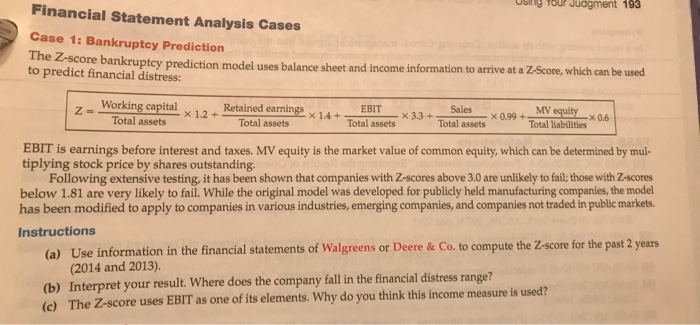

Osing rour Judgment 193 Financial Statement Analysis Cases Case 1: Bankruptcy Prediction to predict financial distress: bankruptcy prediction model uses balance sheet and income information to arrive at a Z-Score, which can be used Working capital x 12+ Z- Retained earnings x 14- EBIT -X 3.3 + Seles-x 0.99 + MV equity x EBIT is earnings before interest and taxes. MV equity is the market value of common equity, which can be determined by mul below 1.81 are very likely to fail. While the original model was developed for publicly held manufacturing companies, the model Total assets Total assets Total liabilities tiplying stock price by shares outstanding. Following extensive testing, it has been shown that companies with Z-scores above 3.0 are unlikely to fail; those with Z-scores has been modified to apply to companies in various industries, emerging companies, and companies not traded in public markets. Instructions (a) Use information in the financial statements of Walgreens or Deere&Co. to compute the Z-score for the past 2 years (2014 and 2013). (b) Interpret your result. Where does the company fall in the financial distress range? (c) The Z-score uses EBIT as one of its elements. Why do you think this income measure is used? Osing rour Judgment 193 Financial Statement Analysis Cases Case 1: Bankruptcy Prediction to predict financial distress: bankruptcy prediction model uses balance sheet and income information to arrive at a Z-Score, which can be used Working capital x 12+ Z- Retained earnings x 14- EBIT -X 3.3 + Seles-x 0.99 + MV equity x EBIT is earnings before interest and taxes. MV equity is the market value of common equity, which can be determined by mul below 1.81 are very likely to fail. While the original model was developed for publicly held manufacturing companies, the model Total assets Total assets Total liabilities tiplying stock price by shares outstanding. Following extensive testing, it has been shown that companies with Z-scores above 3.0 are unlikely to fail; those with Z-scores has been modified to apply to companies in various industries, emerging companies, and companies not traded in public markets. Instructions (a) Use information in the financial statements of Walgreens or Deere&Co. to compute the Z-score for the past 2 years (2014 and 2013). (b) Interpret your result. Where does the company fall in the financial distress range? (c) The Z-score uses EBIT as one of its elements. Why do you think this income measure is used