Answered step by step

Verified Expert Solution

Question

1 Approved Answer

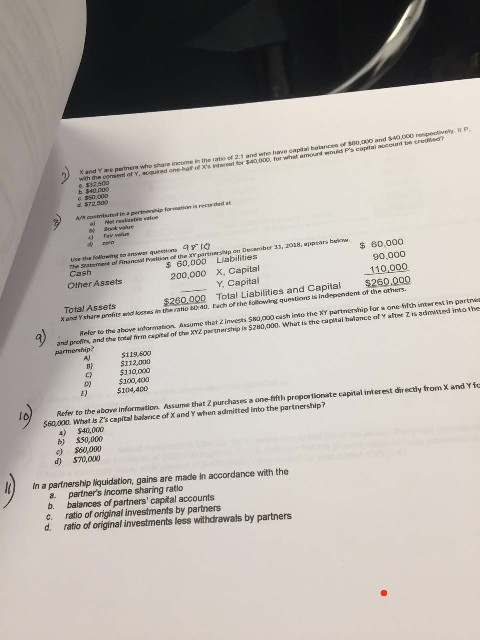

oso and S40 00 for what amoant would Ps copitai account be X and Y are partnera who shure income in the ratio of 2.1

oso and S40 00 for what amoant would Ps copitai account be X and Y are partnera who shure income in the ratio of 2.1 and wfro have capl 40000 furwiar balances of n with me conient of Y, soquired one-hoir oer 54a, al Net reeliastle value use tha fallowing to answar questions io 33, 2018, pptars $ 80,000 90,000 110,000 260.000 s 60,000 Liabilities 200,000 X, Capital OtherAssets Y Capital Total Liabilities and Capital Each of the following questions is independent of Total Assets 260.000 the others. x and Yshare profits ars looxes in the rato 0a0. q) Refer to the hove information Assume ethat & invsts $O,000 oash imo the XY partnership for one hlth intwrest in partrwe and profits and the to hrm cpital of the XYZ partnership is $2H0,000. What is the capihal buloncc af V altee Z is admwited into th purtnenship? A) B) C3 119,600 $112,000 $110,000 5100,400 D) 5104,400 Refier to the atove information Assume that Z purchases a one-tifth proportionate capital interest directly from X andYf $60,000 Whst ls 's capital Batance of X and Y when admitted into the partnership? 4) $40,00 b) $50,000 )$60,000 d $70,000 Iin a partnership liquidation, gains are made in accordance with the a partner's income sharing ratlo b. balances of partners' capital accounts c. ratio of original investments by partners d ratio of original investments less withdrawals by partners oso and S40 00 for what amoant would Ps copitai account be X and Y are partnera who shure income in the ratio of 2.1 and wfro have capl 40000 furwiar balances of n with me conient of Y, soquired one-hoir oer 54a, al Net reeliastle value use tha fallowing to answar questions io 33, 2018, pptars $ 80,000 90,000 110,000 260.000 s 60,000 Liabilities 200,000 X, Capital OtherAssets Y Capital Total Liabilities and Capital Each of the following questions is independent of Total Assets 260.000 the others. x and Yshare profits ars looxes in the rato 0a0. q) Refer to the hove information Assume ethat & invsts $O,000 oash imo the XY partnership for one hlth intwrest in partrwe and profits and the to hrm cpital of the XYZ partnership is $2H0,000. What is the capihal buloncc af V altee Z is admwited into th purtnenship? A) B) C3 119,600 $112,000 $110,000 5100,400 D) 5104,400 Refier to the atove information Assume that Z purchases a one-tifth proportionate capital interest directly from X andYf $60,000 Whst ls 's capital Batance of X and Y when admitted into the partnership? 4) $40,00 b) $50,000 )$60,000 d $70,000 Iin a partnership liquidation, gains are made in accordance with the a partner's income sharing ratlo b. balances of partners' capital accounts c. ratio of original investments by partners d ratio of original investments less withdrawals by partners

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started