Question

Osman Ali believes that the financial data for 2021 will remain more or less unchanged at the firms existing current asset policy. However Osman Ali

Osman Ali believes that the financial data for 2021 will remain more or less unchanged at the firms existing current asset policy. However Osman Ali believes that the 2021 sales could be raised by 10 percent by relaxing the current asset investment policy, which would require accounts receivable to be raised by Tk.100,000 and Inventories by Tk.200,000 to support the additional sales. Simultaneously, cost of goods sold would increase by 8 percent. Furthermore, Rahmanias fixed operating expenses would increase by Tk.100,000 due to the increase in storage, handling and insurance costs associated with inventory. Osman believes that these increases in current assets and fixed operatin expenses could be financed with additional notes payable at the current rate of interest.

1. What was Rahminas working capital financing need is 2020 to complete its cash conversion cycle and how much will this financing need be in 2021?

2. Should Rahmania relax its working capital investment policy based on Osman Ali Mridhas estimates? Why or why not?

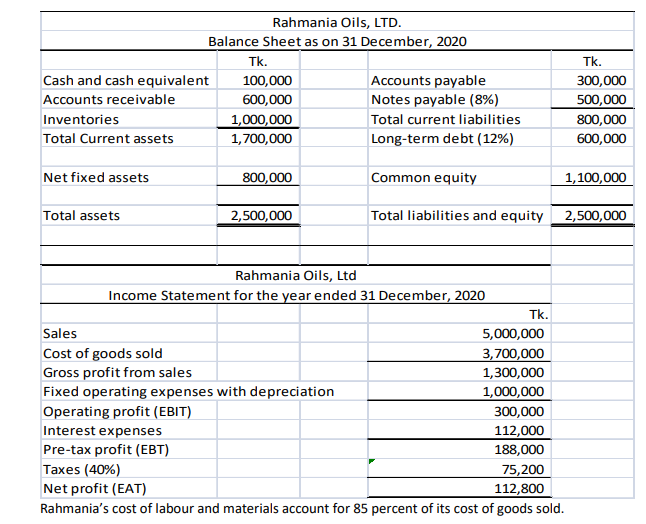

Rahmania Oils, LTD. Balance Sheet as on 31 December, 2020 Tk. Cash and cash equivalent 100,000 Accounts payable Accounts receivable 600,000 Notes payable (8%) Inventories 1,000,000 Total current liabilities Total Current assets 1,700,000 Long-term debt (12%) Tk. 300,000 500,000 800,000 600,000 Net fixed assets 800,000 Common equity 1,100,000 Total assets 2,500,000 Total liabilities and equity 2,500,000 Rahmania Oils, Ltd Income Statement for the year ended 31 December, 2020 Tk. Sales 5,000,000 Cost of goods sold 3,700,000 Gross profit from sales 1,300,000 Fixed operating expenses with depreciation 1,000,000 Operating profit (EBIT) 300,000 Interest expenses 112,000 Pre-tax profit (EBT) 188,000 Taxes (40%) 75,200 Net profit (EAT) 112,800 Rahmania's cost of labour and materials account for 85 percent of its cost of goods sold. Rahmania Oils, LTD. Balance Sheet as on 31 December, 2020 Tk. Cash and cash equivalent 100,000 Accounts payable Accounts receivable 600,000 Notes payable (8%) Inventories 1,000,000 Total current liabilities Total Current assets 1,700,000 Long-term debt (12%) Tk. 300,000 500,000 800,000 600,000 Net fixed assets 800,000 Common equity 1,100,000 Total assets 2,500,000 Total liabilities and equity 2,500,000 Rahmania Oils, Ltd Income Statement for the year ended 31 December, 2020 Tk. Sales 5,000,000 Cost of goods sold 3,700,000 Gross profit from sales 1,300,000 Fixed operating expenses with depreciation 1,000,000 Operating profit (EBIT) 300,000 Interest expenses 112,000 Pre-tax profit (EBT) 188,000 Taxes (40%) 75,200 Net profit (EAT) 112,800 Rahmania's cost of labour and materials account for 85 percent of its cost of goods soldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started