Answered step by step

Verified Expert Solution

Question

1 Approved Answer

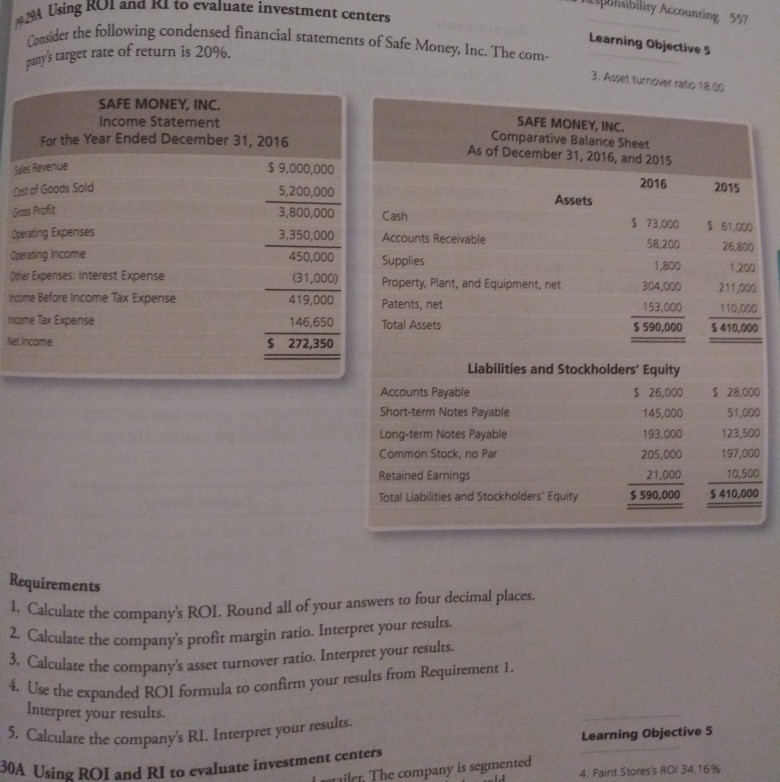

osibility Accounting 557 294 Using R Using RUI and Rl to evaluate investment centers the following condensed financial statements of Safe Money. Inc. The com

osibility Accounting 557 294 Using R Using RUI and Rl to evaluate investment centers the following condensed financial statements of Safe Money. Inc. The com Consider the following co Learning Objective 5 puny's targer rate of return is 20%. 3. Asset turnover ratio 18.00 2015 Goss Profit SAFE MONEY, INC. Income Statement For the Year Ended December 31, 2016 Si Revenue $ 9,000,000 Cast of Goods Sold 5,200,000 3,800,000 Operating Expenses 3,350,000 Operating Income 450,000 Other Expenses: Interest Expense (31,000) ncome Before Income Tax Expense 419,000 Income Tax Expense 146,650 Net Income $ 272,350 SAFE MONEY, INC. Comparative Balance Sheet As of December 31, 2016, and 2015 2016 Assets Cash $ 73,000 Accounts Receivable 58,200 Supplies 1.800 Property, plant, and Equipment, net 304,000 Patents, net 153,000 Total Assets 5 590,000 5 61,600 26.800 211.000 110,000 $410,000 Liabilities and Stockholders' Equity Accounts Payable $ 26,000 Short-term Notes Payable 145,000 Long-term Notes Payable 193,000 Common Stock, no Par 205,000 Retained Earnings 21,000 Total Liabilities and Stockholders' Equity $ 590,000 528,000 51,000 123,500 197,000 10,500 $ 410,000 Requirements 1. Calculate the 2. Calculate the compa ate the company's ROI. Round all of your answers to four decimal places, culate the company's profit margin ratio. Interpret your results. ate the company's asset turnover ratio. Interpret your results. we expanded ROI formula to confirm your results from Requirement 1. 4. Use the expanded Interpret your results. . Calculate the company's RI. Interpret your Learning Objective 5 30A Using ROI and R the company's RI. Interpret your results. sing ROI and RI to evaluate investment centers I mailer. The company is segmented 4. Paint Stores's ROI 34.16%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started