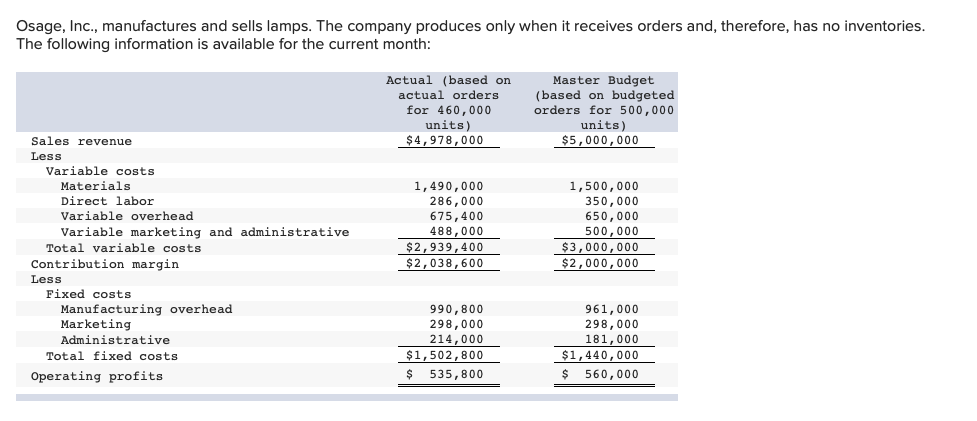

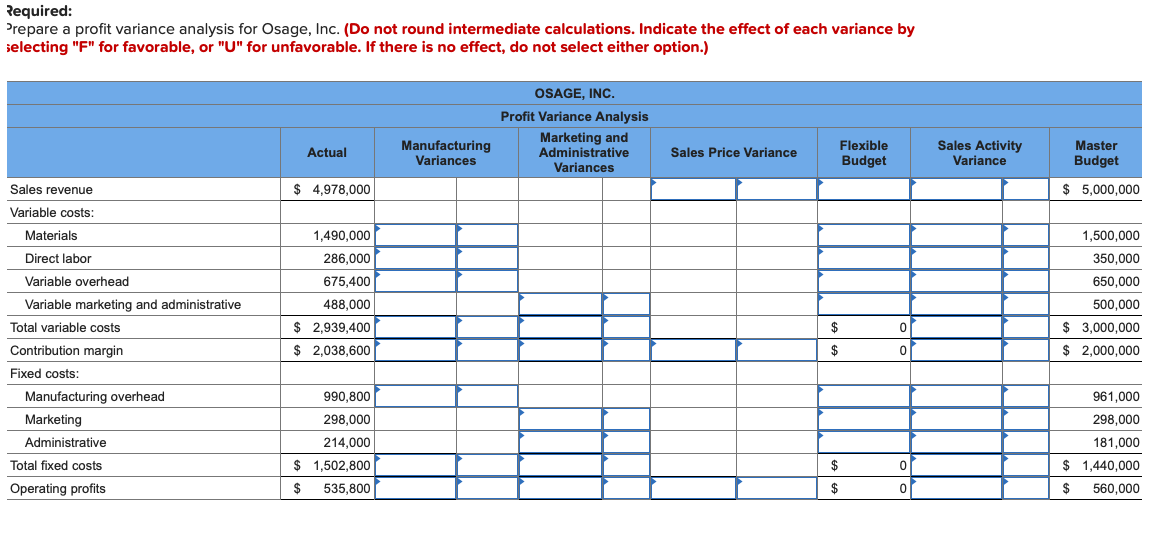

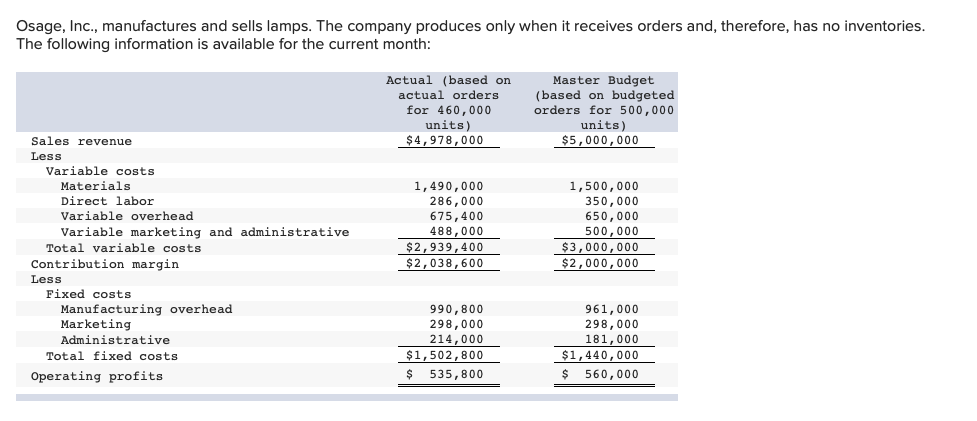

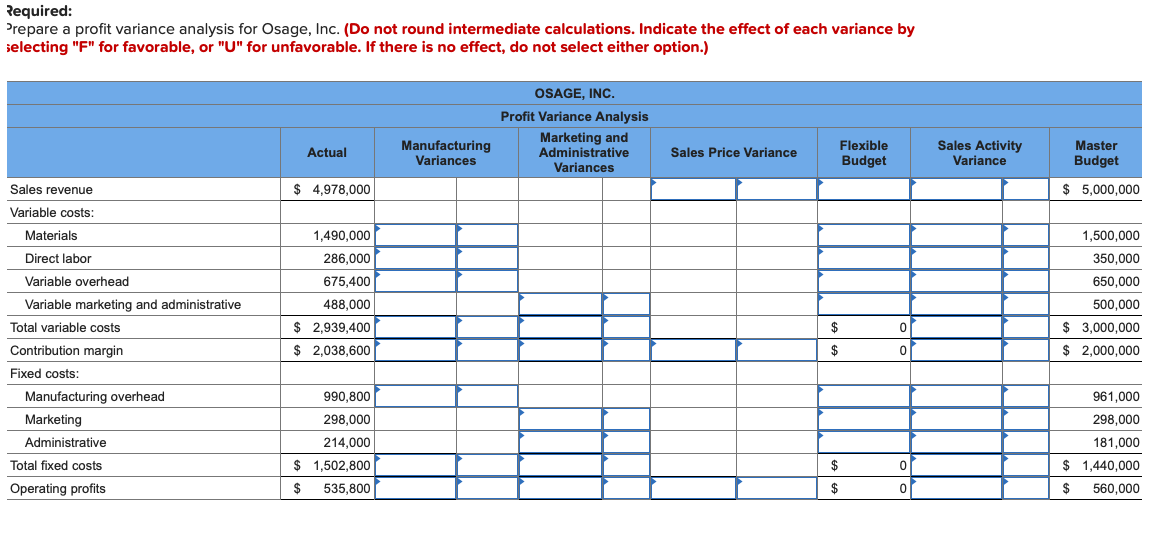

Osage, Inc., manufactures and sells lamps. The company produces only when it receives orders and, therefore, has no inventories. The following information is available for the current month: Actual (based on actual orders for 460,000 units) $ 4,978,000 Master Budget (based on budgeted orders for 500,000 units) $5,000,000 Sales revenue Less Variable costs Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Less Fixed costs Manufacturing overhead Marketing Administrative Total fixed costs Operating profits 1,490,000 286,000 675, 400 488,000 $2,939, 400 $2,038, 600 1,500,000 350,000 650,000 500,000 $3,000,000 $ 2,000,000 990,800 298,000 214,000 $1,502,800 $ 535,800 961,000 298,000 181,000 $1,440,000 $ 560,000 Required: Prepare a profit variance analysis for Osage, Inc. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) OSAGE, INC. Profit Variance Analysis Marketing and Administrative Variances Actual Manufacturing Variances Sales Price Variance Flexible Budget Sales Activity Variance Master Budget $ 4,978,000 $ 5,000,000 Sales revenue Variable costs: Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Fixed costs: Manufacturing overhead Marketing Administrative Total fixed costs Operating profits 1,490,000 286,000 675,400 488,000 $ 2,939,400 $ 2,038,600 1,500,000 350,000 650,000 500,000 $ 3,000,000 $ 2,000,000 990,800 298,000 214,000 1,502,800 535,800 961,000 298,000 181,000 1,440,000 560,000 $ $ $ $ Osage, Inc., manufactures and sells lamps. The company produces only when it receives orders and, therefore, has no inventories. The following information is available for the current month: Actual (based on actual orders for 460,000 units) $ 4,978,000 Master Budget (based on budgeted orders for 500,000 units) $5,000,000 Sales revenue Less Variable costs Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Less Fixed costs Manufacturing overhead Marketing Administrative Total fixed costs Operating profits 1,490,000 286,000 675, 400 488,000 $2,939, 400 $2,038, 600 1,500,000 350,000 650,000 500,000 $3,000,000 $ 2,000,000 990,800 298,000 214,000 $1,502,800 $ 535,800 961,000 298,000 181,000 $1,440,000 $ 560,000 Required: Prepare a profit variance analysis for Osage, Inc. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) OSAGE, INC. Profit Variance Analysis Marketing and Administrative Variances Actual Manufacturing Variances Sales Price Variance Flexible Budget Sales Activity Variance Master Budget $ 4,978,000 $ 5,000,000 Sales revenue Variable costs: Materials Direct labor Variable overhead Variable marketing and administrative Total variable costs Contribution margin Fixed costs: Manufacturing overhead Marketing Administrative Total fixed costs Operating profits 1,490,000 286,000 675,400 488,000 $ 2,939,400 $ 2,038,600 1,500,000 350,000 650,000 500,000 $ 3,000,000 $ 2,000,000 990,800 298,000 214,000 1,502,800 535,800 961,000 298,000 181,000 1,440,000 560,000 $ $ $ $