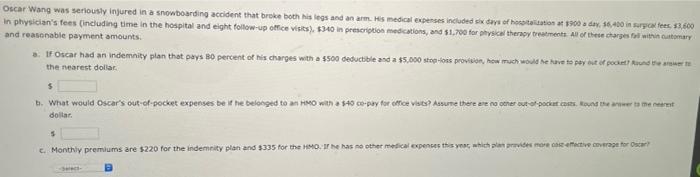

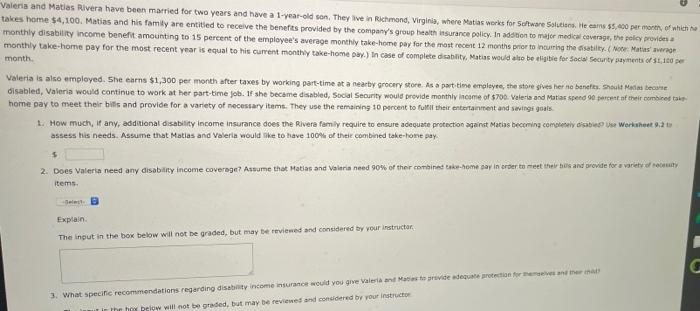

Oscar Wang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included a days of herstellation at 1900 a day. 46,400 in suryox tees 53.600 in physician's fees (including time in the hospital and eight follow-up office visits). 1.340 in prescription medications, and $1,700 for physical therapy treatments All of these charges with customary and reasonable payment amounts 1 Oscar had an indemnity plan that pays 80 percent of Nis charges with a $500 deductible and a $5,000 stop-los provision, how much would he have to pay out of poort Road the nearest dollar 5 . What would Oscar's out-of-pocket expenses be the belonged to an HMO with 3 549 co-pay for once VSE? Asume there were no one e pocket cons on the per te me rastet dollar 5 Monthly premiums are $220 for the indemnity plan and $335 for the HMOs Ir ne has no other medical expenses this year which provide more on Motive coverage for Or Valeria and Matias Rivera have been married for two years and have a 1-year-old son. They vein Richmond, Virginia, where Matas works for Software Solutions. He cam 5.00 per month of which takes home $4,100. Matias and his family are entitled to receve the benefits provided by the company's group health insurance policy. In addition to major medical coverage, the pole provides monthly disability income benefit amounting to 15 percent of the employee's average monthly take-home pay for the most recent 12 months prior to incurring the disability. (Note: Mates' war monthly take-home pay for the most recent year is equal to his current monthly take-home ow.) In case of complete disability. Matias would alto be eligible for socw Security payments of 1,100 month Valeria is also employed. She earns $1,300 per month after taxes by working part-time at a nearby grocery store. As a part time employee, the store ves her ne benefits. Shoul Malas become disabled, Valeria would continue to work at her part-time job. If she became disabled, Social Security would provide monthly income of $700. Valeria and Matias speed 90 percent of their combine the home pay to meet their hills and provide for a variety of necessary items. They use the remaining 10 percent to fulfil their entertainment and swings goals 1. How much, Wany, additional disability Income Insurance does the Rivera family require to ensure adeguate protection against Matlas becoming comely diabe er Worksheet 26 assess his needs. Assume that Matlas and Valeria would like to have 100% of the combined take-home pay $ 2. Does Valeria need any disability income coverage? Assume that Matias and Valeria need 90% of the combined take home say in order to meet the bes and provide for a variety items. Explain The input in the box below will not be graded, but may be reviewed and considered by your instructor, 3. What specific recommendations regarding disability income insurance would you give Valeria Miesto provide adequate protection and me the below will not be graded, but may be reviewed and considered by your instructor