Question

Oscar Wang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included five days of hospitalization

Oscar Wang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included five days of hospitalization at $700 a day, $5,100 in surgical fees, $6,600 in physician's fees (including time in the hospital and six follow-up office visits), $560 in prescription medications, and $2,600 for physical therapy treatments. All of these charges fall within customary and reasonable payment amounts.

-

If Oscar had an indemnity plan that pays 80 percent of his charges with a $500 deductible and a $5,000 stop-loss provision, how much would he have to pay out of pocket? Round the answer to the nearest dollar.

$

-

What would Oscar's out-of-pocket expenses be if he belonged to an HMO with a $40 co-pay for office visits? Assume there are no other out-of-pocket costs. Round the answer to the nearest dollar.

$

-

Monthly premiums are $315 for the indemnity plan and $375 for the HMO. If he has no other medical expenses this year, which plan provides more cost-effective coverage for Oscar?

HMO or Indemnity

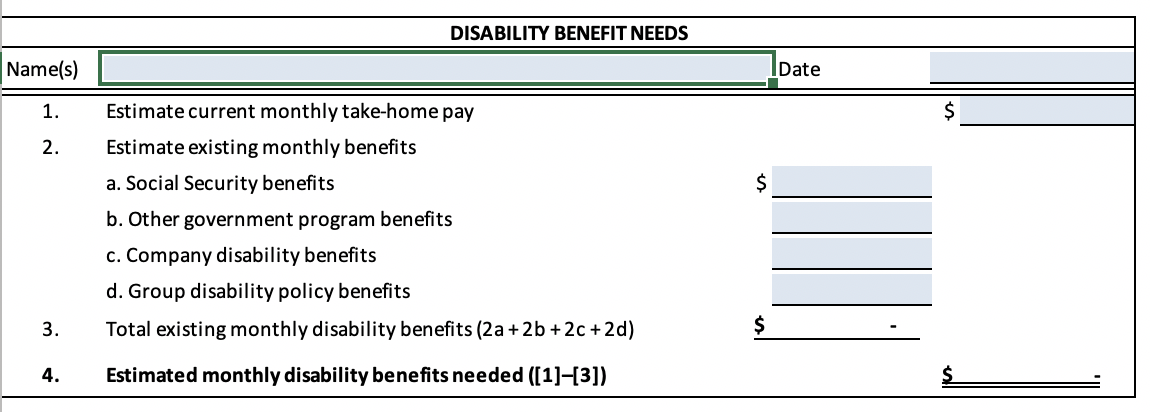

Use Worksheet 9.2. Asher Perkins, a 35-year-old computer programmer, earns $93,000 a year. His monthly take-home pay is $4,900. His wife, Ellie, works part-time at their children's elementary school but receives no benefits. Under state law, Ellie's employer contributes to a workers' compensation insurance fund that would provide $1,950 per month for six months if Asher were disabled and unable to work.

-

Use Worksheet 9.2 to calculate Asher's disability insurance needs, assuming that he won't qualify for Medicare under his Social Security benefits. Round your answer to the nearest whole.

$

| eBook Chapter 9 Critical Thinking Case 2 Valeria and Matias Rivera Evaluate Their Disability Income Needs Valeria and Matias Rivera have been married for two years and have a 1-year-old son. They live in Richmond, Virginia, where Matias works for Software Solutions. He earns $5,300 per month, of which he takes home $4,000. Matias and his family are entitled to receive the benefits provided by the company's group health insurance policy. In addition to major medical coverage, the policy provides a monthly disability income benefit amounting to 15 percent of the employee's average monthly take-home pay for the most recent 12 months prior to incurring the disability. ( Note: Matias' average monthly take-home pay for the most recent year is equal to his current monthly take-home pay.) In case of complete disability, Matias would also be eligible for Social Security payments of $1,400 per month. Valeria is also employed. She earns $1,600 per month after taxes by working part-time at a nearby grocery store. As a part-time employee, the store gives her no benefits. Should Matias become disabled, Valeria would continue to work at her part-time job. If she became disabled, Social Security would provide monthly income of $700. Valeria and Matias spend 90 percent of their combined take-home pay to meet their bills and provide for a variety of necessary items. They use the remaining 10 percent to fulfill their entertainment and savings goals.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started