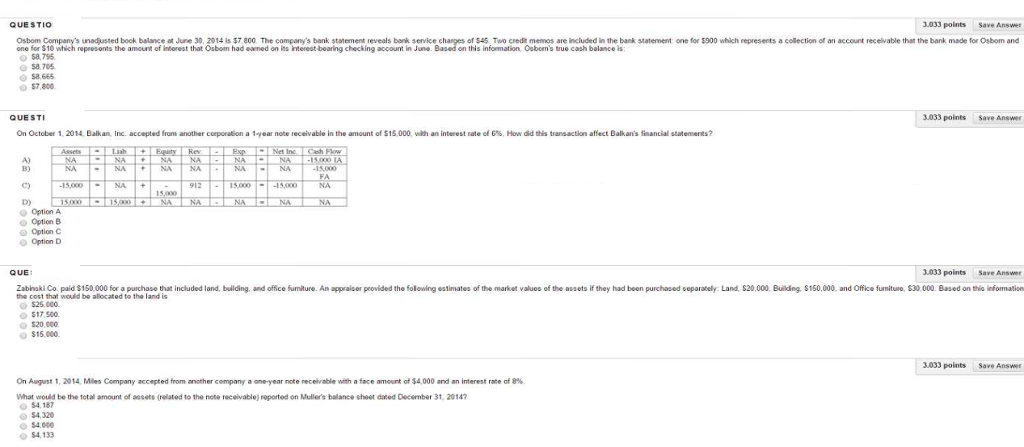

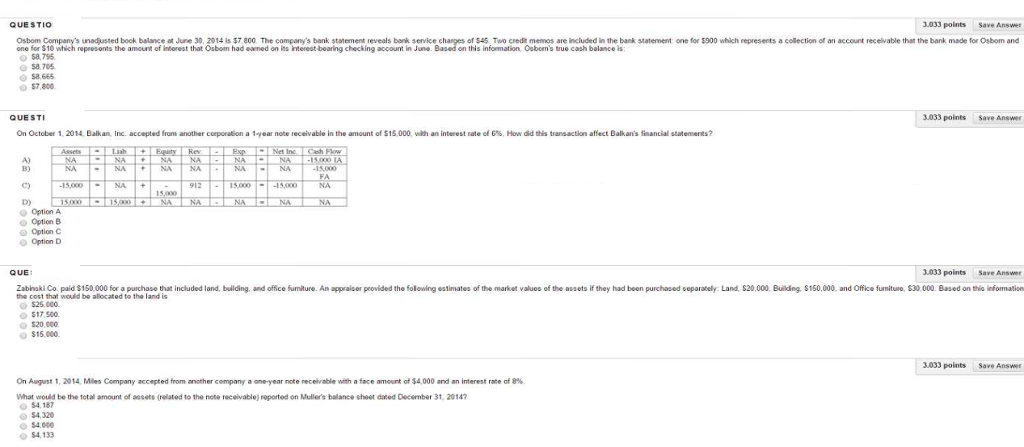

Osbom Company's unadjusted books balance at June 30, 2014 is $7, 800 The company's bank statement reveals bank service charges of $45 Two credit memos are included in the bank statement one for $900 which represents a collection of an account receivable that the bank made for Osbom and one for $10 which represents the amount of interest that Osborn had earned on its interest-bearing checking account in June. Based on this information. Osborn's true cash balance is $8, 795 $8, 705 &8, 665 $7, 800 On October 2014, Balkan, accepted from another corporation a 1year not receivable in the amount of $15,000, with interest rate of 6%, How did this transaction affect Balkans financial statements? Option A Option B Option C Option D Zabinski Co. paid $150.000 for a purchase that included land, building, and office furniture. An appraiser Provided the following estimates of the market values of the assets if they had been purchased separately: Land, $20,000. Building. $150.000. and Office furniture, $30.000. Based on this information the cost that would be allocated to the land is $25.000 $17500 $20.000 $15,000. On August 1, 2014 Miles Company accepted from another company a one year note receivable with a face amount of $4,000 and an interest rate of 8% What would be the total amount of assets (related to the note receivable) reported on Muller's balance sheet dated December 31, 2014? $4, 187 $4, 320 $4,000 $4, 133 Osbom Company's unadjusted books balance at June 30, 2014 is $7, 800 The company's bank statement reveals bank service charges of $45 Two credit memos are included in the bank statement one for $900 which represents a collection of an account receivable that the bank made for Osbom and one for $10 which represents the amount of interest that Osborn had earned on its interest-bearing checking account in June. Based on this information. Osborn's true cash balance is $8, 795 $8, 705 &8, 665 $7, 800 On October 2014, Balkan, accepted from another corporation a 1year not receivable in the amount of $15,000, with interest rate of 6%, How did this transaction affect Balkans financial statements? Option A Option B Option C Option D Zabinski Co. paid $150.000 for a purchase that included land, building, and office furniture. An appraiser Provided the following estimates of the market values of the assets if they had been purchased separately: Land, $20,000. Building. $150.000. and Office furniture, $30.000. Based on this information the cost that would be allocated to the land is $25.000 $17500 $20.000 $15,000. On August 1, 2014 Miles Company accepted from another company a one year note receivable with a face amount of $4,000 and an interest rate of 8% What would be the total amount of assets (related to the note receivable) reported on Muller's balance sheet dated December 31, 2014? $4, 187 $4, 320 $4,000 $4, 133