annual return to the condo building to be 3.8% and that of the REI' to be 7.2% if John believes his brother-in-law's claim that an equity investment in the condo building will yield a return of 1.9% over the next year but he believes the annual return on his investment in the industrial property will deliver a higher return of 5.2%, then he should invest in the industrial property. if John forecasts the return to the industrial property to be 8% but the return to the condo 1.4%, he should invest in the condo building if John expects the impending annual return to the condo building to be 3% but believes the industrial property will deliver a higher return of 3.3%, he should invest in the industrial property if John expects the impending annual return to the condo building to be 1.4% but believes the industrial property will deliver a higher return of 7.0%, he should invest in the industrial property